Key Takeaways

- Leveraging technology and operational scale, Meituan's international and lower-tier city expansions could transform revenue growth and market share beyond current expectations.

- Strategic reinvestment and growth in high-margin, cross-selling businesses signal stronger earnings resilience and new profit engines not fully reflected in present market views.

- Intensifying competition, rising costs, slower monetization, ongoing cash burn from new ventures, and macroeconomic pressures threaten Meituan's profitability and long-term growth potential.

Catalysts

About Meituan- Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

- Analyst consensus expects Meituan's international expansion (notably Keeta in Saudi Arabia and Qatar) to gradually boost revenue, but this view may understate the scale-management targets HKD 100 billion GMV in ten years with plans to leverage proprietary technology and China-scale operational efficiencies, indicating global revenue share could become a transformational growth engine.

- While consensus sees technology and AI investment improving net margins, a more bullish take is that Meituan's use of AI for merchant digitization, supply chain automation, and last-mile logistics will genuinely reset the competitive landscape, potentially enabling faster-than-expected margin recovery as subsidies recede and raising long-term operating leverage.

- With accelerating online service adoption in lower-tier Chinese cities and rural areas, Meituan stands to unlock a huge, largely untapped base, which could drive outsized growth in transaction volume, average revenue per user, and overall market share well beyond current market models.

- The company's fast-expanding high-margin businesses-particularly in local services, advertising, and in-store travel-are beginning to show strong cross-sell flywheels through Meituan's membership ecosystem, suggesting a sustained step change in blended net margins and more resilient earnings growth compared to food delivery alone.

- Meituan's strong cash position and demonstrated capital discipline post-Select restructuring now enable aggressive reinvestment into proprietary grocery, omnichannel retail, fintech, and high-frequency value-added services, setting the stage for multiple new profit engines and far higher long-term earnings power than factored into present valuations.

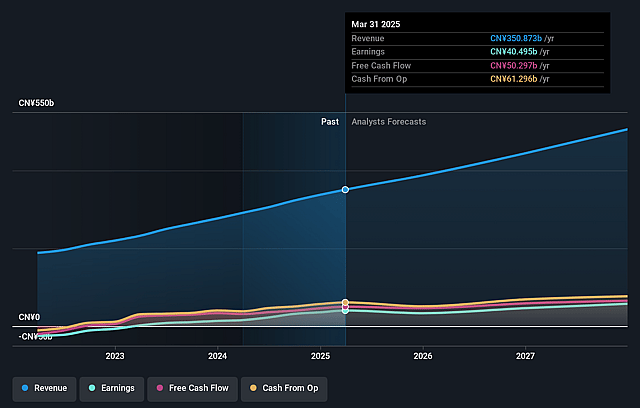

Meituan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Meituan compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Meituan's revenue will grow by 17.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.2% today to 15.0% in 3 years time.

- The bullish analysts expect earnings to reach CN¥87.0 billion (and earnings per share of CN¥13.58) by about September 2028, up from CN¥29.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 19.2x today. This future PE is greater than the current PE for the HK Hospitality industry at 16.7x.

- Analysts expect the number of shares outstanding to grow by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Meituan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition and subsidy wars in food delivery and on-demand retail are causing significant declines in Meituan's net margins and operating profit, and there are no signs that this environment will normalize soon, which may depress earnings recovery for an extended period.

- Rising courier incentive costs, expanded welfare and insurance programs, and regulatory risks related to gig worker protections are driving up operating expenses, which will further pressure Meituan's profitability and erode net margins over time.

- A slowdown in top-line growth for core local commerce, with revenue growth lagging behind order volume and gross transaction value expansion, suggests monetization in mature business segments may be plateauing, jeopardizing long-term revenue growth as the addressable market matures.

- Large, recurring investments in high-growth but cash-burning new ventures such as grocery, international expansion, and community retail are increasing Meituan's cash burn, which has already resulted in meaningful reductions in cash generated from operating activities and could undermine future earnings if these ventures fail to turn profitable.

- Macroeconomic headwinds, weak consumer sentiment, and China's aging demographic profile threaten to constrain discretionary spending and limit overall consumption growth in food delivery and local services, ultimately putting downward pressure on Meituan's revenue and earnings growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Meituan is HK$203.79, which represents two standard deviations above the consensus price target of HK$132.33. This valuation is based on what can be assumed as the expectations of Meituan's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$300.76, and the most bearish reporting a price target of just HK$78.22.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥581.6 billion, earnings will come to CN¥87.0 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 9.0%.

- Given the current share price of HK$101.7, the bullish analyst price target of HK$203.79 is 50.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.