- Hong Kong

- /

- Industrials

- /

- SEHK:659

CTF Services (SEHK:659) Margin Boost Reinforces Bull Case, but One-Off Gain Clouds Quality

Reviewed by Simply Wall St

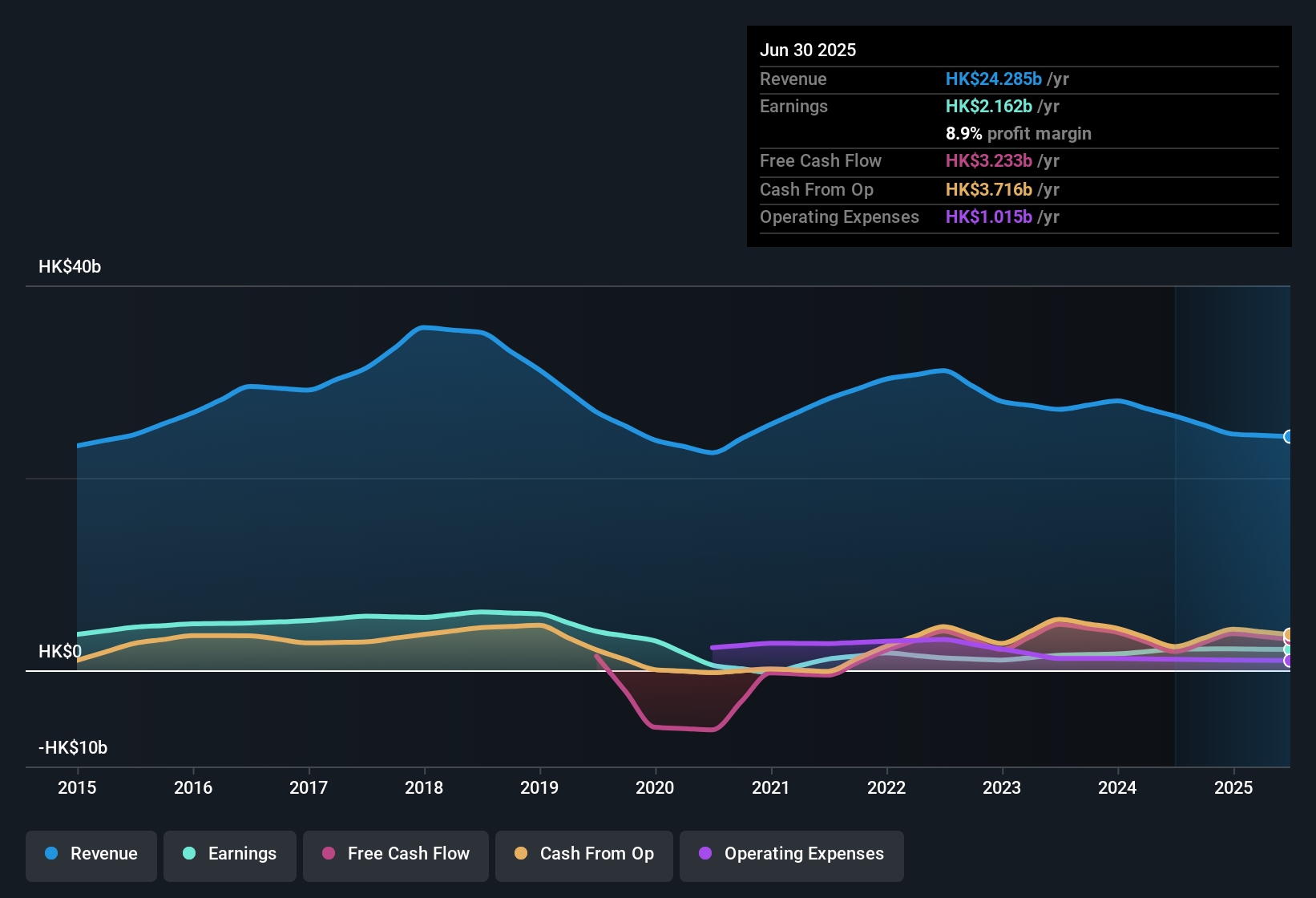

CTF Services (SEHK:659) is forecasting earnings growth of 13.78% per year and revenue growth of 4.2% per year, according to its latest filings. Net profit margins have climbed to 8.9%, up from last year’s 8.3%, with recent results given a boost by a one-off gain of HK$2.4 billion in the twelve months ending June 30, 2025. Over the past five years, earnings have grown at 27.4% annually, and the current price-to-earnings ratio of 15.8x appears attractive compared to the peer group average of 27.6x, though it remains above the Asian Industrials industry average.

See our full analysis for CTF Services.The next step is to see how these headline results hold up when compared to the leading market narratives. We will highlight where consensus matches and where the numbers tell a different story.

See what the community is saying about CTF Services

Analysts See Margins Expanding Beyond Industry Norms

- Profit margins are forecast to climb from 9.1% to 11.2% in the next three years, according to analysts. This suggests CTF Services could move notably ahead of the sector’s typical margin profile.

- Analysts' consensus view highlights two linked drivers for this upside:

- Ongoing strategic acquisitions in logistics and insurance are expected to bring scale, diversify income, and deliver more stable and higher-margin revenue streams than legacy segments.

- Disciplined financial management, such as leveraging low-cost Panda Bonds, is set to help maintain a competitive cost of capital. This would reinforce net margin improvements over strict industry peers.

- Analysts also suggest that sustained growth in profit margins could make CTF Services more resilient to market downturns compared to competitors focused only on core toll roads or construction.

Consensus forecasts for rising margins emphasize how the current strategy may deliver stronger-than-expected profitability, but there is still debate over how much of this can persist long term. 📈 Read the full CTF Services Consensus Narrative.

Dividend Growth Faces Challenge From One-Off Gains

- The most recent net profits were lifted by a one-off gain of HK$2.4 billion, an item which is unlikely to recur and may cast doubt on the sustainability of elevated dividends going forward.

- Analysts' consensus view points to this tension between headline growth and earnings quality:

- The company’s push for a sustainable dividend policy, underpinned by stable cash flows, supports a positive outlook for payouts.

- However, concerns persist about the consistency of core profits, especially when non-recurring items account for a significant share of reported net profit.

Valuation Discount to Peer Group Narrows, Premium Remains Over Industry

- CTF Services trades at a price-to-earnings ratio of 15.8x, appearing attractively priced compared to the peer group average of 27.6x. The company still maintains a premium relative to the broader Asian Industrials industry at 12.6x.

- Analysts' consensus view sees this pricing as a reflection of both growth potential and caution:

- Bulls point out the company’s expanding profit margins and diverse revenue sources as reasons the market assigns a higher multiple than industry peers.

- Skeptics argue that the current valuation could be stretched if earnings leverage from acquisitions and cost controls does not materialize as forecast.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CTF Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your perspective and create a unique narrative of your own in just a matter of minutes. Do it your way

A great starting point for your CTF Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

CTF Services’ recent headline growth relies on one-off gains and raises questions about how reliably core profits and dividends can be maintained.

If dependable payouts matter to you, consider these 1996 dividend stocks with yields > 3% to find companies with yields backed by stable, recurring earnings instead of one-time boosts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:659

CTF Services

A conglomerate company with a diversified portfolio of businesses in toll roads, insurance, logistics, construction, and facilities management primarily in Hong Kong and the Mainland.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)