Metso Oyj And 2 Other Stocks Possibly Trading Below Estimated Value

Reviewed by Simply Wall St

In the current landscape, global markets have been marked by volatility as U.S. equities faced declines amid inflation concerns and political uncertainty, while European markets experienced modest gains with expectations of interest rate cuts. Amid these fluctuations, identifying undervalued stocks can be a strategic approach for investors seeking opportunities that may offer potential value in an unpredictable environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2228.29 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.57 | A$1.14 | 50% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Dino Polska (WSE:DNP) | PLN433.60 | PLN863.86 | 49.8% |

| Cicor Technologies (SWX:CICN) | CHF59.60 | CHF118.58 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.87 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5869.00 | ¥11708.96 | 49.9% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Let's review some notable picks from our screened stocks.

Metso Oyj (HLSE:METSO)

Overview: Metso Oyj is a company that offers technologies, end-to-end solutions, and services for the aggregates, minerals processing, and metals refining industries across various global regions with a market cap of €7.33 billion.

Operations: The company's revenue is primarily derived from its Minerals segment, which generated €3.73 billion, and its Aggregates segment, which contributed €1.21 billion.

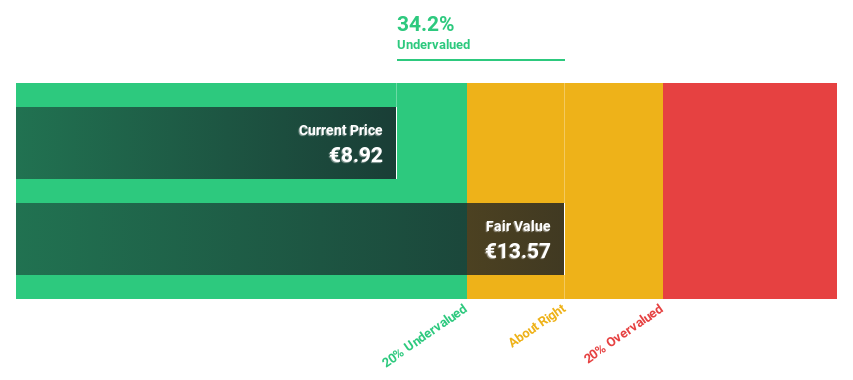

Estimated Discount To Fair Value: 34.9%

Metso Oyj is trading at €8.85, significantly below its estimated fair value of €13.6, suggesting it may be undervalued based on cash flows. Despite recent organizational changes and a net loss in the third quarter of 2024, forecasts indicate revenue growth of 5.3% annually and earnings growth above the Finnish market average at 14.5%. However, its dividend yield of 4.07% is not well covered by free cash flows, indicating potential financial constraints.

- Our comprehensive growth report raises the possibility that Metso Oyj is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Metso Oyj's balance sheet health report.

XD (SEHK:2400)

Overview: XD Inc. is an investment holding company that develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally with a market cap of HK$11.44 billion.

Operations: The company's revenue is derived from its Game segment, which generated CN¥2.43 billion, and the TapTap Platform segment, contributing CN¥1.43 billion.

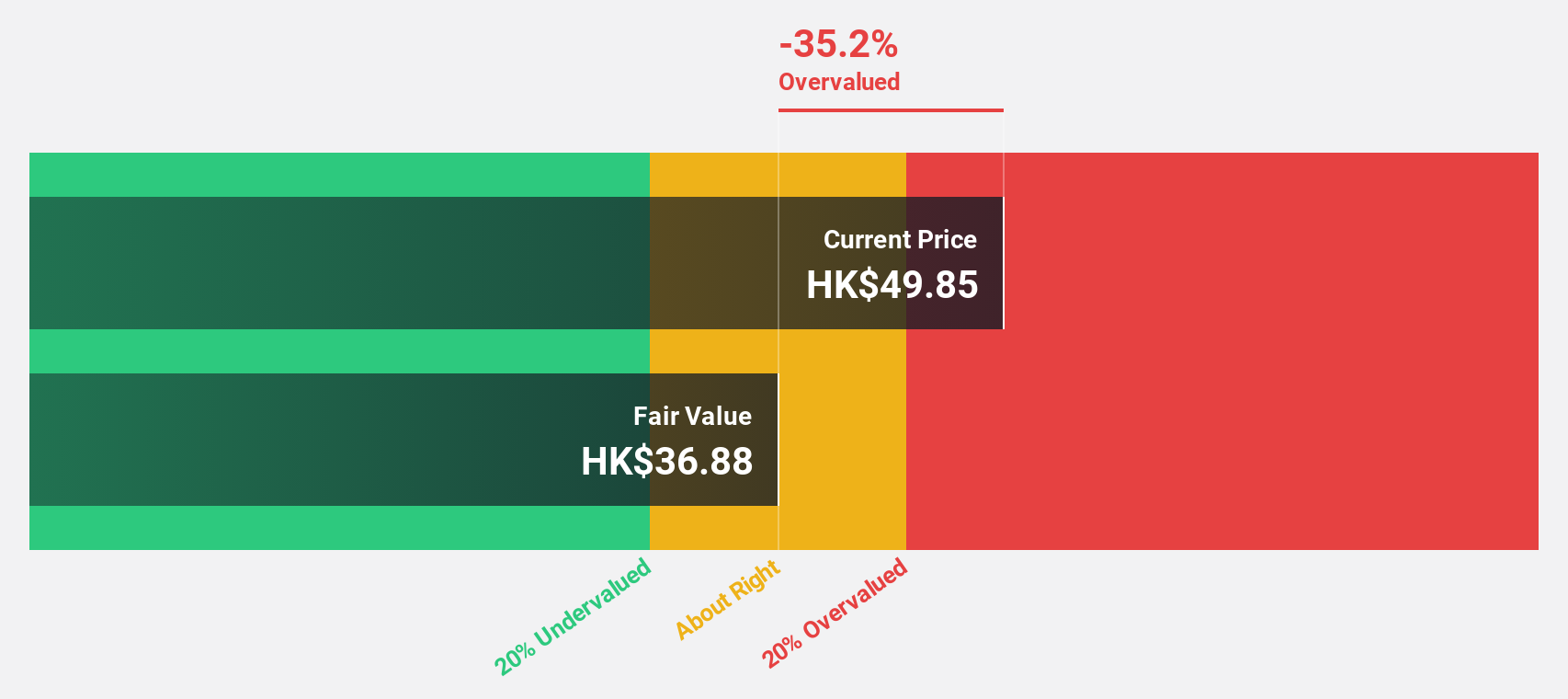

Estimated Discount To Fair Value: 45.5%

XD is trading at HK$23.7, significantly below its estimated fair value of HK$43.5, making it undervalued based on cash flows. Revenue and earnings are expected to grow faster than the Hong Kong market, with earnings projected to rise significantly at 52.7% annually over the next three years. Despite recent shareholder dilution, XD's return on equity is forecasted to be high in three years at 22.3%, highlighting its potential for strong financial performance.

- Upon reviewing our latest growth report, XD's projected financial performance appears quite optimistic.

- Navigate through the intricacies of XD with our comprehensive financial health report here.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China with a market cap of HK$40.41 billion.

Operations: The company's revenue segments include Down Apparels at CN¥20.66 billion, Ladieswear Apparels at CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion.

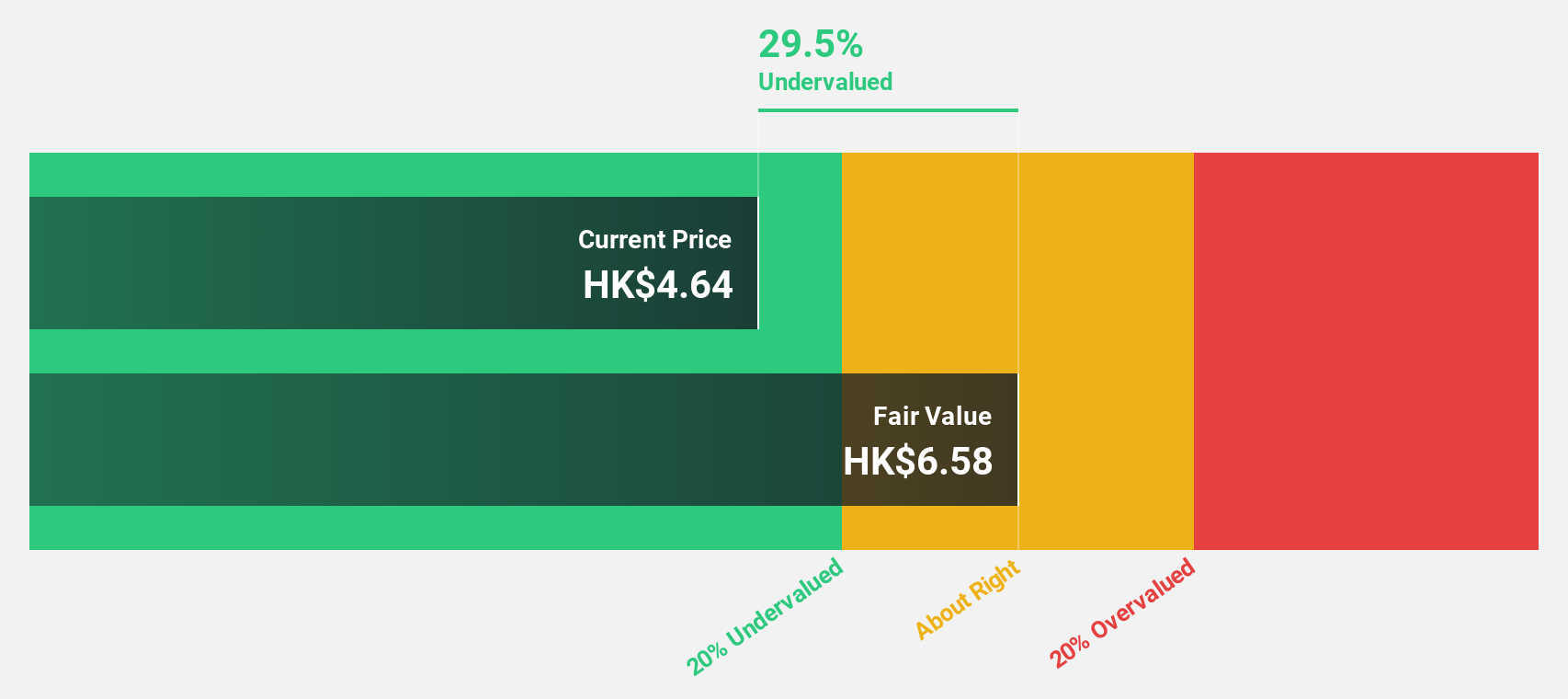

Estimated Discount To Fair Value: 34%

Bosideng International Holdings is trading at HK$3.67, below its estimated fair value of HK$5.56, suggesting it's undervalued based on cash flows. Earnings grew 41.4% last year and are expected to grow faster than the Hong Kong market at 13.1% annually. The company recently announced a share buyback program aimed at enhancing net asset value and earnings per share, indicating a strategic use of available cash flow to potentially increase shareholder value.

- The analysis detailed in our Bosideng International Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Bosideng International Holdings stock in this financial health report.

Seize The Opportunity

- Embark on your investment journey to our 880 Undervalued Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:METSO

Metso Oyj

Provides technologies, end-to-end solutions, and services for aggregates, minerals processing, and metals refining industries in Europe, North and Central America, South America, the Asia Pacific, Greater China, Africa, the Middle East, and India.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives