- Hong Kong

- /

- Construction

- /

- SEHK:2132

Here's Why I Think Landrich Holding (HKG:2132) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Landrich Holding (HKG:2132). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Landrich Holding

How Fast Is Landrich Holding Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Landrich Holding boosted its trailing twelve month EPS from HK$0.03 to HK$0.035, in the last year. I doubt many would complain about that 18% gain.

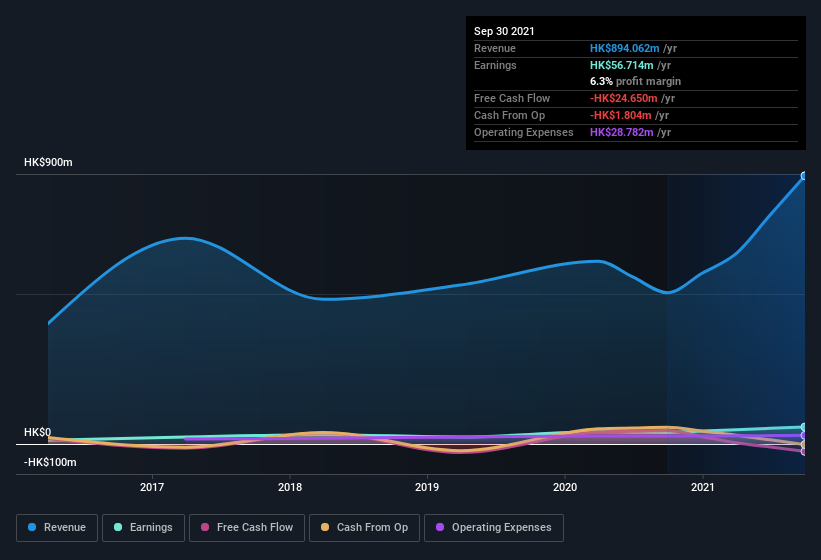

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Landrich Holding maintained stable EBIT margins over the last year, all while growing revenue 77% to HK$894m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Landrich Holding is no giant, with a market capitalization of HK$374m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Landrich Holding Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Landrich Holding insiders own a significant number of shares certainly appeals to me. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about HK$281m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Landrich Holding Worth Keeping An Eye On?

One positive for Landrich Holding is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Landrich Holding you should be aware of, and 1 of them is a bit concerning.

Although Landrich Holding certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2132

Landrich Holding

An investment holding company, provides construction engineering works in Hong Kong.

Excellent balance sheet moderate.

Market Insights

Community Narratives