How Leadership Reshuffle Could Shape China Resources Beer (SEHK:291)'s Future Strategy and Governance

Reviewed by Sasha Jovanovic

- China Resources Beer announced substantial leadership changes effective October 10, 2025, appointing Mr. Jin Hanquan as executive director and president, Mr. Li Nan as non-executive director, and Ms. Yang Hongxia as chief financial officer.

- This reshaping of the executive team brings fresh expertise to the company's management ranks, with potential long-term effects on operational direction and governance.

- We will explore how these high-profile executive appointments could influence China Resources Beer's investment narrative, especially with regard to corporate strategy and governance.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is China Resources Beer (Holdings)'s Investment Narrative?

Owning shares of China Resources Beer means having conviction in the company's ability to maintain steady growth and operational excellence in a highly competitive sector, despite slower revenue and earnings growth forecasts relative to the broader Hong Kong market. The latest leadership overhaul comes on the heels of several executive departures, highlighting a period of significant transition at the top. This may heighten uncertainty regarding short-term strategic execution, especially since new executives will influence ongoing initiatives and could shape priorities differently. Short-term catalysts, like sustained earnings quality and solid dividend payouts, may remain intact if management transition is smooth. However, recurring board changes are now a larger risk, adding unpredictability to corporate strategy and governance stability. Overall, the impact of these recent appointments warrants close attention, as investor sentiment could shift rapidly if operational direction appears disrupted.

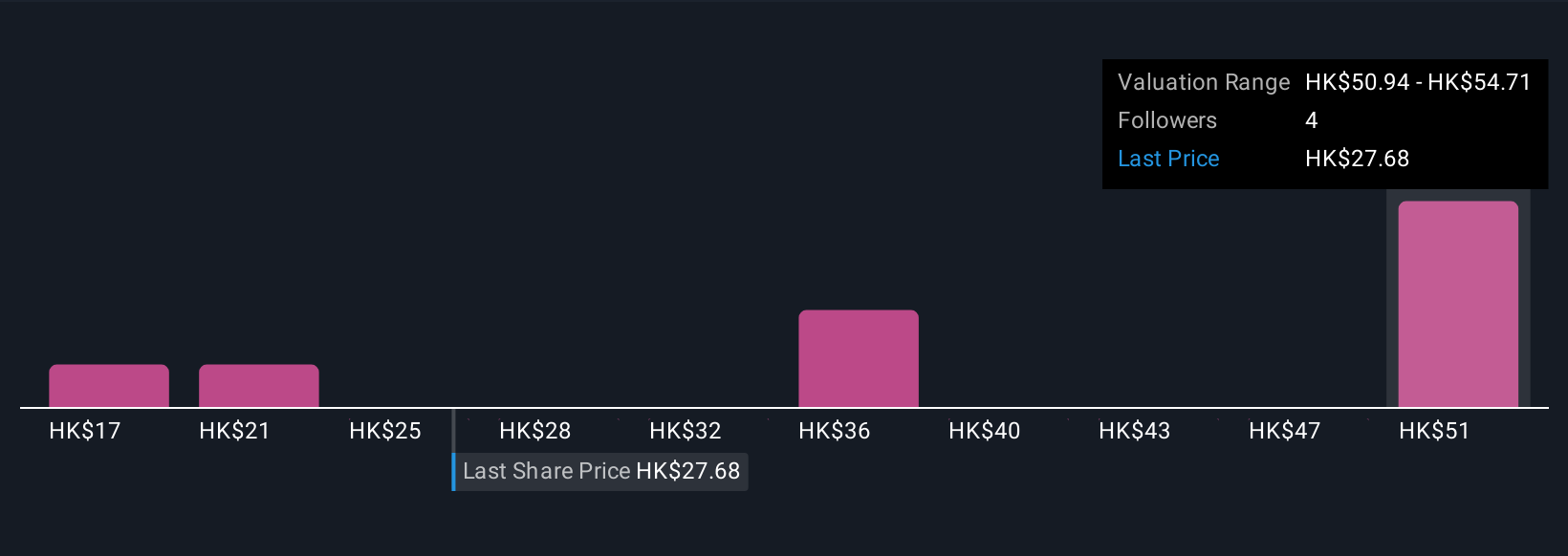

But with board turnover accelerating, stability is something investors need to watch closely. China Resources Beer (Holdings)'s shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on China Resources Beer (Holdings) - why the stock might be worth 38% less than the current price!

Build Your Own China Resources Beer (Holdings) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Beer (Holdings) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Resources Beer (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Beer (Holdings)'s overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:291

China Resources Beer (Holdings)

An investment holding company, manufactures, distributes, and sells alcoholic beverages in Mainland China.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives