Here's Why We Think L.K. Technology Holdings (HKG:558) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like L.K. Technology Holdings (HKG:558). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for L.K. Technology Holdings

How Quickly Is L.K. Technology Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. L.K. Technology Holdings' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 46%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

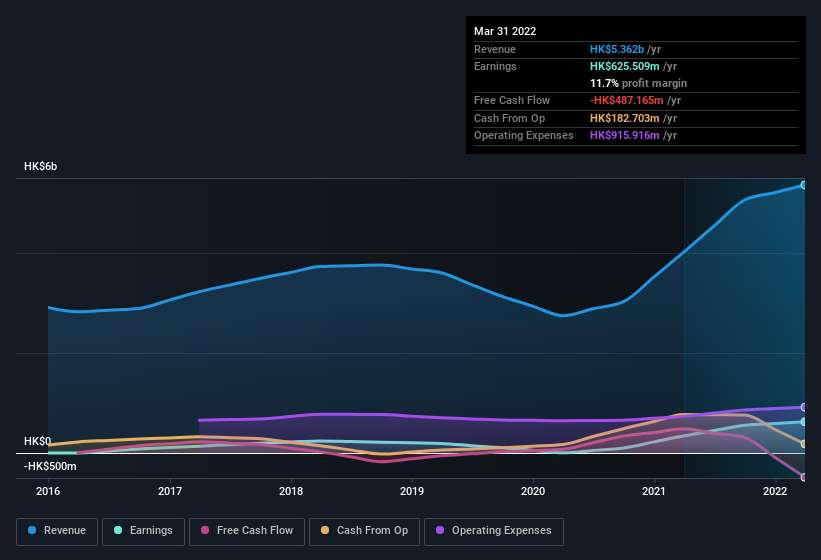

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for L.K. Technology Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 33% to HK$5.4b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for L.K. Technology Holdings' future profits.

Are L.K. Technology Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for L.K. Technology Holdings is the serious outlay one insider has made to buy shares, in the last year. Specifically, the Executive Chairperson, Siw Yin Chong, accumulated HK$10m worth of shares at a price of HK$10.27. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for L.K. Technology Holdings will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 62% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. HK$7.4b That level of investment from insiders is nothing to sneeze at.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because L.K. Technology Holdings' CEO, Zhuo Ming Liu, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between HK$7.8b and HK$25b, like L.K. Technology Holdings, the median CEO pay is around HK$4.0m.

L.K. Technology Holdings' CEO took home a total compensation package of HK$1.4m in the year prior to March 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does L.K. Technology Holdings Deserve A Spot On Your Watchlist?

L.K. Technology Holdings' earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest L.K. Technology Holdings belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for L.K. Technology Holdings that you need to be mindful of.

The good news is that L.K. Technology Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:558

L.K. Technology Holdings

An investment holding company, engages in the design, manufacture, and sale of hot and cold chamber die-casting machines in Mainland China, Hong Kong, Europe, Central America and South America, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives