- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Meituan (SEHK:3690) Is Down 7.6% After Q3 Profit Turns To Loss Despite Higher Revenue

Reviewed by Sasha Jovanovic

- In the third quarter of 2025, Meituan reported revenue of CNY 95,488.11 million, up from CNY 93,577.32 million a year earlier, but swung from net income of CNY 12,864.70 million to a net loss of CNY 18,632.45 million.

- This move from profit to loss, despite higher sales, highlights how rising costs and investment spend are weighing heavily on Meituan’s profitability profile.

- We’ll now examine how Meituan’s shift from profit to a sizeable quarterly loss affects its previously margin-focused investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Meituan Investment Narrative Recap

To own Meituan, you need to believe its huge on-demand ecosystem and user base can eventually convert scale into sustainable, cash-generative margins. The Q3 2025 swing to a CNY 18,632.45 million loss, despite higher revenue, directly challenges the near term margin-repair catalyst and reinforces the biggest risk right now: structurally higher costs from competition and investment that could keep profitability volatile.

The recent update on Meituan’s ongoing share buyback, with CNY 5,224.80 million spent repurchasing 42,305,400 shares since August 2024, is particularly relevant in this context. It shows management continuing to return capital even as quarterly earnings turn negative, which some investors may see as a vote of confidence while others may question given the current pressure on net income and margins.

But while scale and diversification can be appealing, the surge in subsidies and courier incentives is a risk investors should be aware of because...

Read the full narrative on Meituan (it's free!)

Meituan's narrative projects CN¥496.8 billion revenue and CN¥48.4 billion earnings by 2028. This requires 11.3% yearly revenue growth and about CN¥18.9 billion earnings increase from CN¥29.5 billion today.

Uncover how Meituan's forecasts yield a HK$129.65 fair value, a 35% upside to its current price.

Exploring Other Perspectives

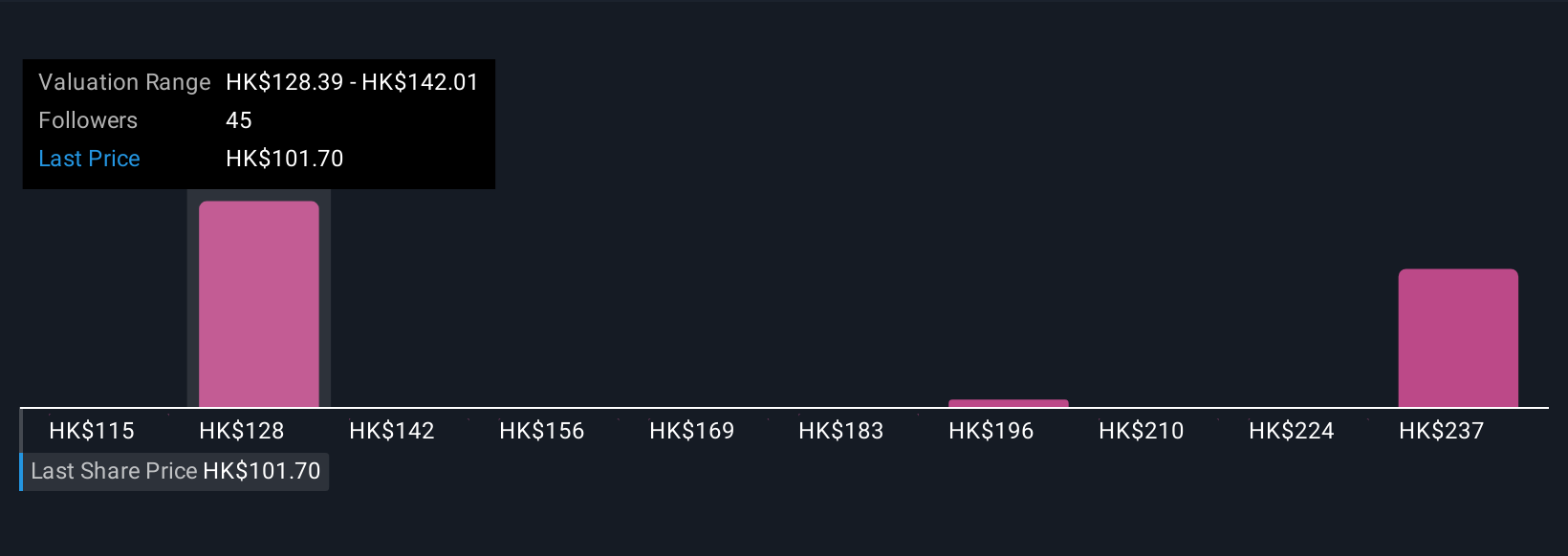

Simply Wall St Community members offer 11 fair value estimates for Meituan, ranging widely from HK$83.35 to HK$318.35, underlining how far apart views on upside really are. Against that backdrop, the latest quarterly loss despite rising revenue brings the risk of persistent margin compression into sharper focus and gives you a clear reason to compare multiple viewpoints before deciding what Meituan’s long term earnings power might look like.

Explore 11 other fair value estimates on Meituan - why the stock might be worth 13% less than the current price!

Build Your Own Meituan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meituan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Meituan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meituan's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026