- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Is Meituan Finally a Bargain After a 37% Share Price Slump?

Reviewed by Bailey Pemberton

- Wondering if Meituan is finally a bargain after years of volatility, or just another value trap in Chinese tech? This breakdown is designed to help you decide with a clear, valuation-led lens.

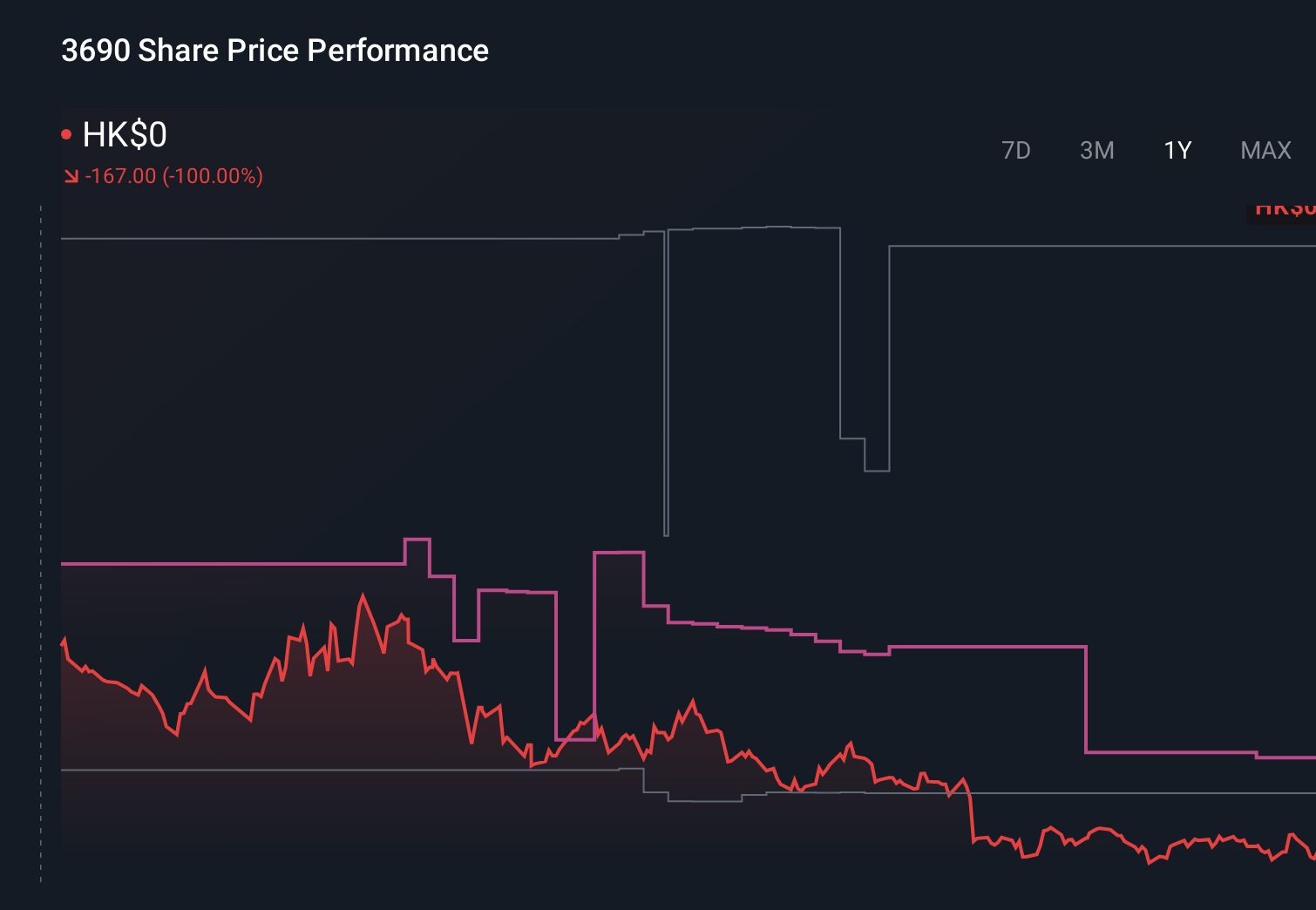

- The stock has inched up 2.2% over the last week even as it remains down 33.9% year to date and 37.3% over the past year, a combination that often signals shifting views on risk and long-term upside.

- Much of the recent movement has been shaped by ongoing headlines about China’s consumer recovery, regulatory scrutiny of internet platforms, and competition in food delivery and local services. Investors are juggling upbeat commentary on domestic travel and services demand with caution around policy risks and margin pressure.

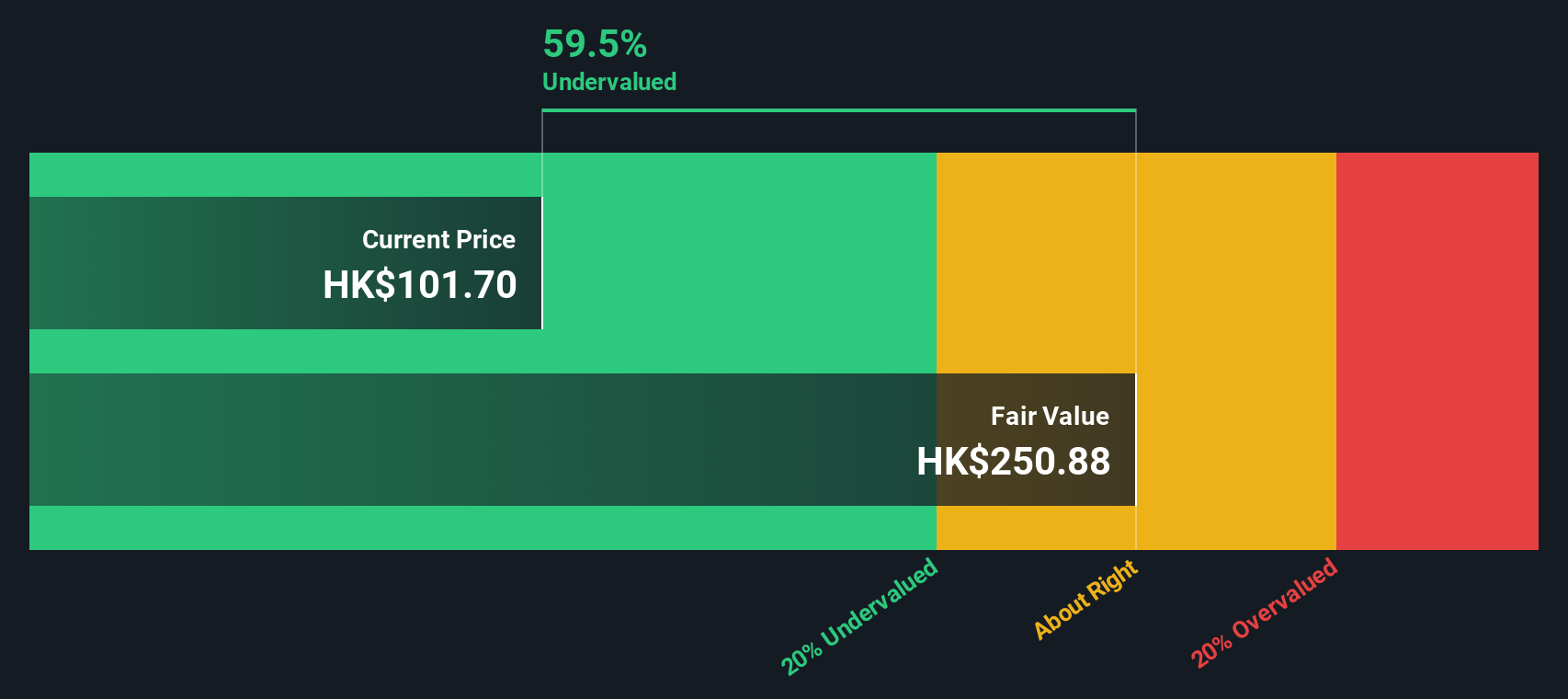

- Right now Meituan scores a 4/6 on our valuation checks, suggesting pockets of undervaluation that look interesting but not unequivocally cheap. Next we will unpack what different valuation approaches say about the stock, before finishing with a more holistic way to judge whether the current price truly makes sense.

Find out why Meituan's -37.3% return over the last year is lagging behind its peers.

Approach 1: Meituan Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today, adjusting for risk and time.

For Meituan, the latest twelve month free cash flow is about CN¥1.83 billion, and analysts expect this to scale rapidly as the platform matures. Using a two stage Free Cash Flow to Equity model, near term forecasts out to 2028 are combined with longer term extrapolations by Simply Wall St. Projected free cash flow reaches roughly CN¥160.9 billion by 2035 based on a decelerating growth path.

When these cash flows are discounted back to today, the model arrives at an intrinsic value of around HK$315.27 per share. Compared with the current market price, this implies Meituan is trading at a 68.4% discount to its estimated fair value. This suggests that the market is heavily discounting its long term cash generation potential and regulatory risks.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meituan is undervalued by 68.4%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Meituan Price vs Sales

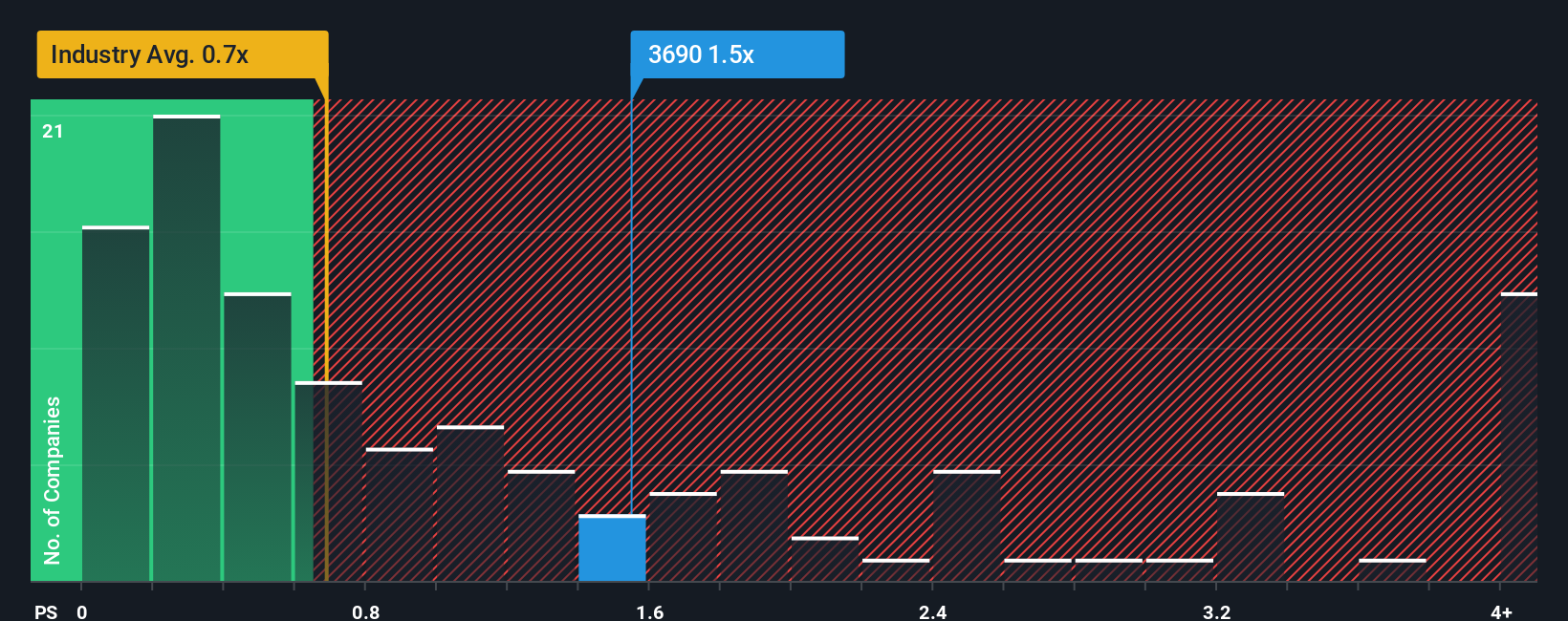

For platform businesses like Meituan that are still normalising profitability, the Price to Sales multiple is often a cleaner way to compare value because it looks at what investors are paying for each unit of revenue, rather than volatile or depressed earnings.

In practice, higher growth and lower perceived risk usually justify a higher sales multiple, while slower growth or elevated regulatory and competitive risks tend to pull that “normal” range down. Against this backdrop, Meituan currently trades on about 1.52x sales, which is just above the Hospitality industry average of roughly 0.71x but well below its peer group, which sits closer to 3.25x.

Simply Wall St’s Fair Ratio is designed to go a step further than simple peer or sector comparisons. It estimates the Price to Sales multiple a stock might trade on after accounting for its growth profile, profitability, risk factors, industry structure and market cap. For Meituan, that Fair Ratio is around 4.86x, which suggests that the company’s current 1.52x sales multiple may not fully reflect its fundamentals and long term growth profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meituan Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story to your numbers by linking your view of Meituan’s future revenue, earnings, and margins to a financial forecast and, ultimately, to a fair value estimate that you can compare with today’s share price to help you decide whether it is a buy, hold, or sell.

Narratives are easy to use, dynamically updated as new news or earnings arrive, and powerful because they make it obvious how different perspectives can coexist. For example, one Meituan Narrative might assume earnings grow toward about CN¥72.4 billion with a fair value near HK$301, while a more cautious Narrative might lean toward CN¥27.1 billion and a fair value closer to HK$78. Both can be tracked and refined over time as the story develops.

Do you think there's more to the story for Meituan? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)