The Hong Kong market has recently faced a challenging environment, with the Hang Seng Index retreating as investors digest weak corporate earnings and economic data. Despite these headwinds, opportunities may exist for discerning investors to find value in stocks that are trading at significant discounts. In such a climate, identifying undervalued stocks involves looking for companies with solid fundamentals that may be temporarily overlooked by the market. Here are three SEHK stocks possibly trading at up to 41.6% discount.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.68 | HK$6.77 | 45.6% |

| CIMC Enric Holdings (SEHK:3899) | HK$5.94 | HK$10.46 | 43.2% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.78 | HK$21.39 | 44.9% |

| Pacific Textiles Holdings (SEHK:1382) | HK$1.50 | HK$2.85 | 47.4% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.60 | HK$19.86 | 41.6% |

| XD (SEHK:2400) | HK$18.20 | HK$31.09 | 41.5% |

| Digital China Holdings (SEHK:861) | HK$3.22 | HK$6.10 | 47.2% |

| Innovent Biologics (SEHK:1801) | HK$42.25 | HK$79.84 | 47.1% |

| United Company RUSAL International (SEHK:486) | HK$2.32 | HK$4.25 | 45.4% |

| Weimob (SEHK:2013) | HK$1.28 | HK$2.54 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Xinte Energy (SEHK:1799)

Overview: Xinte Energy Co., Ltd. and its subsidiaries focus on the research, development, production, and sale of high-purity polysilicon in China, with a market cap of HK$9.27 billion.

Operations: The company generates revenue from three primary segments: Polysilicon (CN¥12.78 billion), Operation of Wind Power and PV Power Plants (CN¥2.34 billion), and Construction of Wind Power and PV Power Plants (CN¥9.48 billion).

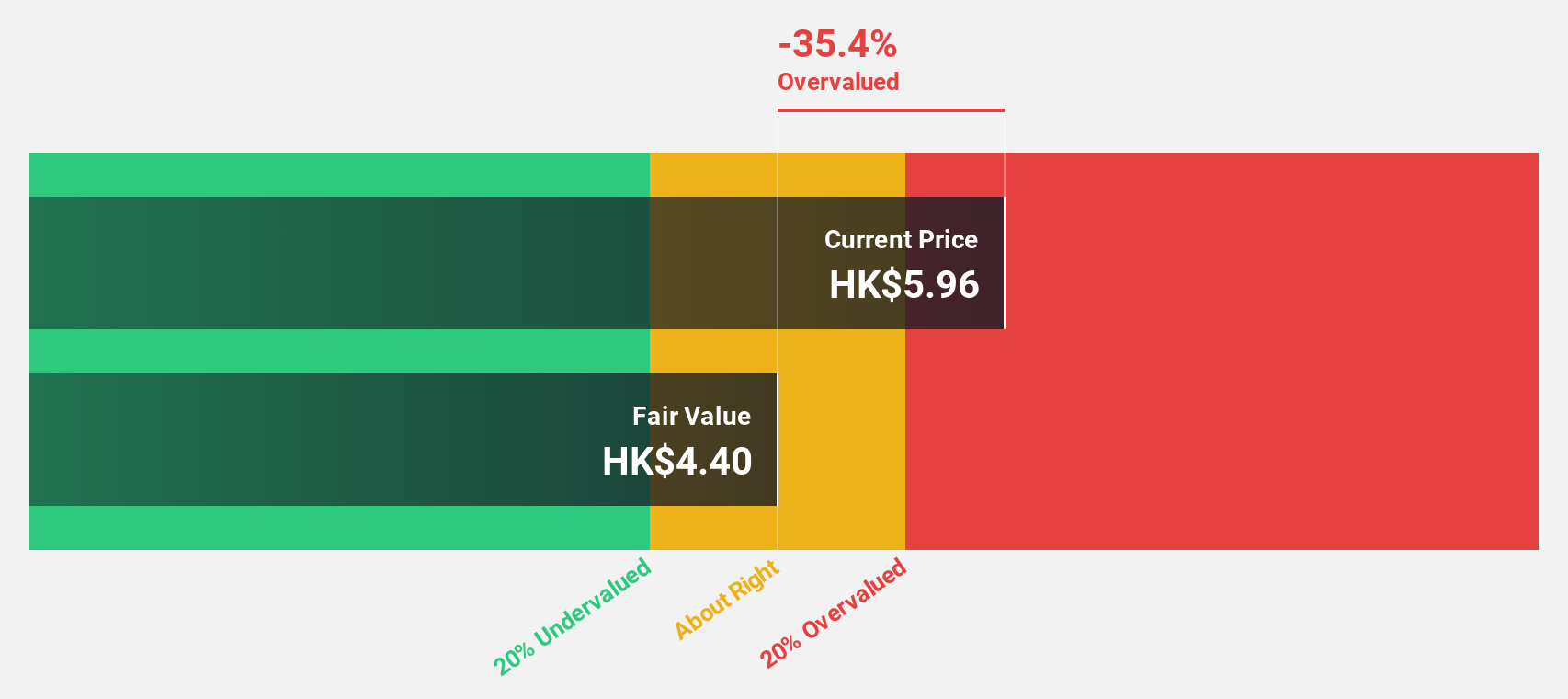

Estimated Discount To Fair Value: 12.5%

Xinte Energy, trading at HK$6.48, is undervalued relative to its fair value estimate of HK$7.41. Despite a significant net loss of CNY 887.02 million for the first half of 2024 due to a sharp decline in polysilicon prices, the company’s revenue is expected to grow faster than the Hong Kong market at 10.5% per year. Recent board changes aim to strengthen corporate governance and strategic oversight, potentially stabilizing future performance.

- According our earnings growth report, there's an indication that Xinte Energy might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Xinte Energy.

Techtronic Industries (SEHK:669)

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products internationally with a market cap of approximately HK$191.68 billion.

Operations: The company's revenue segments include Power Equipment at $13.23 billion and Floorcare & Cleaning at $965.09 million.

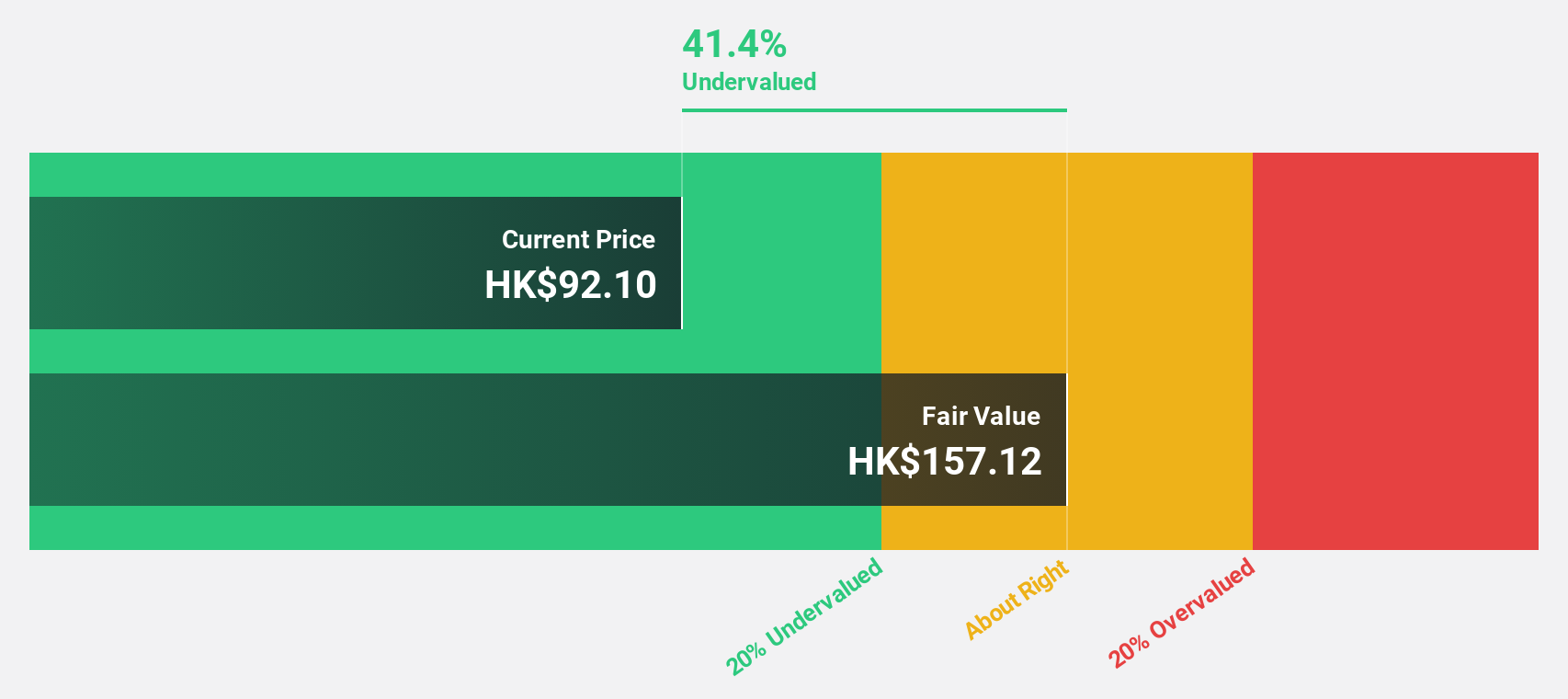

Estimated Discount To Fair Value: 30.2%

Techtronic Industries, trading at HK$104.6, is undervalued by over 20% relative to its fair value estimate of HK$149.87. The company reported a net income increase to US$550.37 million for H1 2024 and announced an interim dividend of HKD 1.08 per share. With earnings forecasted to grow at 15.34% annually, outpacing the Hong Kong market's growth rate of 11.7%, Techtronic shows strong cash flow potential despite modest revenue growth expectations of 8.5% annually.

- Our comprehensive growth report raises the possibility that Techtronic Industries is poised for substantial financial growth.

- Take a closer look at Techtronic Industries' balance sheet health here in our report.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company that offers intra-city on-demand delivery services in the People’s Republic of China, with a market cap of HK$10.61 billion.

Operations: Revenue from intra-city on-demand delivery services amounts to CN¥13.52 billion.

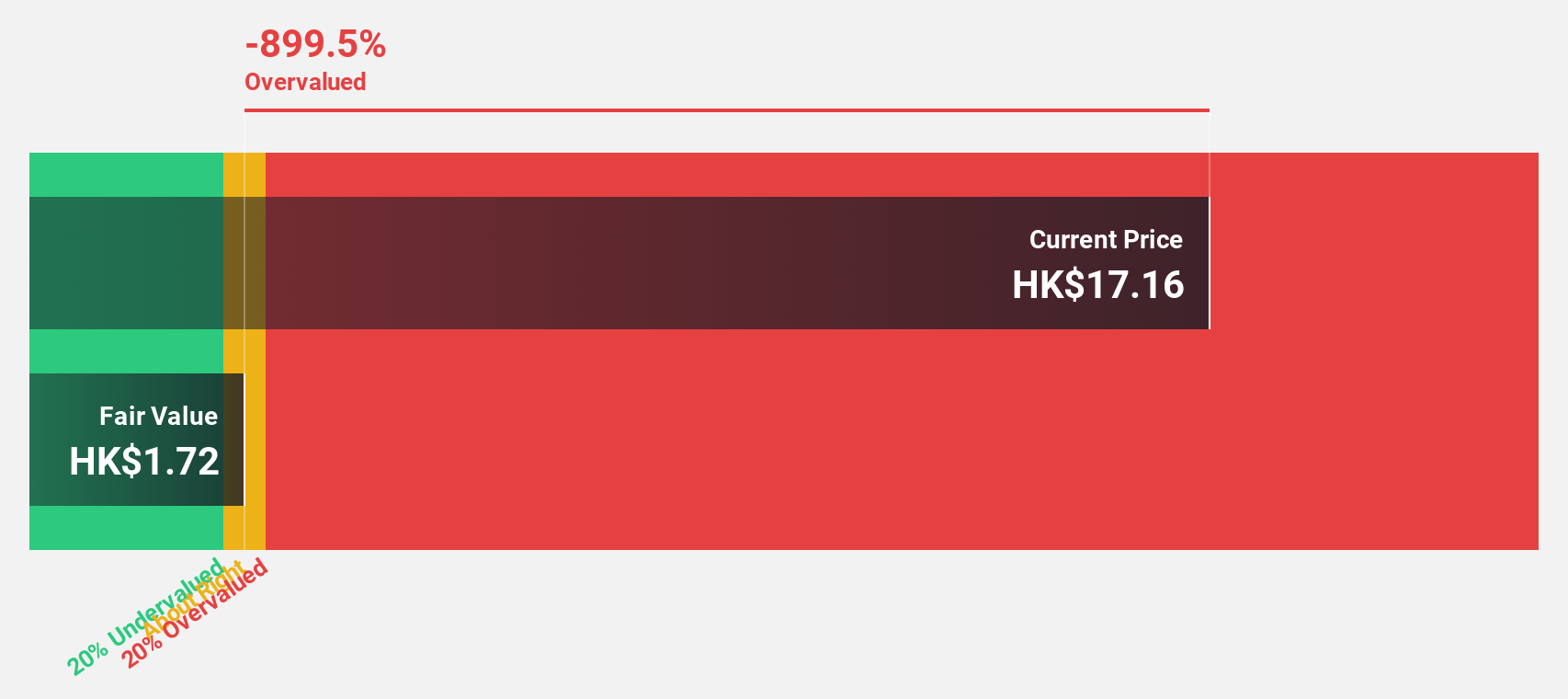

Estimated Discount To Fair Value: 41.6%

Hangzhou SF Intra-city Industrial reported H1 2024 sales of CNY 6.88 billion and net income of CNY 62.17 million, both up significantly from last year. Trading at HK$11.6, the stock is undervalued by over 40% relative to its fair value estimate of HK$19.86 based on discounted cash flow analysis. The company's expansion into Hong Kong's on-demand delivery market and continuous profit growth underscore its strong cash flow potential despite a modest return on equity forecast of 9.2%.

- Insights from our recent growth report point to a promising forecast for Hangzhou SF Intra-city Industrial's business outlook.

- Dive into the specifics of Hangzhou SF Intra-city Industrial here with our thorough financial health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 29 Undervalued SEHK Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou SF Intra-city Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9699

Hangzhou SF Intra-city Industrial

An investment holding company, provides intra-city on-demand delivery services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.