- Singapore

- /

- Construction

- /

- SGX:5CF

Yonghe Medical Group And 2 Other Global Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stock indexes such as the S&P 500 and Nasdaq Composite reaching record highs, buoyed by strong job growth and a positive economic outlook. In this context, investors often seek opportunities in lesser-known areas like penny stocks—an investment category that remains relevant despite its vintage label. These stocks can offer unique growth potential when backed by solid financial health, making them intriguing options for those looking to explore smaller or newer companies with promising prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$110.39M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.37 | HK$839.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.42 | £45.44M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.43 | SEK2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.995 | MYR7.55B | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.40 | £122.27M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,813 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Yonghe Medical Group (SEHK:2279)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yonghe Medical Group Co., Ltd. offers hair-related healthcare services in China and has a market cap of HK$1.11 billion.

Operations: The company generates revenue primarily from its hair transplant services, totaling CN¥1.80 billion.

Market Cap: HK$1.11B

Yonghe Medical Group, with a market cap of HK$1.11 billion, primarily generates revenue from hair transplant services totaling CN¥1.80 billion. Despite being unprofitable and experiencing losses that have increased at 66.6% per year over the past five years, Yonghe has a stable cash runway extending beyond three years due to positive free cash flow and more cash than total debt. The company trades at a significant discount to estimated fair value and has reduced its debt-to-equity ratio from 19.1% to 7% over five years, although it remains highly volatile compared to most Hong Kong stocks.

- Dive into the specifics of Yonghe Medical Group here with our thorough balance sheet health report.

- Evaluate Yonghe Medical Group's prospects by accessing our earnings growth report.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$6.98 billion.

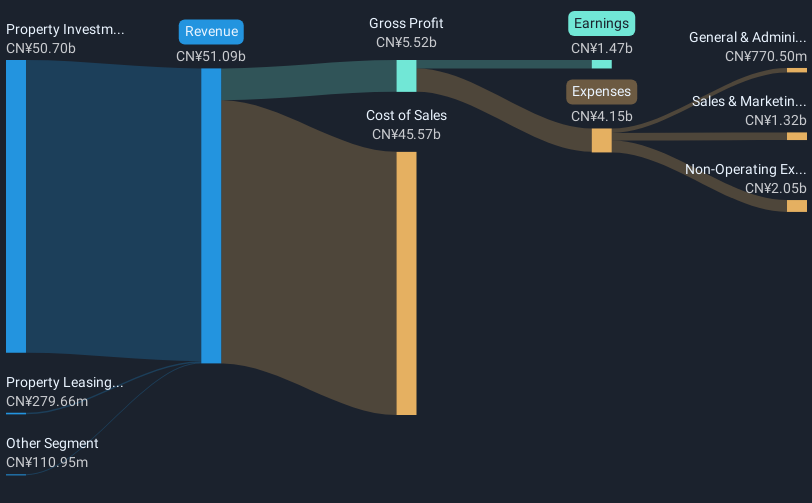

Operations: The company generates revenue primarily from Property Development, accounting for CN¥45.41 billion, and Commercial Property Operations, contributing CN¥484.31 million.

Market Cap: HK$6.98B

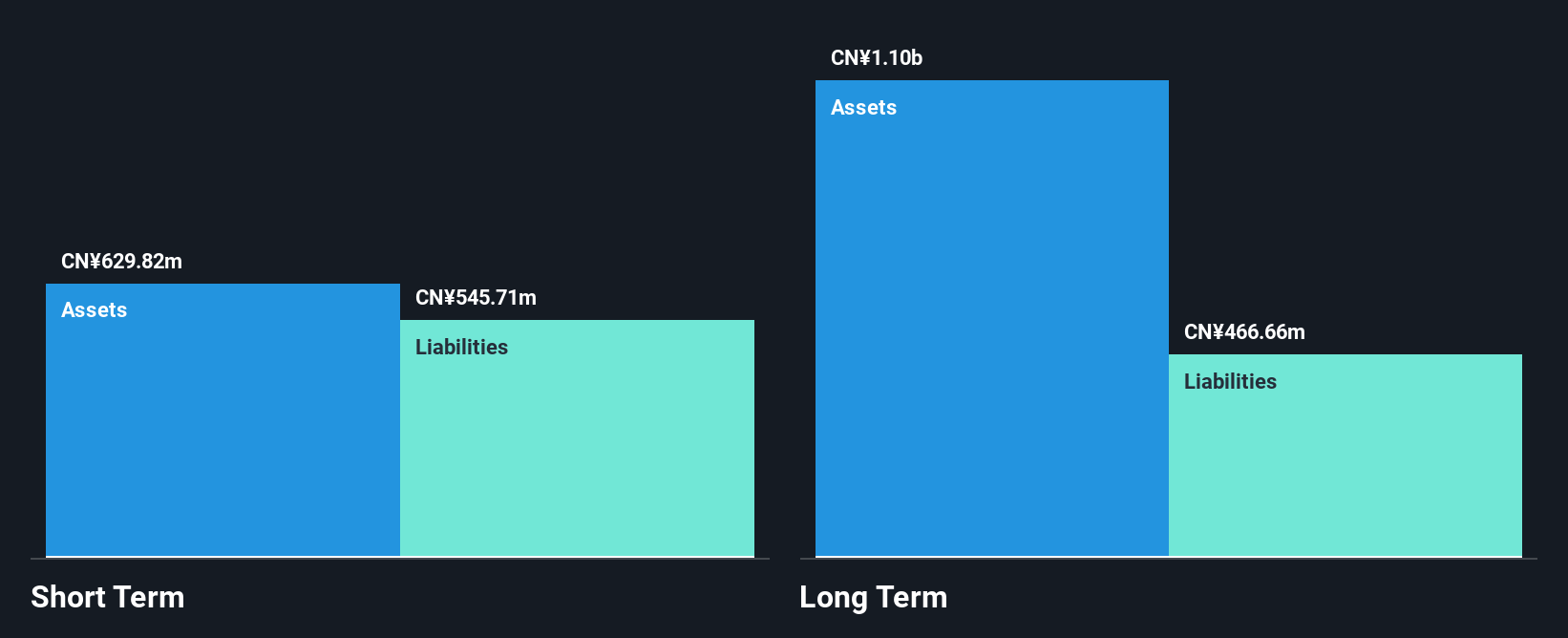

China Overseas Grand Oceans Group, with a market cap of HK$6.98 billion, primarily derives revenue from property development and commercial operations in China and Hong Kong. Despite a seasoned management team and satisfactory net debt to equity ratio of 34.2%, the company faces challenges with declining earnings growth, negative profit margins, and an unstable dividend track record. Recent sales data indicate a year-on-year decrease in contracted property sales value by 12.7% for the first half of 2025. However, short-term assets significantly exceed liabilities, suggesting financial stability amidst these operational hurdles.

- Get an in-depth perspective on China Overseas Grand Oceans Group's performance by reading our balance sheet health report here.

- Gain insights into China Overseas Grand Oceans Group's future direction by reviewing our growth report.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited, with a market cap of SGD313.10 million, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Operations: The company's revenue is primarily derived from its construction segment at SGD135.13 million, followed by maintenance at SGD61.74 million, and rental income contributing SGD6.06 million.

Market Cap: SGD313.1M

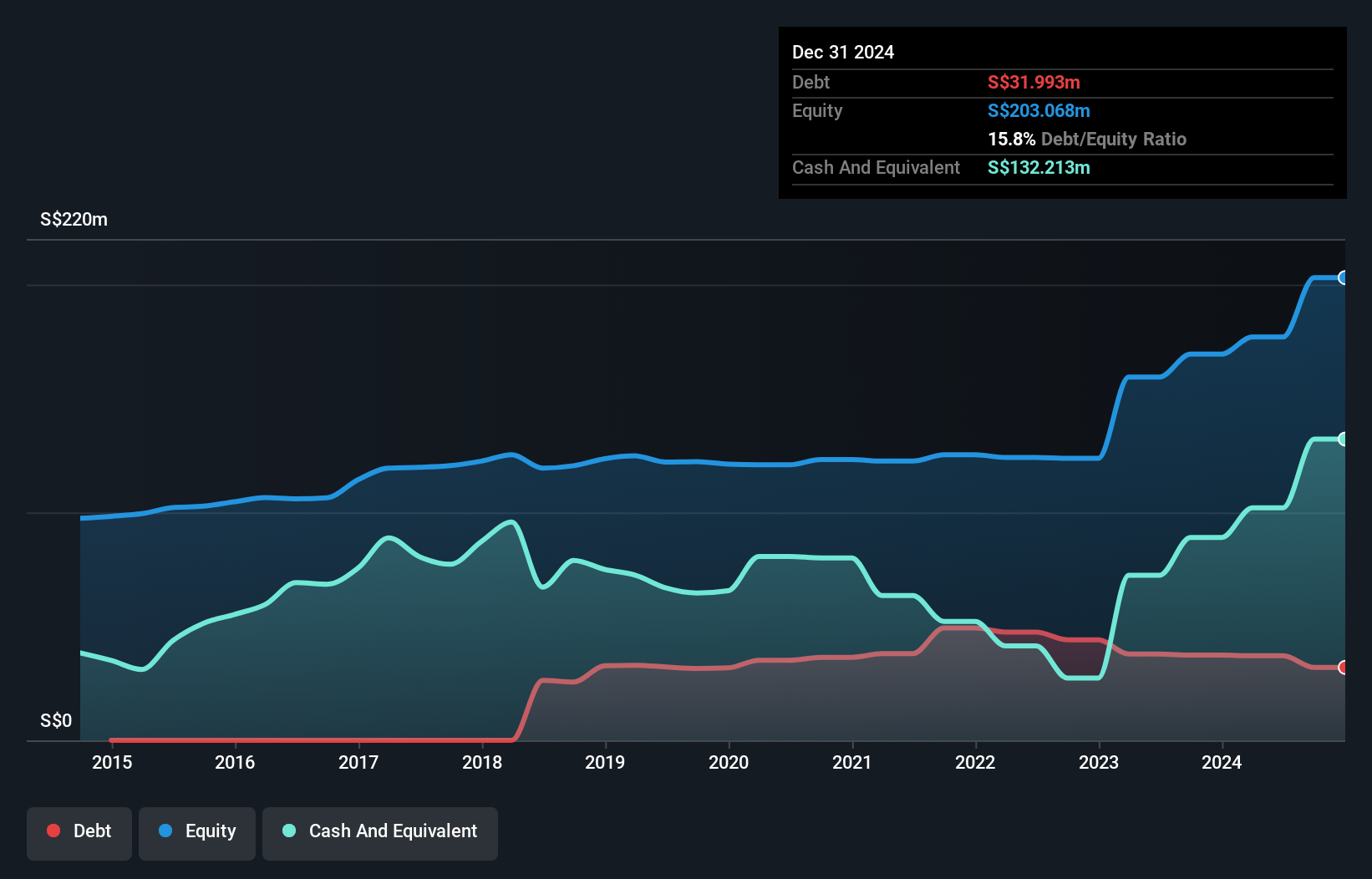

OKP Holdings Limited, with a market cap of SGD313.10 million, shows financial stability as its short-term assets (SGD173.9M) exceed both short-term (SGD75.5M) and long-term liabilities (SGD30.4M). The company has reduced its debt to equity ratio from 26.2% to 15.8% over five years, and its debt is well-covered by operating cash flow at 182.3%. Despite negative earnings growth of -24.5% last year and lower profit margins compared to the previous year, OKP Holdings maintains high-quality earnings and has not experienced significant shareholder dilution recently, trading at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of OKP Holdings stock in this financial health report.

- Gain insights into OKP Holdings' past trends and performance with our report on the company's historical track record.

Make It Happen

- Take a closer look at our Global Penny Stocks list of 3,813 companies by clicking here.

- Seeking Other Investments? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5CF

OKP Holdings

Together with its subsidiary, operates as a transport infrastructure and civil engineering company in Singapore and Australia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026