- Hong Kong

- /

- Commercial Services

- /

- SEHK:1127

Top SEHK Dividend Stocks Including Lion Rock Group

Reviewed by Simply Wall St

Amid a backdrop of global economic uncertainty and fluctuating market conditions, the Hong Kong market has shown resilience, with investors keenly eyeing stable dividend-paying stocks. In this article, we will explore three top dividend stocks listed on the SEHK, including Lion Rock Group, highlighting their potential to provide consistent returns in these volatile times.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.67% | ★★★★★☆ |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.99% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 8.08% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.68% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 10.00% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.46% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.61% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 7.55% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.24% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

Lion Rock Group (SEHK:1127)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lion Rock Group Limited (SEHK:1127) is an investment holding company that offers printing services to international book publishers and print media companies, with a market cap of HK$1.10 billion.

Operations: Lion Rock Group Limited's revenue segments include HK$1.84 billion from printing services and HK$931.82 million from publishing.

Dividend Yield: 7.7%

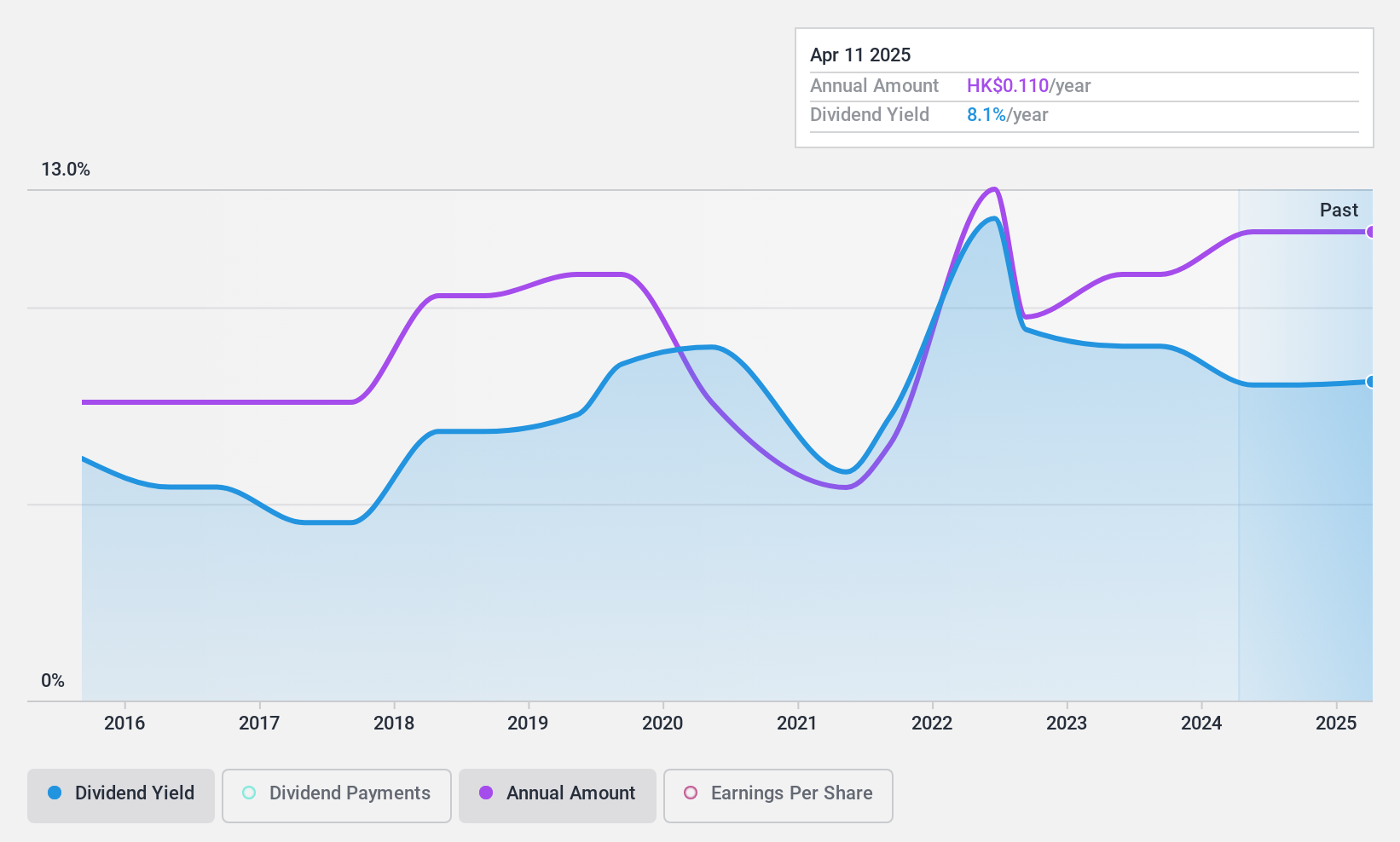

Lion Rock Group's dividend payments are well covered by earnings (payout ratio: 42.5%) and cash flows (cash payout ratio: 38.7%). Although the company's dividends have been volatile over the past decade, they have shown growth. Recently, Lion Rock announced a special dividend of HK$0.015 per share and an interim dividend of HK$0.03 per share for H1 2024, reflecting its solid financial performance with net income rising to HK$79.1 million from HK$71.16 million year-over-year.

- Navigate through the intricacies of Lion Rock Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Lion Rock Group's shares may be trading at a discount.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products in Mainland China and internationally, with a market cap of HK$6.33 billion.

Operations: Tong Ren Tang Technologies Co. Ltd.'s revenue segments include The Company with CN¥4.29 billion and Tong Ren Tang Chinese Medicine with CN¥1.26 billion.

Dividend Yield: 4%

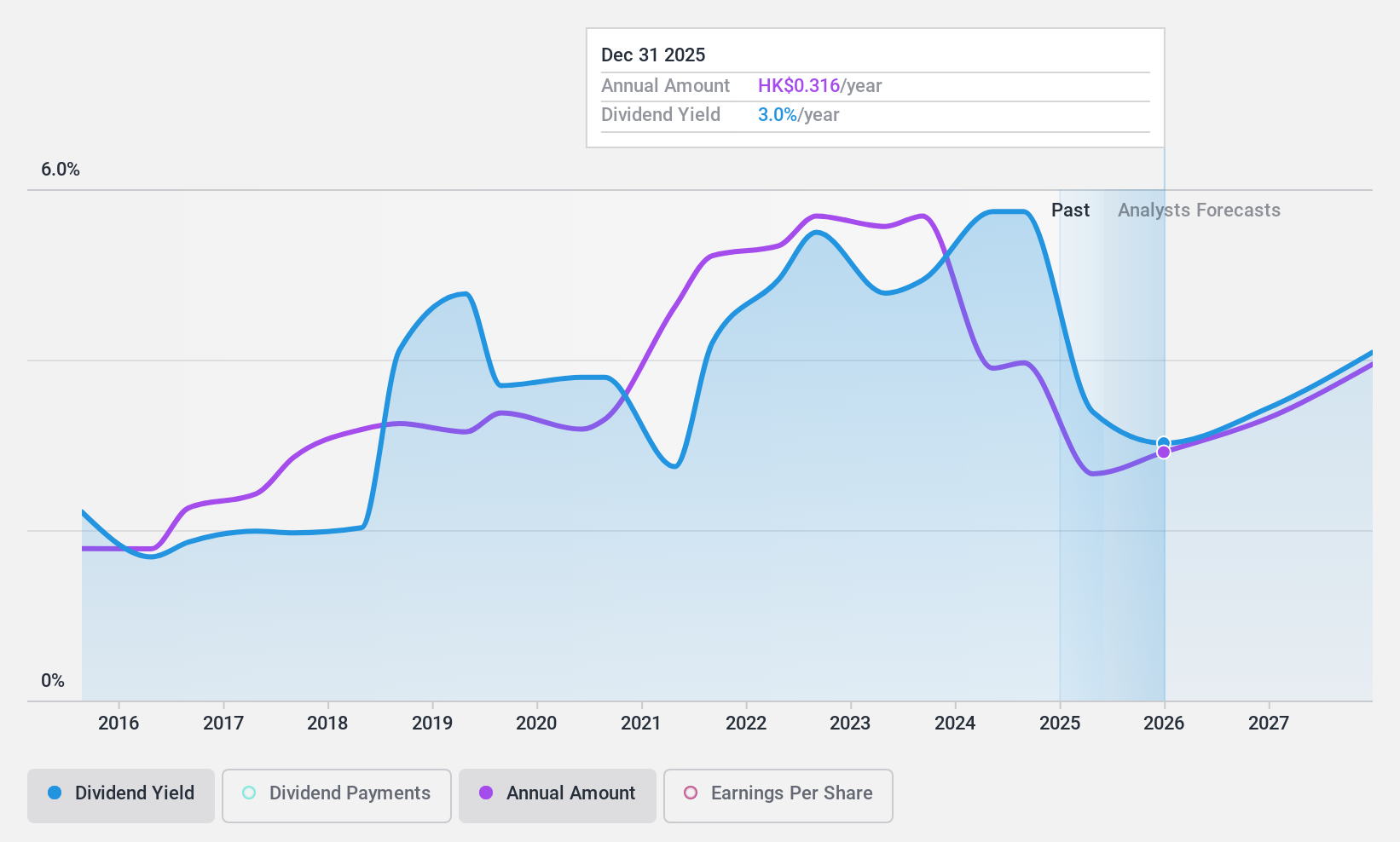

Tong Ren Tang Technologies' dividend yield of 4.01% is below the top tier in Hong Kong but has been stable and growing over the past decade. Despite a low payout ratio of 35.8%, dividends are not covered by free cash flows, raising sustainability concerns. Recent earnings showed net income growth to CNY 428.75 million from CNY 368.15 million year-over-year, and an interim dividend payment was approved, reflecting continued profitability despite cash flow issues.

- Get an in-depth perspective on Tong Ren Tang Technologies' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Tong Ren Tang Technologies shares in the market.

China Medical System Holdings (SEHK:867)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China with a market cap of HK$17.21 billion.

Operations: Revenue from China Medical System Holdings Limited primarily comes from the marketing, promotion, sales, and manufacturing of pharmaceutical products, amounting to CN¥7.01 billion.

Dividend Yield: 6%

China Medical System Holdings' dividend yield of 6.05% is lower than the top 25% in Hong Kong, but its payout ratio of 40.3% indicates dividends are covered by earnings. However, recent financials show a decline in net income to CNY 910.43 million from CNY 1.92 billion year-over-year, and the interim dividend was reduced to HK$0.164 per share. The company has an unstable dividend track record and profit margins have decreased significantly from last year.

- Dive into the specifics of China Medical System Holdings here with our thorough dividend report.

- The analysis detailed in our China Medical System Holdings valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Reveal the 75 hidden gems among our Top SEHK Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1127

Lion Rock Group

An investment holding company, provides printing services to international book publishers, trade, professional and educational publishing conglomerates, and print media companies.

Flawless balance sheet with solid track record and pays a dividend.