Here's Why COFCO Joycome Foods Limited's (HKG:1610) CEO May Deserve A Raise

Shareholders will be pleased by the impressive results for COFCO Joycome Foods Limited (HKG:1610) recently and CEO Jianong Xu has played a key role. At the upcoming AGM on 30 June 2021, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

Check out our latest analysis for COFCO Joycome Foods

Comparing COFCO Joycome Foods Limited's CEO Compensation With the industry

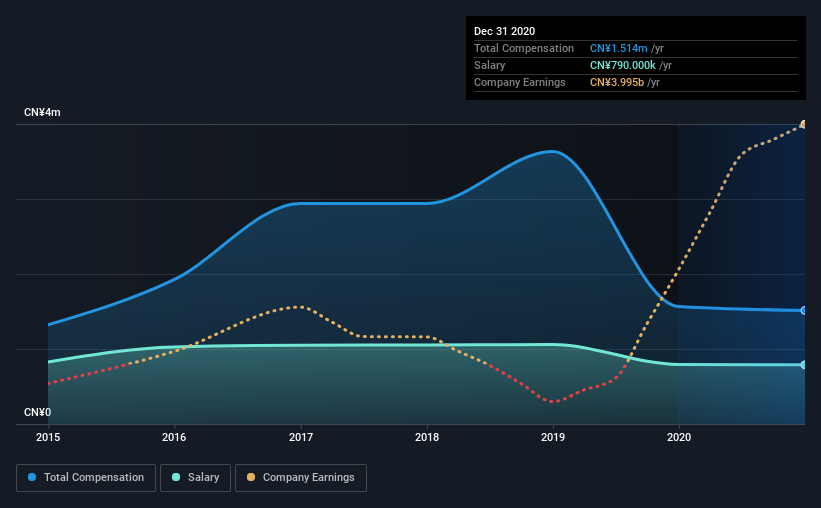

According to our data, COFCO Joycome Foods Limited has a market capitalization of HK$11b, and paid its CEO total annual compensation worth CN¥1.5m over the year to December 2020. We note that's a small decrease of 3.4% on last year. Notably, the salary which is CN¥790.0k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between HK$7.8b and HK$25b, we discovered that the median CEO total compensation of that group was CN¥4.5m. In other words, COFCO Joycome Foods pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥790k | CN¥794k | 52% |

| Other | CN¥724k | CN¥773k | 48% |

| Total Compensation | CN¥1.5m | CN¥1.6m | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. COFCO Joycome Foods pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at COFCO Joycome Foods Limited's Growth Numbers

COFCO Joycome Foods Limited's earnings per share (EPS) grew 107% per year over the last three years. In the last year, its revenue is up 70%.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has COFCO Joycome Foods Limited Been A Good Investment?

Most shareholders would probably be pleased with COFCO Joycome Foods Limited for providing a total return of 153% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 1 which is significant) in COFCO Joycome Foods we think you should know about.

Switching gears from COFCO Joycome Foods, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade COFCO Joycome Foods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1610

COFCO Joycome Foods

An investment holding company, engages in the production and sales of hog, and livestock slaughtering businesses in Mainland China.

Fair value with moderate growth potential.

Market Insights

Community Narratives