Last Update 29 Sep 25

Fair value Decreased 3.11%China Urbanization And Digital Payments Will Expand Market Opportunity

Meituan’s consensus price target was trimmed as its future P/E moved higher despite stable net margins, suggesting valuation multiples have expanded, with fair value revised to HK$131.41.

What's in the News

- Meituan completed the repurchase of 42,305,400 shares (0.69% of outstanding shares) for $5,224.8 million under its ongoing buyback program.

- The board scheduled a meeting to consider and approve interim results for the six months ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Meituan

- The Consensus Analyst Price Target has fallen slightly from HK$135.63 to HK$131.41.

- The Future P/E for Meituan has risen from 20.60x to 21.90x.

- The Net Profit Margin for Meituan remained effectively unchanged, moving only marginally from 9.73% to 9.56%.

Key Takeaways

- Expansion into new business areas and international markets reduces reliance on core food delivery, improving resilience and long-term earning potential.

- Investments in logistics and AI enhance operational efficiency and margins, while a strong platform ecosystem supports user loyalty and future profitability.

- Rising competitive pressures, costly regulatory compliance, and uncertain returns from new ventures are compressing margins, challenging profitability, and threatening sustainable growth.

Catalysts

About Meituan- Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

- The acceleration of urbanization and rising middle-class incomes in China continues to broaden Meituan's addressable market, as evidenced by MAUs exceeding 600 million and growing average transaction frequency; this underpins the potential for long-term revenue growth as digital adoption further expands across population segments.

- Increased smartphone penetration and digital payment adoption are driving higher frequency and seamless transaction experiences, supporting repeat purchases and higher user monetization, which should lift both revenue and operating margins over time as Meituan maintains industry-leading user engagement metrics.

- Ongoing diversification into new business areas such as on-demand grocery delivery (Xiaoxiang Supermarket), international expansion (Keeta), and omnichannel retail, positions Meituan to capture incremental revenue streams and reduce dependence on the saturated core food delivery market, supporting overall top-line resilience and long-term earnings potential.

- Strategic investment in logistics, AI-driven operational efficiency, and supply chain solutions is enhancing delivery speed and reliability, allowing Meituan to better serve price-sensitive users and lower-tier cities while improving future operating leverage and widening margin potential once subsidy-led price wars normalize.

- Industry consolidation and Meituan's focus on platform ecosystem "flywheel" effects (e.g., cross-business membership, merchant digitization, and elevated user loyalty) foster sustained competitive advantages; when short-term subsidies subside, these strengths are likely to result in improved profitability and cash flow, benefiting net income and shareholder returns over the long term.

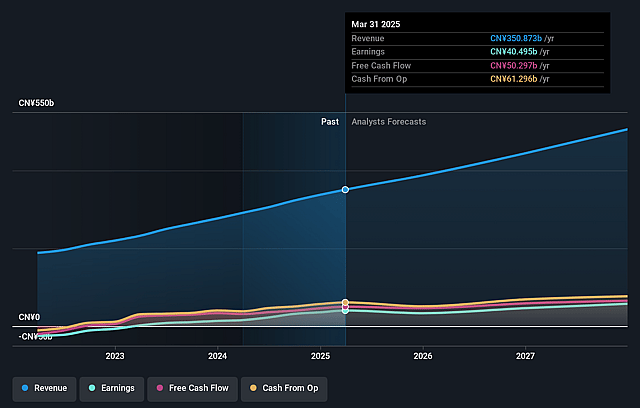

Meituan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Meituan's revenue will grow by 11.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 9.7% in 3 years time.

- Analysts expect earnings to reach CN¥48.4 billion (and earnings per share of CN¥7.48) by about September 2028, up from CN¥29.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥72.4 billion in earnings, and the most bearish expecting CN¥27.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, up from 19.0x today. This future PE is greater than the current PE for the HK Hospitality industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.98%, as per the Simply Wall St company report.

Meituan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensified competition in the on-demand delivery and retail sectors is leading to significant increases in courier incentives, marketing spend, and record-high industry-wide subsidies, resulting in margin compression and significant declines in segment operating profit and adjusted net profit-posing long-term risks to earnings and profitability if the environment does not rationalize.

- Strategic investments in new growth areas-including international expansion (Keeta), grocery retail (Xiaoxiang Supermarket), and experimental offline models-require continued capital outlay, and while management stresses patient, quality growth, these ventures currently operate at a loss or thin margins with uncertain long-term returns, presenting a risk to both cash flow and net margin improvement.

- Rising demands for courier welfare and worker protections, such as nationwide expansion of occupational injury and pension insurance plus additional benefits and subsidies, are increasing fixed operating costs; if regulatory requirements tighten further, this could structurally raise cost of revenue and compress unit economics going forward.

- Ongoing and potentially escalating macroeconomic challenges and consumer demand shifts in China-such as increased price sensitivity, volatility in average order value, and slower revenue growth relative to GTV/order volume expansion-could limit top-line growth opportunities and pressure overall revenues if discretionary spending remains subdued.

- The order volume growth in core segments may be approaching saturation in higher-tier cities, and aggressive pursuit of lower-tier or price-sensitive markets, alongside entry into less-proven verticals, risks capping revenue growth and diluting overall profitability if new users/orders generate lower margins or require sustained promotional support.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$135.635 for Meituan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$300.96, and the most bearish reporting a price target of just HK$78.28.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥496.8 billion, earnings will come to CN¥48.4 billion, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 9.0%.

- Given the current share price of HK$100.5, the analyst price target of HK$135.63 is 25.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.