- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

Should You Be Adding COSCO SHIPPING Energy Transportation (HKG:1138) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in COSCO SHIPPING Energy Transportation (HKG:1138). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our free stock report includes 2 warning signs investors should be aware of before investing in COSCO SHIPPING Energy Transportation. Read for free now.COSCO SHIPPING Energy Transportation's Improving Profits

Over the last three years, COSCO SHIPPING Energy Transportation has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. COSCO SHIPPING Energy Transportation's EPS has risen over the last 12 months, growing from CN¥0.71 to CN¥0.85. This amounts to a 19% gain; a figure that shareholders will be pleased to see.

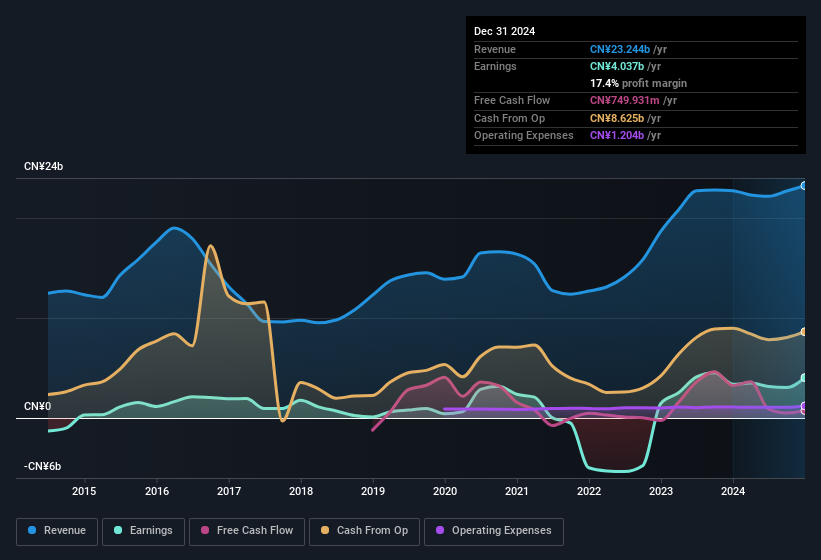

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, COSCO SHIPPING Energy Transportation has done well over the past year, growing revenue by 2.2% to CN¥23b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

See our latest analysis for COSCO SHIPPING Energy Transportation

Fortunately, we've got access to analyst forecasts of COSCO SHIPPING Energy Transportation's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are COSCO SHIPPING Energy Transportation Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥29b and CN¥87b, like COSCO SHIPPING Energy Transportation, the median CEO pay is around CN¥5.2m.

The COSCO SHIPPING Energy Transportation CEO received total compensation of just CN¥2.5m in the year to December 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is COSCO SHIPPING Energy Transportation Worth Keeping An Eye On?

One positive for COSCO SHIPPING Energy Transportation is that it is growing EPS. That's nice to see. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So all in all COSCO SHIPPING Energy Transportation is worthy at least considering for your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for COSCO SHIPPING Energy Transportation that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in HK with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the transportation of oil and liquefied natural gas (LNG) in People’s Republic of China and internationally.

Proven track record with moderate growth potential.

Market Insights

Community Narratives