Key Takeaways

- Escalating subsidies, labor, and regulatory costs are eroding margins and profitability, threatening the sustainability of core business lines and diminishing long-term earnings quality.

- Expansion into new, unproven business areas and demographic challenges risk further stretching resources, making sustained growth and margin recovery increasingly difficult.

- Continued investment in AI-driven efficiency, ecosystem expansion, new market growth, and disciplined management underpins Meituan's long-term revenue potential and resilience amid competition.

Catalysts

About Meituan- Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

- Fierce competition in both food delivery and on-demand retail is now requiring Meituan to significantly increase spending on subsidies for couriers and user incentives, driving up cost of revenue and causing operating profit and net margins to decline sharply; with no signs of market normalization, persistent price wars could lead to long-term margin compression and structurally weaker earnings.

- Intensifying industry-wide reliance on subsidies has resulted in the record-high marketing and promotional expenses. This approach not only erodes near-term profitability but risks setting a precedent where core segments cannot revert to sustainable margin levels, threatening the viability of long-term growth and cash flow generation.

- Recent expansion into new business lines such as international delivery and broader grocery retail is stretching both capital allocation and operational focus; these verticals remain unproven and are driving higher operating losses, putting further downside pressure on group earnings quality and return on invested capital.

- Labor and regulatory costs are rising, with Meituan extending occupational injury and pension insurance to over 1 million couriers and facing growing regulatory pressure around gig worker protections. These trends are likely to structurally increase fulfillment costs and suppress net margins across core businesses in the years ahead.

- Demographic headwinds are accelerating, as urbanization in China is showing signs of plateauing and population aging is set to shrink the company's addressable market over time, making sustained revenue growth much more difficult and heightening the risk of long-term stagnation or contraction in order volumes.

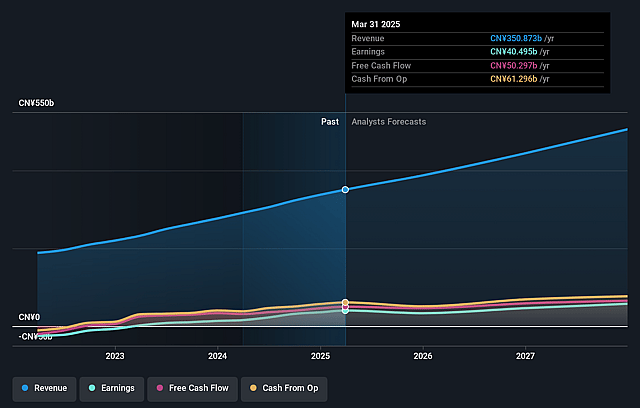

Meituan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Meituan compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Meituan's revenue will grow by 9.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 8.2% today to 6.9% in 3 years time.

- The bearish analysts expect earnings to reach CN¥32.6 billion (and earnings per share of CN¥3.8) by about September 2028, up from CN¥29.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, down from 19.2x today. This future PE is greater than the current PE for the HK Hospitality industry at 16.7x.

- Analysts expect the number of shares outstanding to grow by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Meituan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Meituan's persistent investments in technology, AI-driven logistics, and operational efficiency-along with the rollout of innovative supply initiatives such as cloud kitchens and AI assistant tools for merchants-are likely to structurally lower future fulfillment costs and improve delivery quality, supporting higher net margins and improved earnings quality over time.

- The company's ability to drive strong user growth, deepen engagement through memberships, and cross-sell across food delivery, in-store dining, retail, hotel, and travel services demonstrates a robust ecosystem and network effects, which should underpin recurring revenue growth, higher transaction volumes, and greater share of wallet per user.

- Meituan's rapid expansion in high-growth areas like on-demand retail, with Instashopping and Xiaoxiang Supermarket consistently outpacing industry averages and tapping into lower-tier city growth, indicates a substantial long-term addressable market, providing upside for long-term revenue and potential operating leverage.

- The international expansion of Meituan's Keeta brand, already securing leading positions in new overseas markets such as Hong Kong and Saudi Arabia, opens up significant new revenue streams and demonstrates capability to scale its model globally, potentially boosting consolidated group revenues and diversifying earnings drivers in the future.

- Even amid intense competition and industry-wide subsidies, management's focus on sustainable ecosystem development, operational excellence, and capacity to rebuild profitability once competition rationalizes suggests the company's core business can generate healthy cash flow and stable earnings in the longer term, limiting downside risk to net profit and supporting long-term shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Meituan is HK$78.22, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Meituan's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$300.76, and the most bearish reporting a price target of just HK$78.22.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥470.3 billion, earnings will come to CN¥32.6 billion, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 9.0%.

- Given the current share price of HK$101.7, the bearish analyst price target of HK$78.22 is 30.0% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Meituan?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.