- Thailand

- /

- Capital Markets

- /

- SET:AIRA

December 2024's Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rate cuts and economic data, the Nasdaq Composite has reached new heights while smaller-cap stocks face challenges. In such a climate, investors often seek opportunities in areas that might be overlooked by the broader market. Penny stocks, despite their somewhat outdated moniker, continue to offer intriguing possibilities for those willing to explore smaller or newer companies with strong financial health. These stocks can combine affordability with growth potential, and this article will highlight several promising candidates that stand out for their financial strength.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$141.28M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.08 | £783.67M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$45.04B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £149.22M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.50 | £66.75M | ★★★★☆☆ |

Click here to see the full list of 5,796 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Quanzhou Huixin Micro-credit (SEHK:1577)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Quanzhou Huixin Micro-credit Co., Ltd. is a microfinance company offering short-term financing solutions to entrepreneurs and small to medium-sized enterprises in China, with a market cap of HK$476 million.

Operations: The company generates revenue of CN¥99.84 million from its micro-credit business segment.

Market Cap: HK$476M

Quanzhou Huixin Micro-credit Co., Ltd. presents a mixed picture for penny stock investors. Despite negative earnings growth of -13.2% over the past year, the company boasts high-quality earnings and improved net profit margins at 63.3%. Its financial stability is underscored by more cash than total debt, with operating cash flow well covering its debt obligations. The seasoned management and board teams add to its credibility, while short-term assets significantly exceed liabilities, enhancing liquidity prospects. However, return on equity remains low at 5.6%, and it trades below estimated fair value, indicating potential undervaluation concerns for investors to consider carefully.

- Get an in-depth perspective on Quanzhou Huixin Micro-credit's performance by reading our balance sheet health report here.

- Gain insights into Quanzhou Huixin Micro-credit's historical outcomes by reviewing our past performance report.

Tai Hing Group Holdings (SEHK:6811)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tai Hing Group Holdings Limited is an investment holding company that operates and manages restaurants, with a market cap of HK$713.83 million.

Operations: The company's revenue is primarily derived from its operation and management of restaurants, totaling HK$3.26 billion.

Market Cap: HK$713.83M

Tai Hing Group Holdings Limited offers a complex profile for penny stock investors. Despite stable weekly volatility and being debt-free, the company's financial health is challenged by short-term assets not covering its liabilities and declining earnings over the past five years. Recent earnings growth of 8.4% is an improvement but still trails industry averages. The company trades significantly below its estimated fair value, suggesting potential undervaluation opportunities. A recent share buyback program could enhance net asset value per share, though the dividend remains unsustainable given current profit levels and large one-off losses impacting earnings quality.

- Navigate through the intricacies of Tai Hing Group Holdings with our comprehensive balance sheet health report here.

- Gain insights into Tai Hing Group Holdings' future direction by reviewing our growth report.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

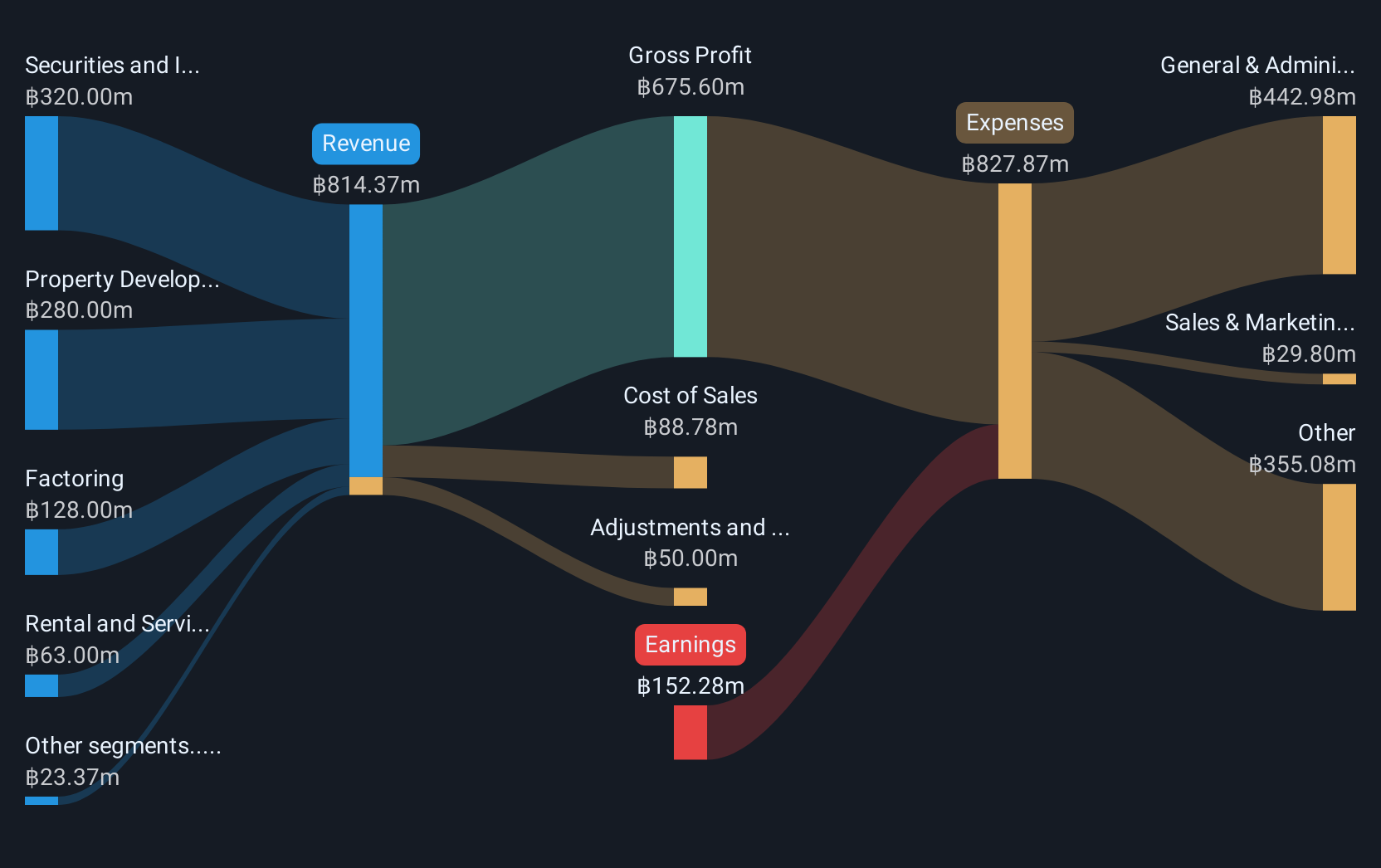

Overview: AIRA Capital Public Company Limited, along with its subsidiaries, offers financial advisory services in Thailand and has a market capitalization of approximately THB7.51 billion.

Operations: The company's revenue is derived from several segments, including Factoring (THB180 million), Property Development (THB266 million), Advisory and Investment Banking (THB18 million), Securities and Investment Business (THB357 million), and Rental and Service Business excluding Property Development (THB105 million).

Market Cap: THB7.51B

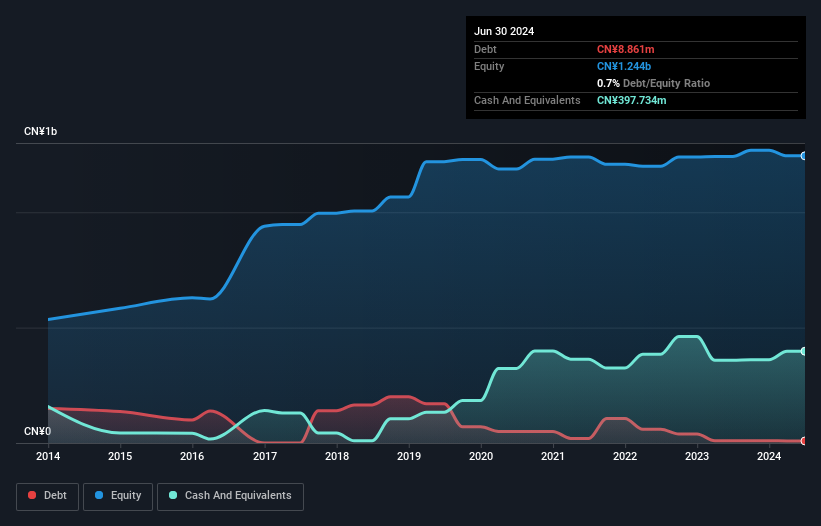

AIRA Capital presents a mixed picture for penny stock investors. The company reported THB865.71 million in revenue for the first nine months of 2024, yet remains unprofitable with losses increasing over five years. Despite this, AIRA's short-term assets significantly exceed both its short and long-term liabilities, indicating a solid liquidity position. While the board and management team are experienced, AIRA's high net debt to equity ratio of 76.9% raises concerns about financial leverage. The share price has been highly volatile recently, which is common in penny stocks but adds risk to potential investments in AIRA Capital.

- Dive into the specifics of AIRA Capital here with our thorough balance sheet health report.

- Understand AIRA Capital's track record by examining our performance history report.

Where To Now?

- Navigate through the entire inventory of 5,796 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AIRA

Adequate balance sheet very low.