- Hong Kong

- /

- Hospitality

- /

- SEHK:3918

Further Upside For NagaCorp Ltd. (HKG:3918) Shares Could Introduce Price Risks After 35% Bounce

Despite an already strong run, NagaCorp Ltd. (HKG:3918) shares have been powering on, with a gain of 35% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 79% in the last year.

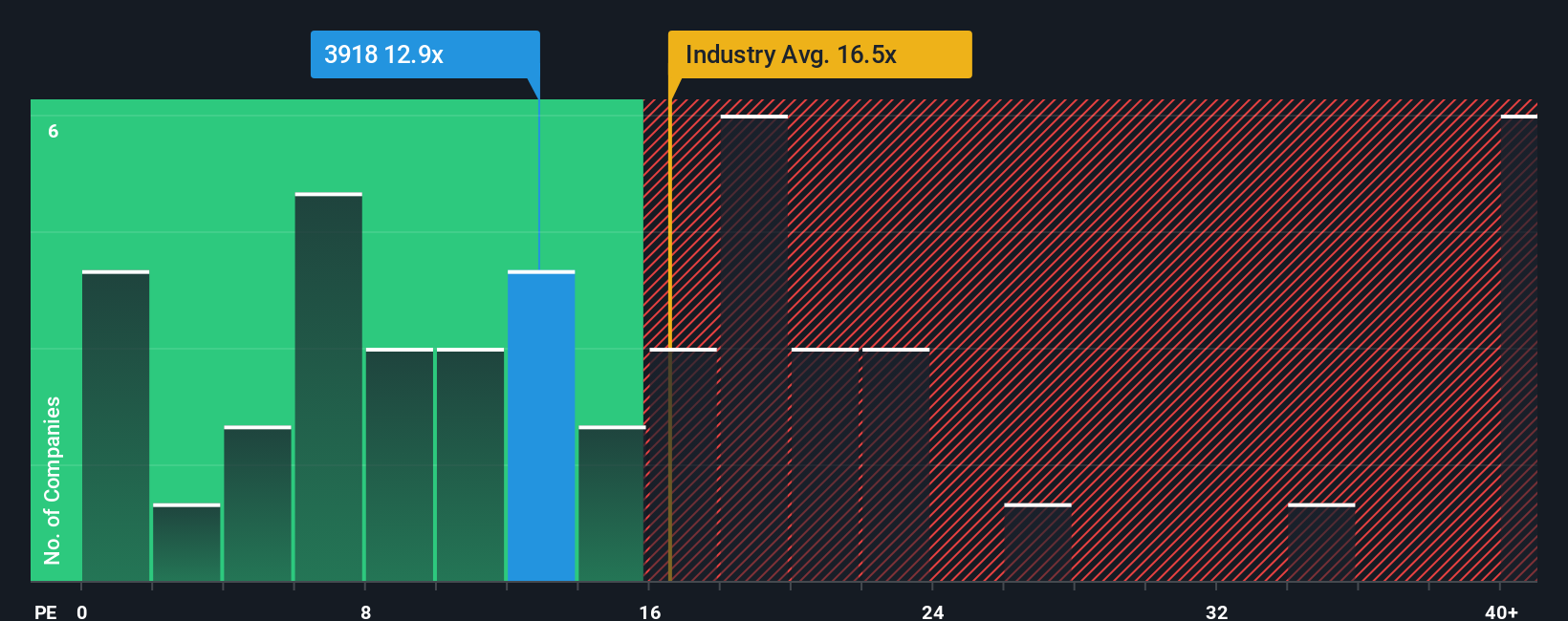

In spite of the firm bounce in price, there still wouldn't be many who think NagaCorp's price-to-earnings (or "P/E") ratio of 12.9x is worth a mention when the median P/E in Hong Kong is similar at about 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for NagaCorp as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for NagaCorp

Does Growth Match The P/E?

NagaCorp's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 177%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 13% per year, which is noticeably less attractive.

With this information, we find it interesting that NagaCorp is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

NagaCorp's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that NagaCorp currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for NagaCorp you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NagaCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3918

NagaCorp

An investment holding company, engages in the management and operation of hotel and casino complex in the Kingdom of Cambodia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)