Is CSSC Offshore & Marine Engineering (Group) (HKG:317) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for CSSC Offshore & Marine Engineering (Group)

What Is CSSC Offshore & Marine Engineering (Group)'s Debt?

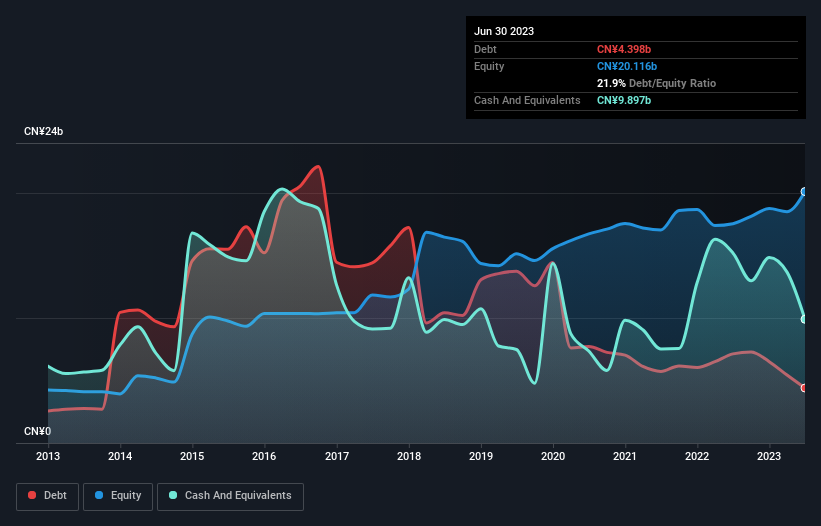

As you can see below, CSSC Offshore & Marine Engineering (Group) had CN¥4.40b of debt at June 2023, down from CN¥7.13b a year prior. However, it does have CN¥9.90b in cash offsetting this, leading to net cash of CN¥5.50b.

A Look At CSSC Offshore & Marine Engineering (Group)'s Liabilities

We can see from the most recent balance sheet that CSSC Offshore & Marine Engineering (Group) had liabilities of CN¥23.3b falling due within a year, and liabilities of CN¥3.41b due beyond that. Offsetting this, it had CN¥9.90b in cash and CN¥5.64b in receivables that were due within 12 months. So its liabilities total CN¥11.2b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because CSSC Offshore & Marine Engineering (Group) is worth CN¥24.1b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, CSSC Offshore & Marine Engineering (Group) boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since CSSC Offshore & Marine Engineering (Group) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, CSSC Offshore & Marine Engineering (Group) reported revenue of CN¥15b, which is a gain of 29%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is CSSC Offshore & Marine Engineering (Group)?

Although CSSC Offshore & Marine Engineering (Group) had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥682m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. One positive is that CSSC Offshore & Marine Engineering (Group) is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But that doesn't change our opinion that the stock is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with CSSC Offshore & Marine Engineering (Group) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026