- Hong Kong

- /

- Consumer Durables

- /

- SEHK:526

Do Lisi Group (Holdings)'s (HKG:526) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Lisi Group (Holdings) (HKG:526), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Lisi Group (Holdings)

How Fast Is Lisi Group (Holdings) Growing Its Earnings Per Share?

In the last three years Lisi Group (Holdings)'s earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Lisi Group (Holdings) has grown its trailing twelve month EPS from CN¥0.034 to CN¥0.037, in the last year. That's a modest gain of 9.6%.

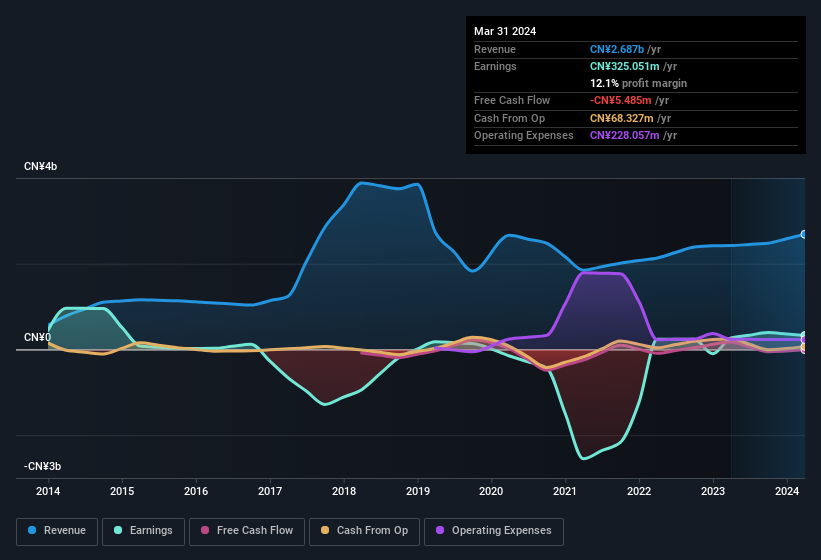

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Lisi Group (Holdings) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to CN¥2.7b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Lisi Group (Holdings) isn't a huge company, given its market capitalisation of HK$1.2b. That makes it extra important to check on its balance sheet strength.

Are Lisi Group (Holdings) Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Lisi Group (Holdings) is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Indeed, company insider Alexia David has accumulated shares over the last year, paying a total of CN¥61m at an average price of about CN¥0.076. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

On top of the insider buying, we can also see that Lisi Group (Holdings) insiders own a large chunk of the company. In fact, they own 57% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about CN¥676m riding on the stock, at current prices. So there's plenty there to keep them focused!

Does Lisi Group (Holdings) Deserve A Spot On Your Watchlist?

As previously touched on, Lisi Group (Holdings) is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. You still need to take note of risks, for example - Lisi Group (Holdings) has 2 warning signs (and 1 which is significant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Lisi Group (Holdings), you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:526

Lisi Group (Holdings)

An investment holding company, manufactures and trades in plastic and metallic household products in Mainland China, Hong Kong, the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives