- Hong Kong

- /

- Real Estate

- /

- SEHK:9909

BAIOO Family Interactive Leads The Charge With These 3 Penny Stocks

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, major indices have reached new highs, driven by optimism surrounding trade policies and technological advancements. In such a buoyant market landscape, investors often seek opportunities in various segments, including the lesser-known realm of penny stocks. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant potential when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.71 | HK$42.65B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,722 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

BAIOO Family Interactive (SEHK:2100)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BAIOO Family Interactive Limited is an investment holding company that offers internet content and services in China and internationally, with a market cap of HK$759.80 million.

Operations: The company generates revenue primarily from its Online Entertainment Business, which accounts for CN¥604.13 million.

Market Cap: HK$759.8M

BAIOO Family Interactive Limited, with a market cap of HK$759.80 million, primarily generates revenue from its Online Entertainment Business, totaling CN¥604.13 million. The company is unprofitable, with losses increasing by 51.3% annually over the past five years and a negative Return on Equity of -1.64%. Despite this, BAIOO's short-term assets (CN¥1.3 billion) comfortably exceed both its short-term (CN¥254.8 million) and long-term liabilities (CN¥20.3 million), suggesting strong liquidity management. Additionally, the company's debt is well covered by operating cash flow at a very large rate compared to its debt levels, indicating effective cash flow management despite profitability challenges.

- Navigate through the intricacies of BAIOO Family Interactive with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into BAIOO Family Interactive's track record.

EVA Precision Industrial Holdings (SEHK:838)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EVA Precision Industrial Holdings Limited is an investment holding company offering precision manufacturing services in China, Vietnam, and Mexico with a market cap of HK$1.11 billion.

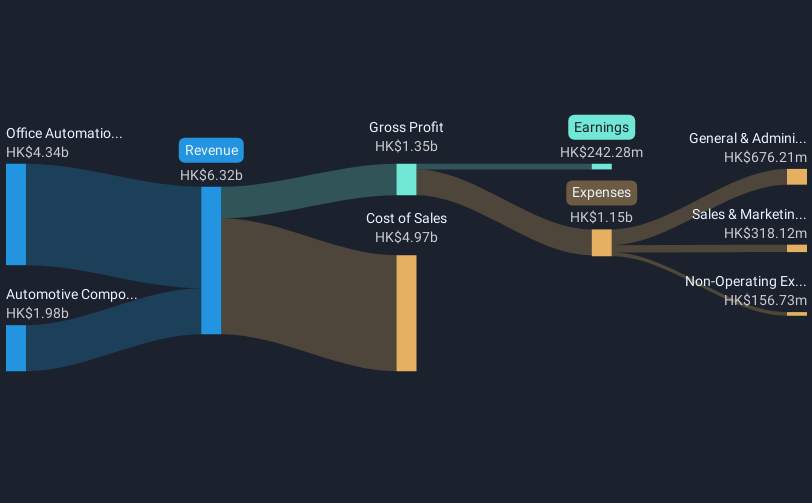

Operations: The company generates revenue from two primary segments: Automotive Components, contributing HK$1.98 billion, and Office Automation Equipment, accounting for HK$4.34 billion.

Market Cap: HK$1.11B

EVA Precision Industrial Holdings, with a market cap of HK$1.11 billion, benefits from a seasoned management team and board with long tenures. The company has shown significant earnings growth over the past five years at 40.6% annually, although recent growth has slowed to 7.2%, underperforming the industry average of 8.5%. EVA's financial health is supported by satisfactory net debt levels (22.6%) and strong asset coverage for both short-term (HK$4.2 billion) and long-term liabilities (HK$1.2 billion). Trading well below its estimated fair value, EVA presents as good relative value among peers despite low return on equity at 7.8%.

- Click here to discover the nuances of EVA Precision Industrial Holdings with our detailed analytical financial health report.

- Examine EVA Precision Industrial Holdings' earnings growth report to understand how analysts expect it to perform.

Powerlong Commercial Management Holdings (SEHK:9909)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Powerlong Commercial Management Holdings Limited, with a market cap of HK$1.68 billion, offers commercial operational and residential property management services in the People’s Republic of China.

Operations: The company generates revenue from two main segments: Commercial Operational Services, contributing CN¥2.17 billion, and Residential Property Management Services, adding CN¥527.49 million.

Market Cap: HK$1.68B

Powerlong Commercial Management Holdings, with a market cap of HK$1.68 billion, operates without debt, showcasing strong financial health as its short-term assets (CN¥4.8 billion) comfortably cover both short-term (CN¥1.6 billion) and long-term liabilities (CN¥1.2 billion). Despite high-quality past earnings and trading at 81.1% below its estimated fair value, recent executive changes may impact strategic direction as Mr. Xu Meng assumes the CEO role following Mr. Hoi Wa Fong's resignation from this position to focus on his duties as chairman of the board. However, negative earnings growth over the past year presents challenges ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Powerlong Commercial Management Holdings.

- Explore Powerlong Commercial Management Holdings' analyst forecasts in our growth report.

Summing It All Up

- Reveal the 5,722 hidden gems among our Penny Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9909

Powerlong Commercial Management Holdings

Provides commercial operational and residential property management services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives