- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

SEHK Growth Stocks With High Insider Ownership Showing 30% Revenue Growth

Reviewed by Simply Wall St

In the midst of global market fluctuations, Hong Kong's stock market has shown resilience, with the Hang Seng Index climbing 10.2% amid optimism about Beijing’s supportive measures. As investors navigate these uncertain times, growth companies with high insider ownership and a track record of strong revenue growth can offer a sense of stability and potential opportunity in an otherwise volatile environment.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Akeso (SEHK:9926) | 20.5% | 53% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Here we highlight a subset of our preferred stocks from the screener.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$10.56 billion.

Operations: The company's revenue segments include Global Payment services generating CN¥722.95 million, Domestic Payment services contributing CN¥309.92 million, and Value-Added Services bringing in CN¥153.01 million.

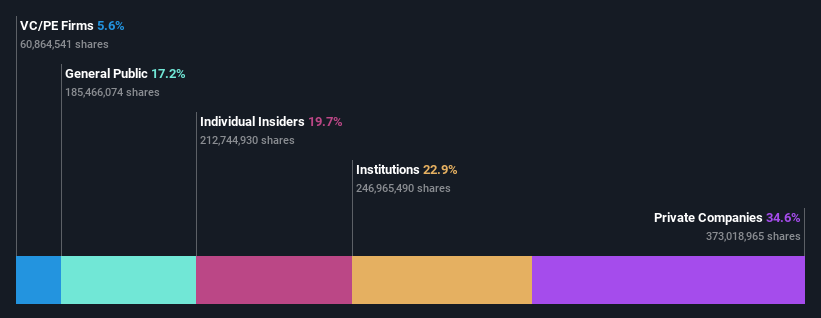

Insider Ownership: 19.7%

Revenue Growth Forecast: 22.3% p.a.

Lianlian DigiTech is experiencing significant growth, with revenue forecasted to increase by 22.3% annually, outpacing the Hong Kong market's average. Although currently unprofitable, it's expected to achieve profitability within three years. Recent earnings show sales rising to CNY 617.39 million for H1 2024 from CNY 440.59 million a year earlier, though net losses remain substantial at CNY 351.29 million. Despite these challenges, the company's growth trajectory and insider ownership suggest potential long-term value creation.

- Take a closer look at Lianlian DigiTech's potential here in our earnings growth report.

- Our valuation report unveils the possibility Lianlian DigiTech's shares may be trading at a premium.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$29.43 billion.

Operations: The company's revenue segment is primarily derived from Jewelry & Watches, amounting to CN¥5.28 billion.

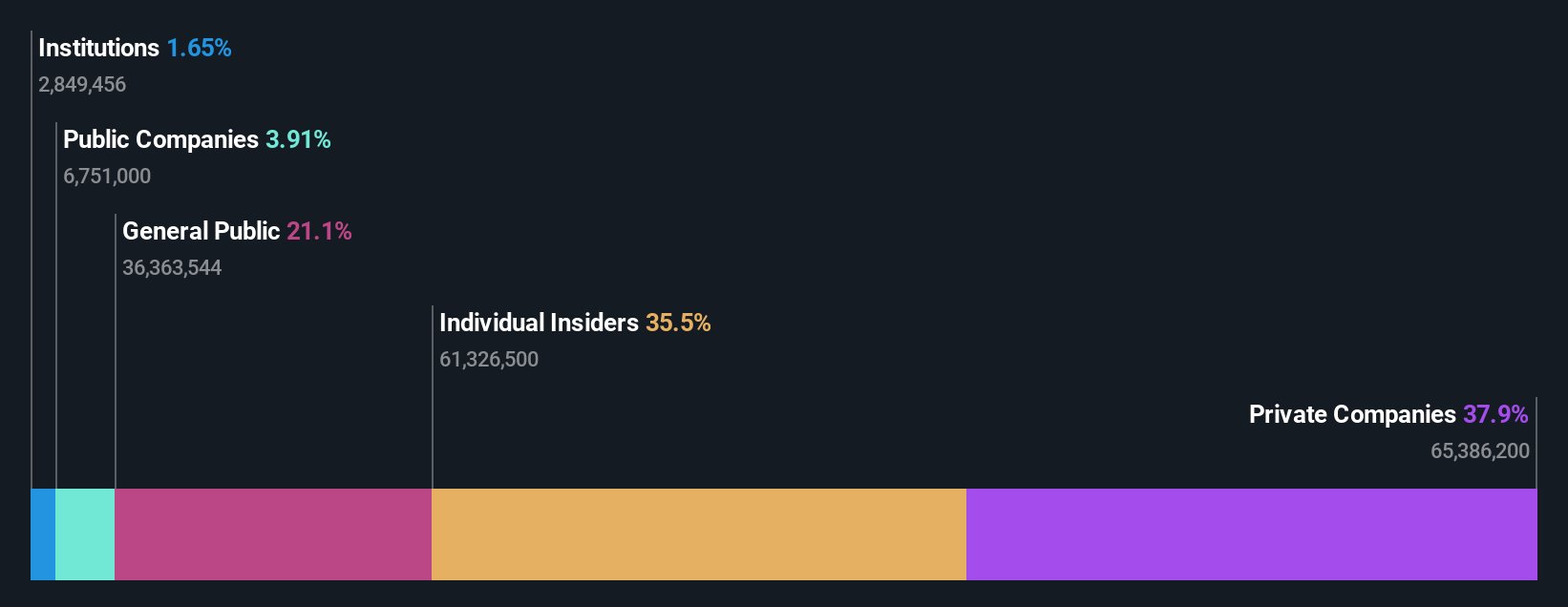

Insider Ownership: 36.4%

Revenue Growth Forecast: 30% p.a.

Laopu Gold is poised for robust growth, with revenue forecasted to rise 30% annually, significantly outpacing the Hong Kong market. Earnings are expected to grow by 33.2% per year, indicating strong profit potential. Recent financials show a substantial increase in sales to CNY 3.52 billion and net income of CNY 587.81 million for H1 2024, compared to the previous year. Amendments to its Articles of Association reflect ongoing strategic adjustments aligning with regulatory standards.

- Dive into the specifics of Laopu Gold here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Laopu Gold is trading beyond its estimated value.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market cap of HK$3.96 billion.

Operations: The company's revenue is primarily derived from its Social Networking Business, contributing CN¥3.80 billion, alongside its Innovative Business segment, which generates CN¥406.28 million.

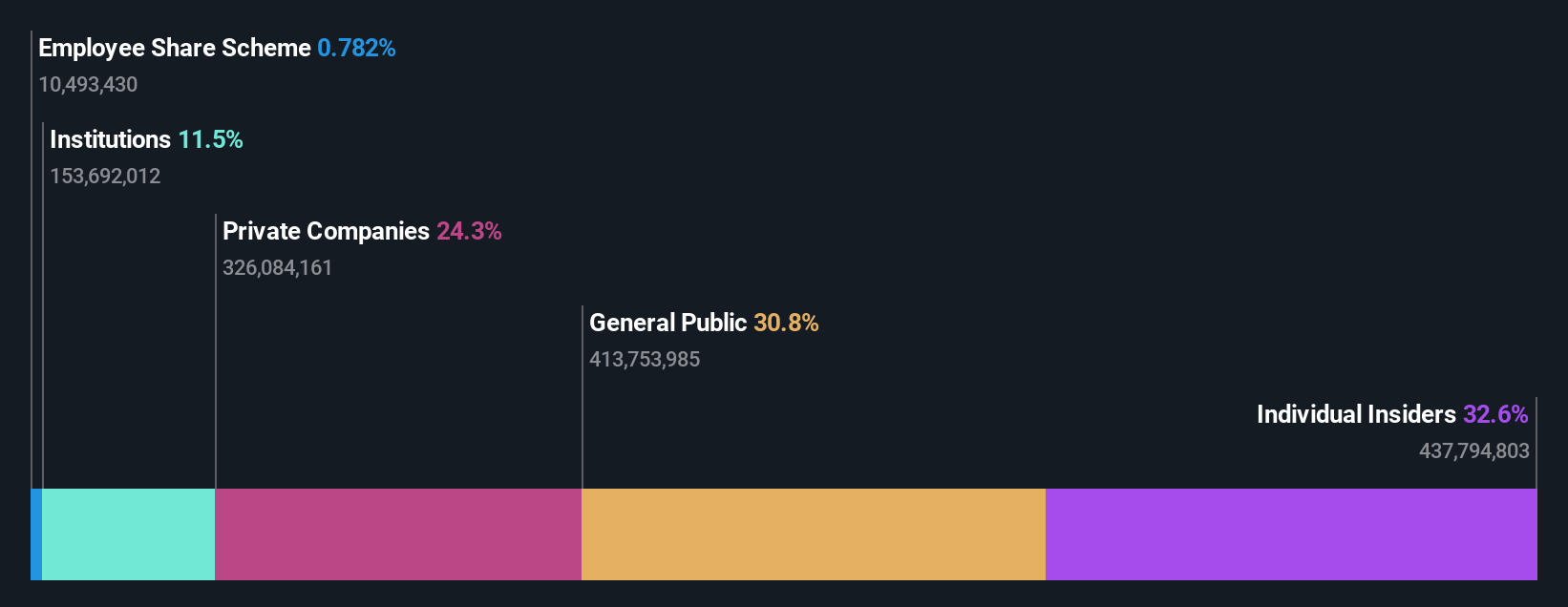

Insider Ownership: 35.4%

Revenue Growth Forecast: 13.5% p.a.

Newborn Town demonstrates growth potential with earnings forecasted to increase by 14.64% annually, surpassing the Hong Kong market's average. Revenue is also expected to grow at 13.5% per year, driven by market expansion in regions like the Middle East and North Africa. Recent results show sales reaching CNY 2.27 billion for H1 2024, up from CNY 1.37 billion a year ago, alongside strategic leadership changes to enhance operational efficiency and performance improvement initiatives.

- Click here to discover the nuances of Newborn Town with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Newborn Town's current price could be quite moderate.

Make It Happen

- Access the full spectrum of 47 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China.

Reasonable growth potential with adequate balance sheet.