- Hong Kong

- /

- Trade Distributors

- /

- SEHK:990

Deep Source Holdings' (HKG:990) Soft Earnings Are Actually Better Than They Appear

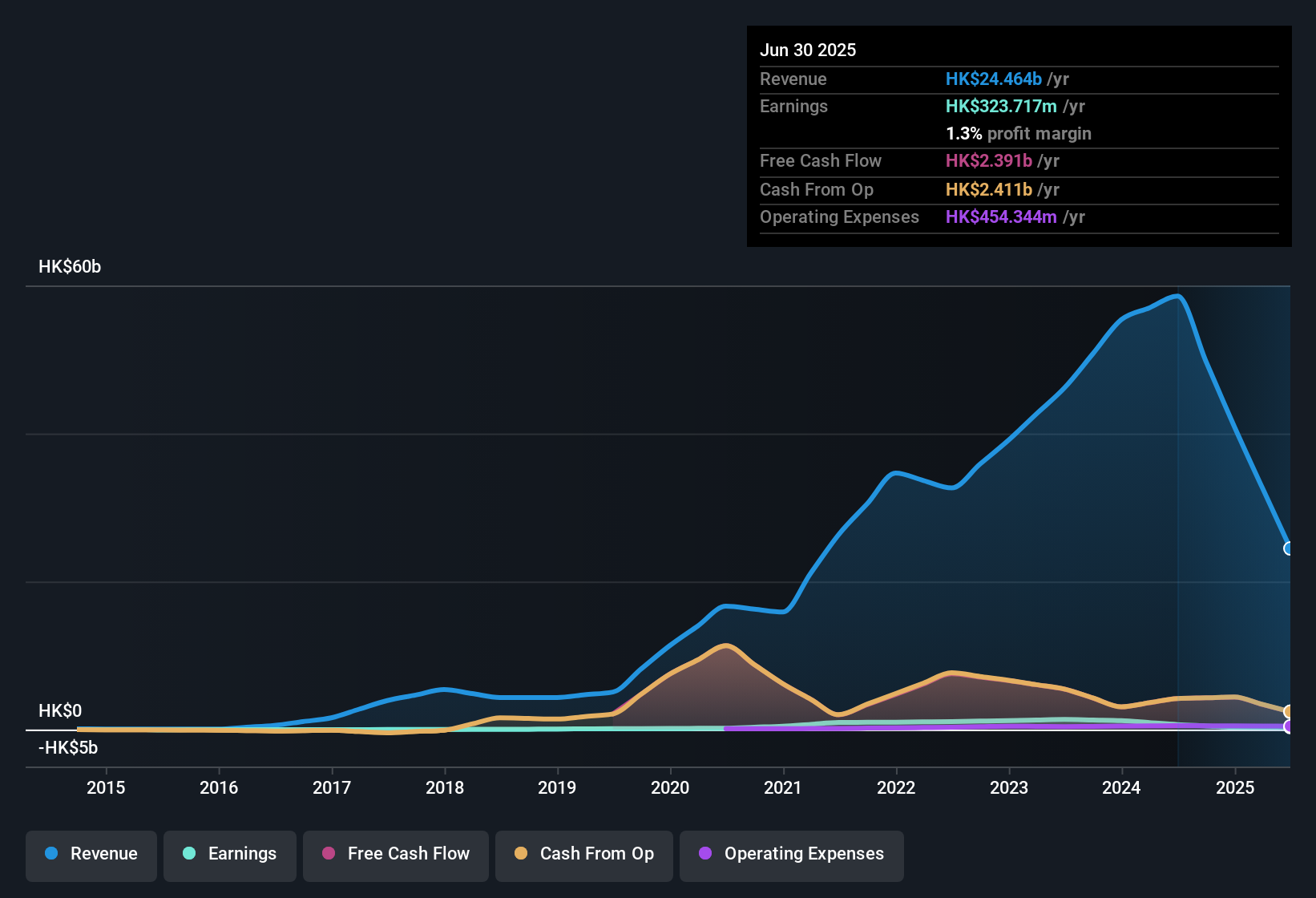

Deep Source Holdings Limited's (HKG:990) earnings announcement last week didn't impress shareholders. Despite the soft profit numbers, our analysis has optimistic about the overall quality of the income statement.

Zooming In On Deep Source Holdings' Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

For the year to June 2025, Deep Source Holdings had an accrual ratio of -1.82. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of HK$2.4b during the period, dwarfing its reported profit of HK$323.7m. Deep Source Holdings did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Deep Source Holdings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Deep Source Holdings expanded the number of shares on issue by 6.0% over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Deep Source Holdings' EPS by clicking here.

A Look At The Impact Of Deep Source Holdings' Dilution On Its Earnings Per Share (EPS)

Deep Source Holdings' net profit dropped by 70% per year over the last three years. Even looking at the last year, profit was still down 51%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 51% in the same period. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Deep Source Holdings' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Deep Source Holdings' Profit Performance

In conclusion, Deep Source Holdings has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Based on these factors, we think that Deep Source Holdings' profits are a reasonably conservative guide to its underlying profitability. So while earnings quality is important, it's equally important to consider the risks facing Deep Source Holdings at this point in time. At Simply Wall St, we found 1 warning sign for Deep Source Holdings and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:990

Deep Source Holdings

An investment holding company, engages in the processing, distribution, and trading of bulk commodities and related products in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026