CIMC Enric Holdings (HKG:3899) Is Increasing Its Dividend To CN¥0.30

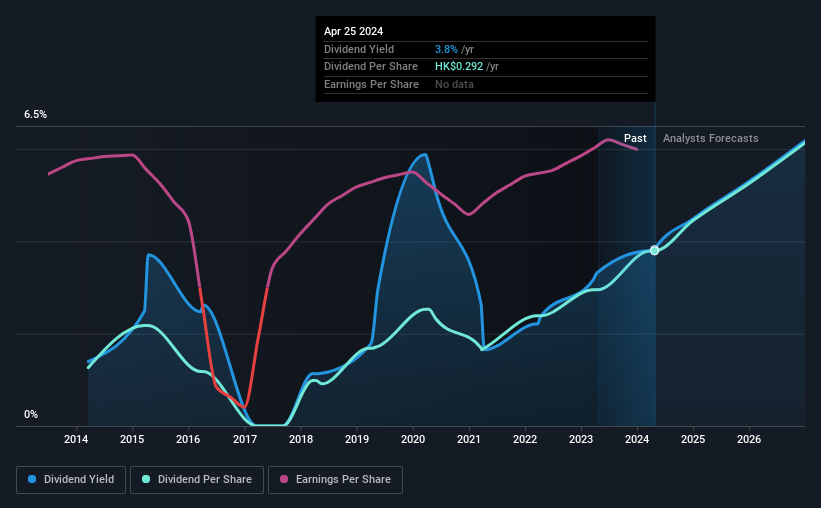

The board of CIMC Enric Holdings Limited (HKG:3899) has announced that it will be paying its dividend of CN¥0.30 on the 28th of June, an increased payment from last year's comparable dividend. This makes the dividend yield 3.8%, which is above the industry average.

See our latest analysis for CIMC Enric Holdings

CIMC Enric Holdings' Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last dividend was quite easily covered by CIMC Enric Holdings' earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 59.7%. Assuming the dividend continues along recent trends, we think the payout ratio could be 37% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from CN¥0.09 total annually to CN¥0.27. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. CIMC Enric Holdings has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

We Could See CIMC Enric Holdings' Dividend Growing

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see that CIMC Enric Holdings has been growing its earnings per share at 6.4% a year over the past five years. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for CIMC Enric Holdings that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3899

CIMC Enric Holdings

Provides transportation, storage, and processing equipment and services.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)