- Hong Kong

- /

- Consumer Services

- /

- SEHK:1449

Leader Education Limited (HKG:1449) Shares Fly 29% But Investors Aren't Buying For Growth

Leader Education Limited (HKG:1449) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

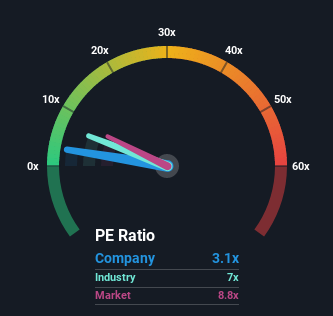

In spite of the firm bounce in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 9x, you may still consider Leader Education as a highly attractive investment with its 3.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Leader Education has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out the opportunities and risks within the HK Consumer Services industry.

How Is Leader Education's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Leader Education's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.7% last year. Still, lamentably EPS has fallen 40% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 17% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Leader Education's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Leader Education's P/E

Shares in Leader Education are going to need a lot more upward momentum to get the company's P/E out of its slump. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Leader Education maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Leader Education (1 can't be ignored!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you're looking to trade Leader Education, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1449

Leader Education

An investment holding company, engages in the provision of private higher and vocational education services in the People’s Republic of China.

Slight and fair value.

Market Insights

Community Narratives