- Hong Kong

- /

- Auto Components

- /

- SEHK:360

3 Promising Penny Stocks With Market Caps At Least US$300M

Reviewed by Simply Wall St

As global markets navigate a busy earnings season, major indices have experienced fluctuations, with small-cap stocks showing resilience compared to their larger counterparts. In such a landscape, investors often seek opportunities in lesser-known areas of the market. Penny stocks, despite their somewhat outdated label, remain an intriguing investment area for those interested in smaller or newer companies that may offer both value and growth potential when supported by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$507.83M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.55 | £360.49M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.54 | MYR766.84M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.04 | MYR2.09B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.025 | £391.86M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ForFarmers N.V. offers feed solutions for both conventional and organic livestock farming across several European countries and internationally, with a market cap of €302.28 million.

Operations: The company's revenue from food processing amounts to €2.72 billion.

Market Cap: €302.28M

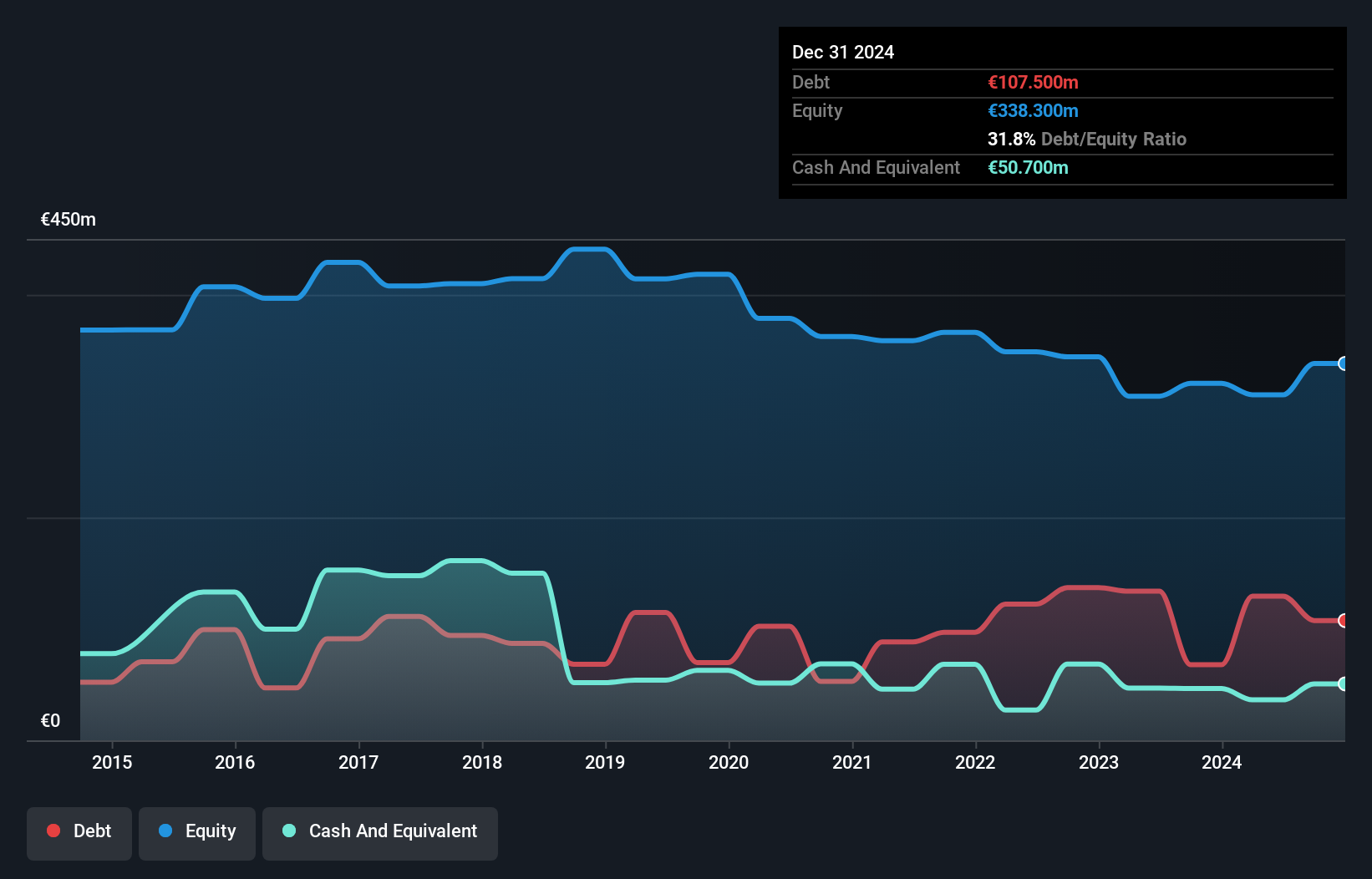

ForFarmers N.V., with a market cap of €302.28 million and revenues of €2.72 billion, has shown recent profitability improvement, reporting a net income of €4 million for the first half of 2024 compared to a loss in the previous year. The strategic joint venture with team agrar aims to enhance its German market presence and operational efficiency, potentially driving future growth. However, challenges include low return on equity at 6.5% and interest coverage below optimal levels at 2.9x EBIT, suggesting financial constraints despite satisfactory debt management and strong asset coverage for liabilities.

- Get an in-depth perspective on ForFarmers' performance by reading our balance sheet health report here.

- Gain insights into ForFarmers' future direction by reviewing our growth report.

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.45 billion.

Operations: The company's revenue primarily comes from the oil and gas segment, which generated CN¥2.98 billion, complemented by the new energy and refinery and chemical segment with CN¥64.13 million.

Market Cap: HK$1.45B

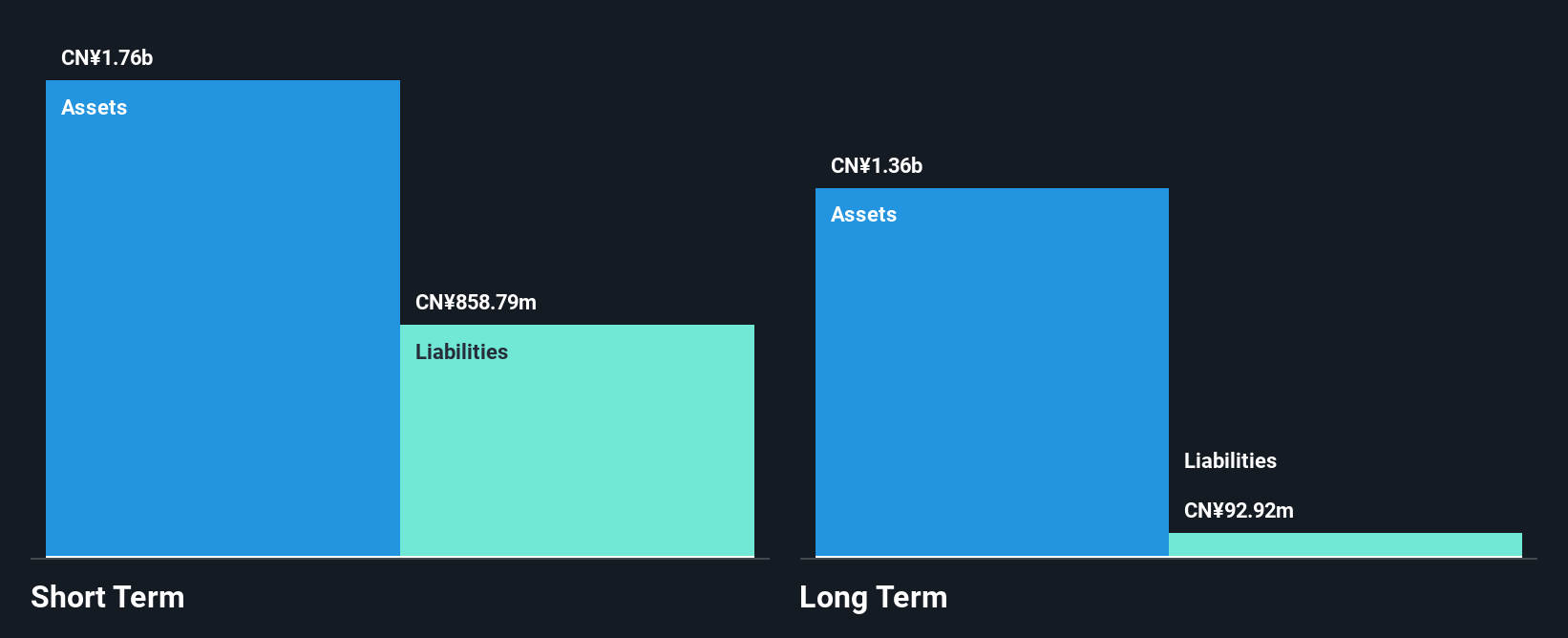

Jutal Offshore Oil Services, with a market cap of HK$1.45 billion, has demonstrated significant earnings growth, reporting CN¥177.31 million in net income for the first half of 2024 compared to CN¥68.84 million a year ago. The company's revenue primarily stems from its oil and gas segment, supplemented by new energy and refinery activities. Despite shareholder dilution over the past year, Jutal's financial health is robust with short-term assets exceeding liabilities and debt levels well-managed by cash flow. However, its board lacks experience with an average tenure of 2.4 years, potentially impacting strategic decisions moving forward.

- Click to explore a detailed breakdown of our findings in Jutal Offshore Oil Services' financial health report.

- Learn about Jutal Offshore Oil Services' historical performance here.

New Focus Auto Tech Holdings (SEHK:360)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: New Focus Auto Tech Holdings Limited is an investment holding company that manufactures and sells electronic and power-related automotive parts and accessories across the People’s Republic of China, the Americas, Europe, and the Asia Pacific, with a market cap of HK$843.63 million.

Operations: The company's revenue is derived from two main segments: The Manufacturing and Trading Business, which generated CN¥410.94 million, and The Automobile Dealership and Service Business, contributing CN¥125.92 million.

Market Cap: HK$843.63M

New Focus Auto Tech Holdings, with a market cap of HK$843.63 million, has faced challenges in profitability, reporting a net loss of CN¥15.92 million for the first half of 2024 compared to CN¥5.23 million the previous year. The company's revenue is primarily from its Manufacturing and Trading Business (CN¥410.94 million) and Automobile Dealership and Service Business (CN¥125.92 million). Despite having more cash than total debt and reducing its debt-to-equity ratio over five years, short-term liabilities exceed short-term assets by CN¥66.3M, indicating potential liquidity concerns amidst high share price volatility and an inexperienced board.

- Dive into the specifics of New Focus Auto Tech Holdings here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into New Focus Auto Tech Holdings' track record.

Where To Now?

- Investigate our full lineup of 5,823 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Focus Auto Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:360

New Focus Auto Tech Holdings

An investment holding company, manufactures and sells of electronic and power-related automotive parts and accessories in the People’s Republic of China, the Americas, Europe, and the Asia Pacific.

Mediocre balance sheet minimal.

Market Insights

Community Narratives