- China

- /

- Semiconductors

- /

- SHSE:688478

3 Growth Companies With Insider Ownership To Watch Closely

Reviewed by Simply Wall St

As global markets navigate through easing inflation and strong bank earnings, major U.S. stock indexes have rebounded, with value stocks outshining growth shares amid rising oil prices and profit-taking in large-cap tech firms. In this environment of shifting economic indicators, companies with high insider ownership can be particularly appealing to investors, as they often signal confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 30.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's explore several standout options from the results in the screener.

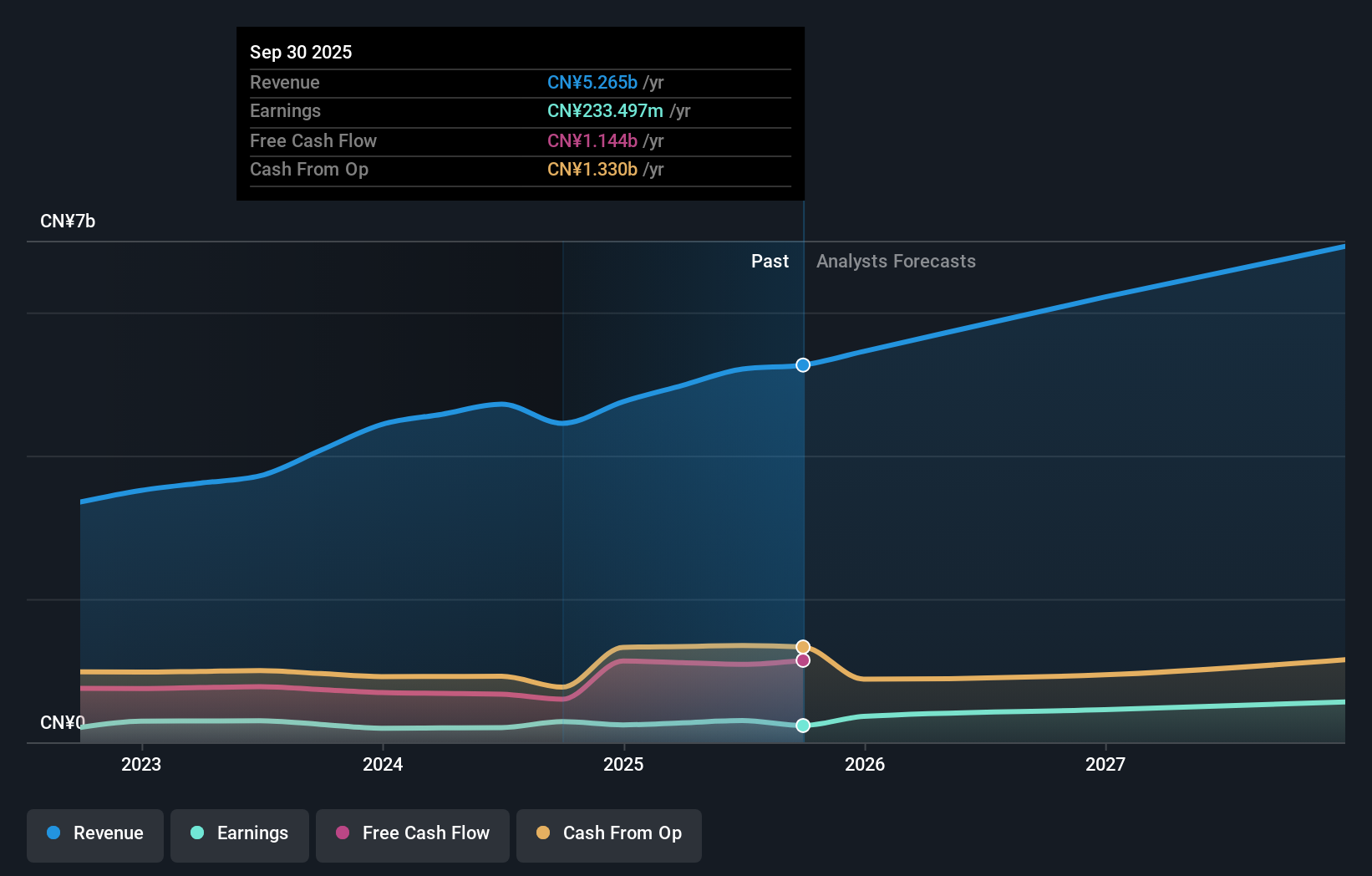

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anton Oilfield Services Group is an investment holding company that offers oilfield engineering and technical services to oil companies in China, Iraq, and internationally, with a market cap of approximately HK$2.07 billion.

Operations: The company's revenue is primarily derived from Oilfield Technical Services (CN¥2.22 billion), Oilfield Management Services (CN¥1.77 billion), Inspection Services (CN¥441.14 million), and Drilling Rig Services (CN¥292.99 million).

Insider Ownership: 25.9%

Earnings Growth Forecast: 25.4% p.a.

Anton Oilfield Services Group is positioned for significant earnings growth, with forecasts of 25.4% annually, outpacing the Hong Kong market's 11.5%. Despite this, revenue growth at 13.1% remains below the high-growth threshold but exceeds market averages. The stock trades at a substantial discount to its estimated fair value and has seen no insider trading activity recently. Recent board changes include appointing Ms. CHEN Xin as an independent director and ESG Committee chairperson, potentially enhancing governance practices.

- Click here and access our complete growth analysis report to understand the dynamics of Anton Oilfield Services Group.

- According our valuation report, there's an indication that Anton Oilfield Services Group's share price might be on the cheaper side.

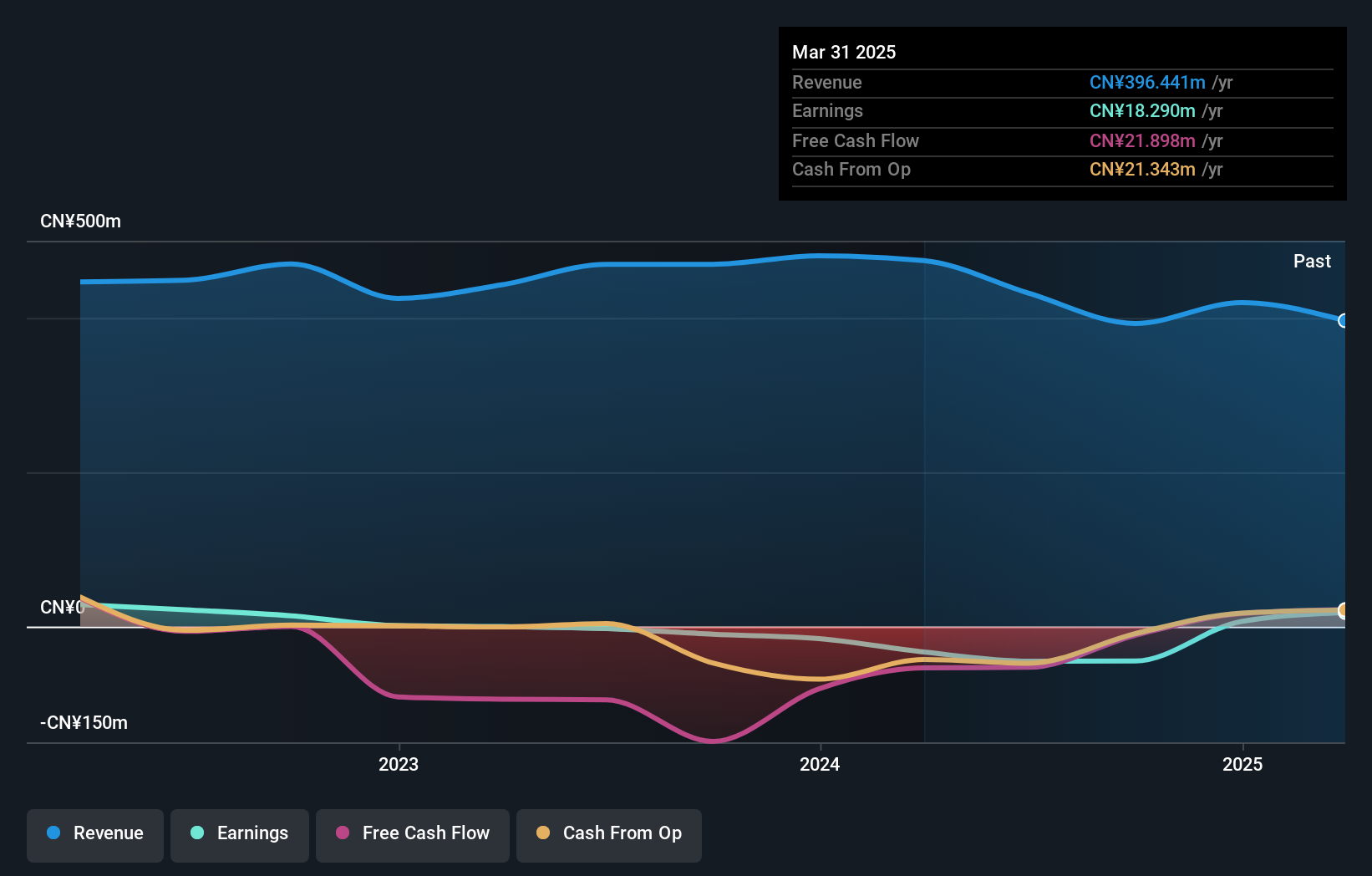

Primeton Information Technologies (SHSE:688118)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primeton Information Technologies, Inc. offers professional software foundation platforms and technical services in China, with a market cap of CN¥2 billion.

Operations: The company's revenue segment includes CN¥392.80 million from computer services.

Insider Ownership: 34.2%

Earnings Growth Forecast: 112.2% p.a.

Primeton Information Technologies is forecast to achieve robust revenue growth of 24.5% annually, surpassing the Chinese market average of 13.4%. Earnings are expected to grow significantly at 112.17% per year, with profitability anticipated within three years, though Return on Equity remains low at 8.4%. Despite recent financial challenges—sales and net loss declined—the upcoming shareholder meeting may provide strategic insights. No insider trading activity has been reported recently.

- Get an in-depth perspective on Primeton Information Technologies' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Primeton Information Technologies' share price might be too optimistic.

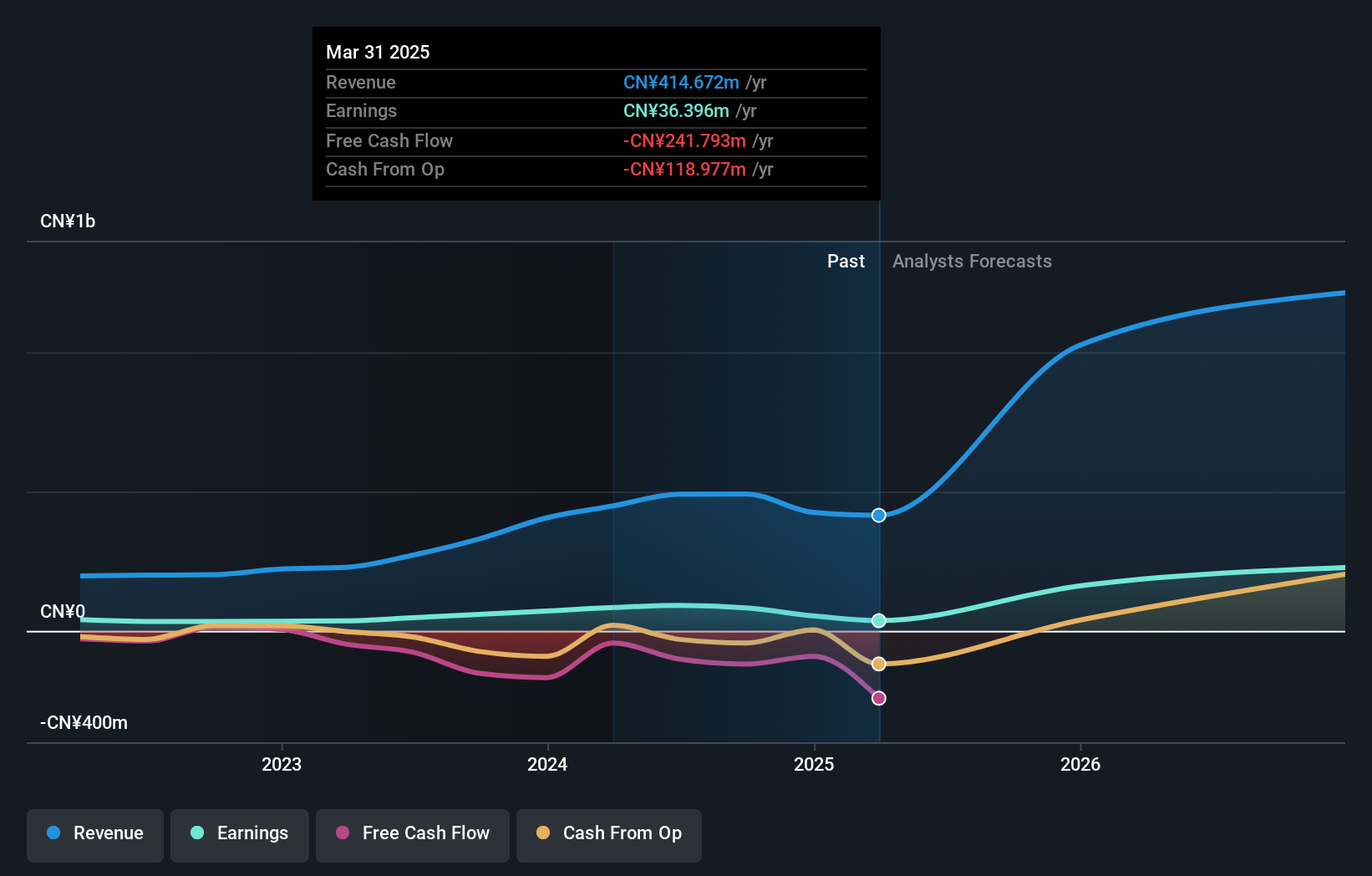

Crystal Growth & Energy EquipmentLtd (SHSE:688478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crystal Growth & Energy Equipment Co., Ltd. (ticker: SHSE:688478) operates in the field of manufacturing equipment for crystal growth and energy applications, with a market cap of CN¥3.96 billion.

Operations: Crystal Growth & Energy Equipment Co., Ltd. generates its revenue primarily from manufacturing equipment used in crystal growth and energy applications.

Insider Ownership: 25%

Earnings Growth Forecast: 43.5% p.a.

Crystal Growth & Energy Equipment Ltd. is poised for substantial growth, with revenue projected to increase by 35.5% annually, outpacing the Chinese market average of 13.4%. Earnings are expected to grow significantly at 43.47% per year, although Return on Equity remains low at 11.1%. Recent developments include a completed acquisition of a 6.51% stake by Lu Yu for approximately CNY 290 million and a share buyback totaling CNY 50.09 million, reflecting strategic insider confidence despite its removal from the S&P Global BMI Index.

- Click here to discover the nuances of Crystal Growth & Energy EquipmentLtd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Crystal Growth & Energy EquipmentLtd is priced higher than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 1462 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688478

Crystal Growth & Energy EquipmentLtd

Crystal Growth & Energy Equipment Co.,Ltd.

Flawless balance sheet with high growth potential.