China Mengniu Dairy (SEHK:2319) Eyes Emerging Markets Expansion Despite Operational Challenges

Reviewed by Simply Wall St

China Mengniu Dairy (SEHK:2319) is experiencing significant revenue growth, with a notable 15% year-over-year increase, driven by strong demand in its core markets and successful product innovations. However, the company faces challenges from rising costs and competitive pressures, impacting margins and profitability. The following report explores key areas such as financial performance, market expansion strategies, and operational efficiencies, providing a comprehensive overview of the company's current position and future prospects.

Navigate through the intricacies of China Mengniu Dairy with our comprehensive report here.

Key Assets Propelling China Mengniu Dairy Forward

The company demonstrates strong revenue growth, with a reported 15% year-over-year increase, as highlighted by CEO Gao Fei. This growth is attributed to strong demand in core markets, indicating a solid market position. Product innovation is another strength, with new product lines receiving excellent feedback, expected to significantly boost revenue in upcoming quarters. The focus on innovation underscores a commitment to enhancing offerings, fostering customer loyalty and market share expansion. Additionally, strong customer relationships have been fortified through long-term contracts, ensuring stable revenue streams. Financially, the company maintains a satisfactory net debt to equity ratio of 30.3%, and earnings are projected to grow by 11.07% annually, reflecting a positive financial outlook.

Vulnerabilities Impacting China Mengniu Dairy

The company faces challenges such as operational inefficiencies, with rising costs impacting margins. Competitive pressures are also significant, as increased market competition leads to pricing challenges. The company's return on equity is relatively low at 8.5%, and net profit margins have slightly decreased from 4.8% to 4.6%. Furthermore, earnings growth has seen a 7.4% decline over the past year, and dividend payments have been volatile, with a yield of 3.1% falling short of top dividend payers in the Hong Kong market.

Growth Avenues Awaiting China Mengniu Dairy

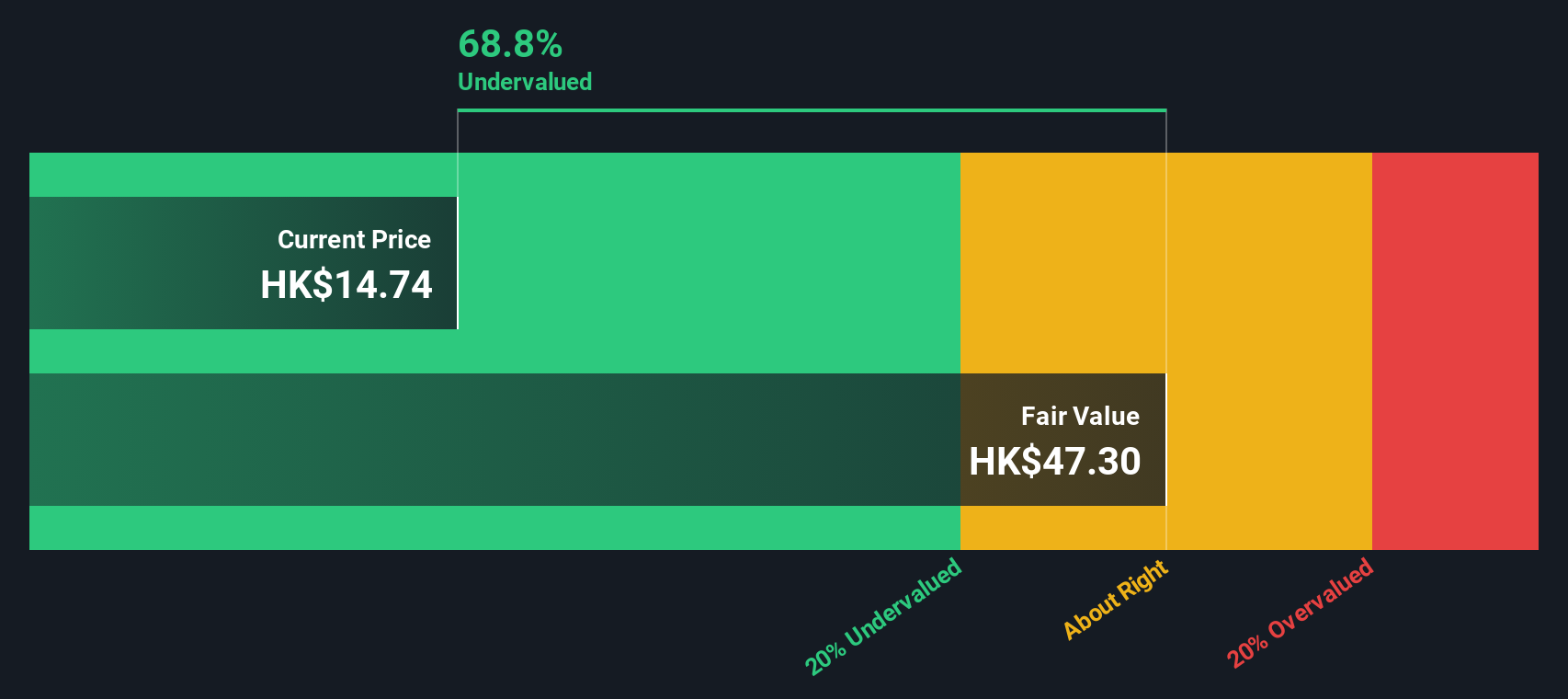

The company is exploring expansion into emerging markets, where demand is rapidly increasing, presenting significant revenue growth opportunities. Investments in AI and automation are poised to enhance operational efficiency and reduce costs, aligning with a forward-thinking approach. Additionally, targeted marketing campaigns aim to attract new customers and increase market share. The company is trading significantly below its estimated fair value, suggesting potential for price appreciation, despite being considered expensive relative to industry peers.

External Factors Threatening China Mengniu Dairy

Economic headwinds pose risks, as consumer spending may be impacted by broader economic conditions. Regulatory changes present potential operational challenges, necessitating adaptability. Supply chain disruptions have been acknowledged, indicating vulnerabilities that could affect production and delivery schedules, impacting customer satisfaction and revenue. Earnings growth is forecasted to be slower than the Hong Kong market rate, highlighting the need for strategic initiatives to navigate these challenges.

Conclusion

China Mengniu Dairy's strong revenue growth and product innovation highlight its solid market position and commitment to expanding customer loyalty and market share. However, operational inefficiencies and competitive pressures present challenges that could impact profitability, as evidenced by declining profit margins and volatile dividend yields. The company's strategic investments in emerging markets and technology, along with its trading below estimated fair value, suggest potential for future growth and price appreciation. This potential is contingent upon successfully navigating economic headwinds, regulatory changes, and supply chain disruptions, which are crucial for sustaining its positive financial outlook and achieving projected earnings growth.

Next Steps

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:2319

China Mengniu Dairy

An investment holding company, manufactures and distributes dairy products under the MENGNIU brand in the People’s Republic of China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives