- Hong Kong

- /

- Real Estate

- /

- SEHK:674

Do China Tangshang Holdings' (HKG:674) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like China Tangshang Holdings (HKG:674), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for China Tangshang Holdings

China Tangshang Holdings' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that China Tangshang Holdings' EPS went from HK$0.0048 to HK$0.017 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

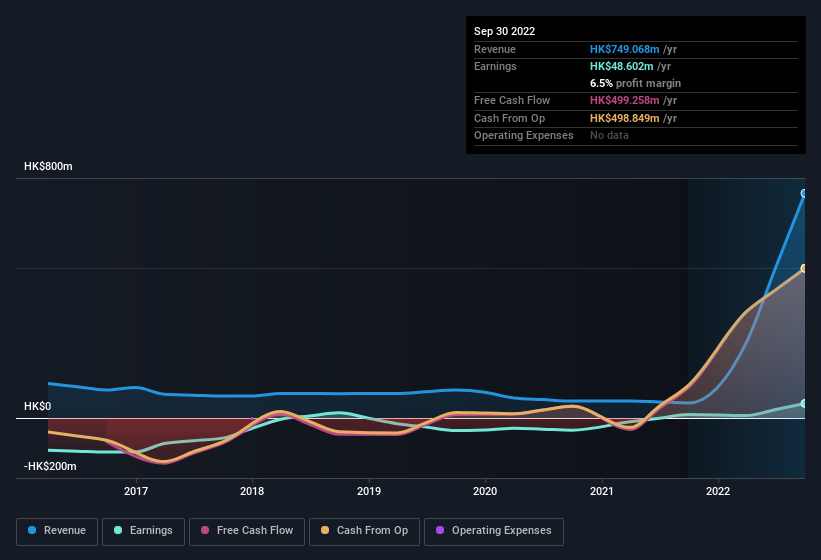

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of China Tangshang Holdings shareholders is that EBIT margins have grown from 24% to 27% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since China Tangshang Holdings is no giant, with a market capitalisation of HK$617m, you should definitely check its cash and debt before getting too excited about its prospects.

Are China Tangshang Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for China Tangshang Holdings is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Indeed, Executive Chairman Weiwu Chen has accumulated shares over the last year, paying a total of HK$18m at an average price of about HK$0.25. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

And the insider buying isn't the only sign of alignment between shareholders and the board, since China Tangshang Holdings insiders own more than a third of the company. Owning 50% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have HK$309m invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add China Tangshang Holdings To Your Watchlist?

China Tangshang Holdings' earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe China Tangshang Holdings deserves timely attention. Before you take the next step you should know about the 3 warning signs for China Tangshang Holdings that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, China Tangshang Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:674

China Tangshang Holdings

An investment holding company, engages in the property investment, development, and sub-leasing activities in Hong Kong and the People’s Republic of China.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives