- Poland

- /

- Food and Staples Retail

- /

- WSE:DNP

3 Growth Stocks With High Insider Ownership Growing Revenue Up To 22%

Reviewed by Simply Wall St

As global markets navigate choppy waters, with U.S. equities experiencing declines amid inflation concerns and political uncertainties, investors are keenly observing how these macroeconomic factors influence growth stocks. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate management's confidence in the business's long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Underneath we present a selection of stocks filtered out by our screen.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company offering hardware and software services both in Mainland China and internationally, with a market cap of HK$841.66 billion.

Operations: The company's revenue is primarily derived from its Smartphones segment at CN¥184.68 billion, followed by IoT and Lifestyle Products at CN¥93.58 billion, and Internet Services contributing CN¥32.66 billion.

Insider Ownership: 34%

Revenue Growth Forecast: 14.2% p.a.

Xiaomi's recent financial performance shows solid growth, with earnings increasing by 21.8% over the past year and a forecasted annual profit growth of 21.4%, outpacing the Hong Kong market average. The company's revenue is expected to grow at 14.2% annually, which is above the market rate but not exceptionally high for a growth company. Despite trading below fair value estimates, insider ownership remains significant with no substantial insider trading activity reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Xiaomi.

- Our valuation report here indicates Xiaomi may be overvalued.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$47.31 billion.

Operations: The company's revenue segment primarily consists of its Jewelry & Watches division, generating CN¥5.28 billion.

Insider Ownership: 36.4%

Revenue Growth Forecast: 22.6% p.a.

Laopu Gold's earnings have surged 217.7% over the past year, with forecasts predicting continued robust growth of 35.8% annually, significantly outpacing the Hong Kong market average. Revenue is also expected to expand rapidly at 22.6% per year, exceeding market expectations. Despite a highly volatile share price recently, no substantial insider trading activity has been reported in the last three months. Laopu Gold was added to the S&P Global BMI Index in December 2024.

- Dive into the specifics of Laopu Gold here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Laopu Gold's current price could be inflated.

Dino Polska (WSE:DNP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN42.51 billion.

Operations: Dino Polska generates revenue through its network of mid-sized grocery supermarkets across Poland.

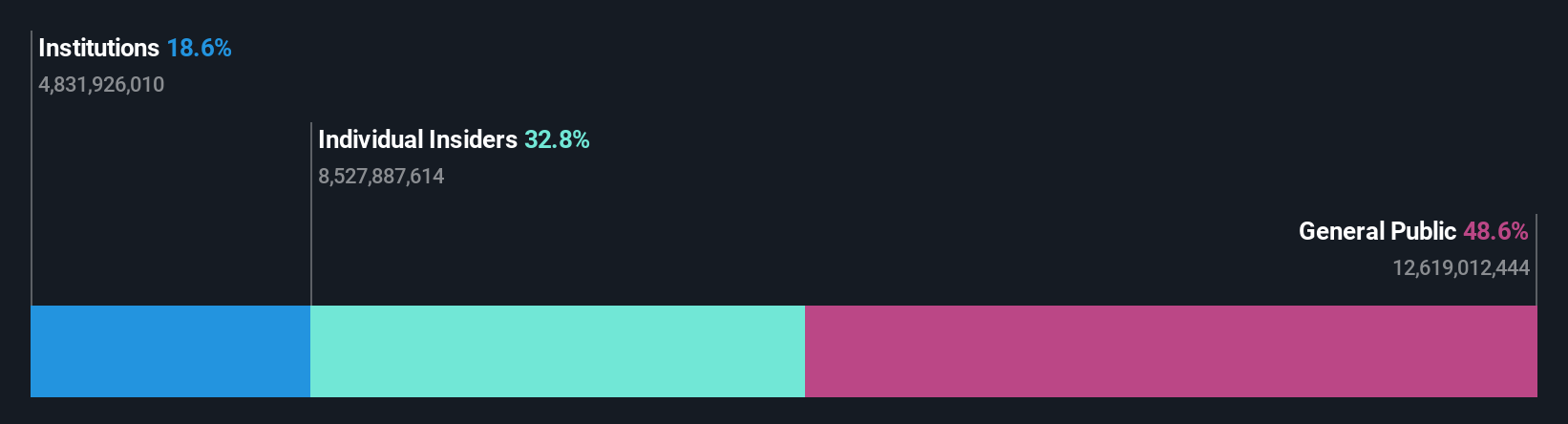

Insider Ownership: 36%

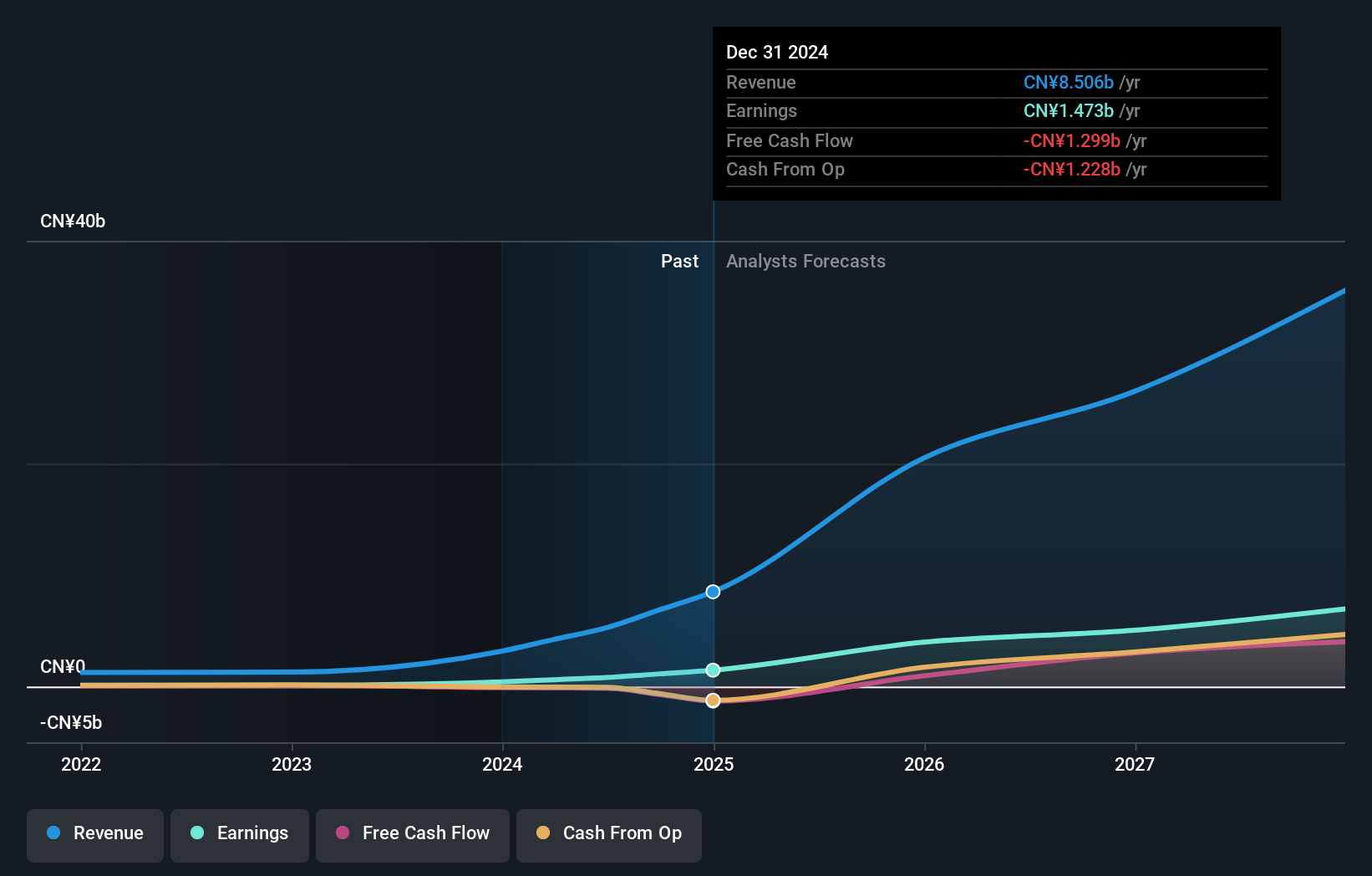

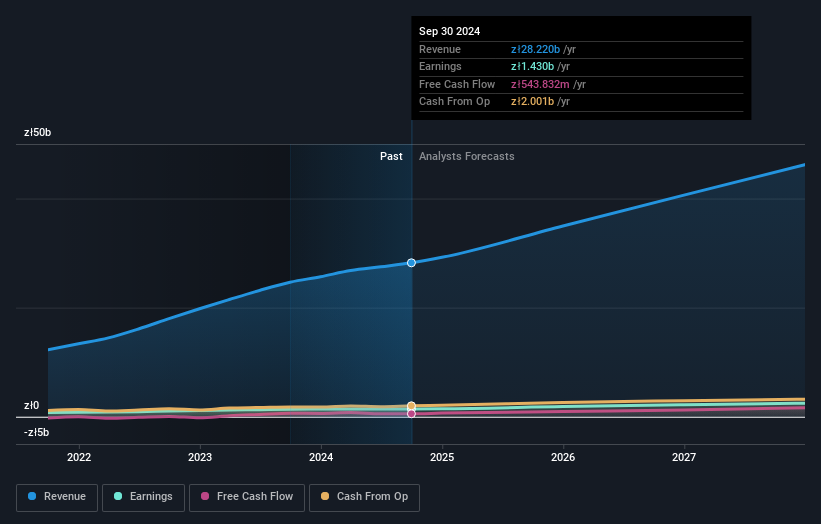

Revenue Growth Forecast: 13.6% p.a.

Dino Polska's recent earnings report shows steady growth, with third-quarter sales rising to PLN 7.61 billion and net income at PLN 438.21 million. While revenue growth is projected at 13.6% annually, slower than the ideal for high-growth companies, it still surpasses the Polish market's average of 4.7%. The company trades significantly below its fair value estimate and boasts a strong Return on Equity forecast of 22.6%, though no recent insider trading activity has been noted.

- Click to explore a detailed breakdown of our findings in Dino Polska's earnings growth report.

- Our expertly prepared valuation report Dino Polska implies its share price may be lower than expected.

Summing It All Up

- Discover the full array of 1474 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DNP

Dino Polska

Operates a network of mid-sized grocery supermarkets under the Dino brand name in Poland.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives