- Hong Kong

- /

- Consumer Finance

- /

- SEHK:8030

Exploring Undiscovered Gems in Asia This September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious monetary policies and mixed economic signals, investors are increasingly turning their attention to Asia, where small-cap stocks present intriguing opportunities amid resilient local economies and evolving market dynamics. Identifying potential gems in this environment requires a keen understanding of regional growth trends and the ability to spot companies with strong fundamentals that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 32.58% | 38.70% | ★★★★★★ |

| Brillian Network & Automation Integrated System | NA | 23.32% | 24.44% | ★★★★★★ |

| Maxigen Biotech | NA | 9.89% | 24.48% | ★★★★★★ |

| Advancetek EnterpriseLtd | 48.44% | 34.46% | 54.65% | ★★★★★★ |

| Grade Upon Technology | 3.39% | 16.93% | 65.43% | ★★★★★★ |

| Te Chang Construction | 15.29% | 14.72% | 17.71% | ★★★★★☆ |

| Lucky Cement | 47.61% | 4.43% | 16.92% | ★★★★★☆ |

| Uniplus Electronics | 45.33% | 46.79% | 73.91% | ★★★★★☆ |

| Johnson Chemical Pharmaceutical Works | 9.07% | 9.87% | 8.78% | ★★★★★☆ |

| Dong Fang Offshore | 41.99% | 33.40% | 39.04% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Impro Precision Industries (SEHK:1286)

Simply Wall St Value Rating: ★★★★★☆

Overview: Impro Precision Industries Limited specializes in providing casting products and precision machining parts across the Americas, Europe, and Asia, with a market capitalization of approximately HK$8.19 billion.

Operations: Impro Precision Industries Limited generates its revenue primarily from investment casting (HK$1.77 billion), precision machining (HK$1.61 billion), and sand casting (HK$1.28 billion). The company also earns from surface treatment services, contributing HK$105.76 million to its revenue streams.

Impro Precision Industries, a promising player in the machinery sector, has shown robust earnings growth of 17% over the past year, outpacing the industry average of 3.4%. Trading at nearly 24% below its estimated fair value, it presents an attractive opportunity. The company's debt to equity ratio rose from 23.3% to 44.5% over five years but remains manageable with interest payments well-covered by EBIT at a multiple of 9.3x. Recent inclusion in the S&P Global BMI Index and interim dividend announcements underscore its growing market presence and financial health, with net income reaching HK$346 million for H1 2025.

Fengyinhe Holdings (SEHK:8030)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fengyinhe Holdings Limited is an investment holding company offering a range of financial services to the real estate market in the People's Republic of China, with a market capitalization of approximately HK$2.85 billion.

Operations: The company's primary revenue stream is derived from its financial service platforms, contributing CN¥100.37 million, while the provision of entrusted loan, pawn loan, other loan services, and financial consultation services add CN¥7.70 million.

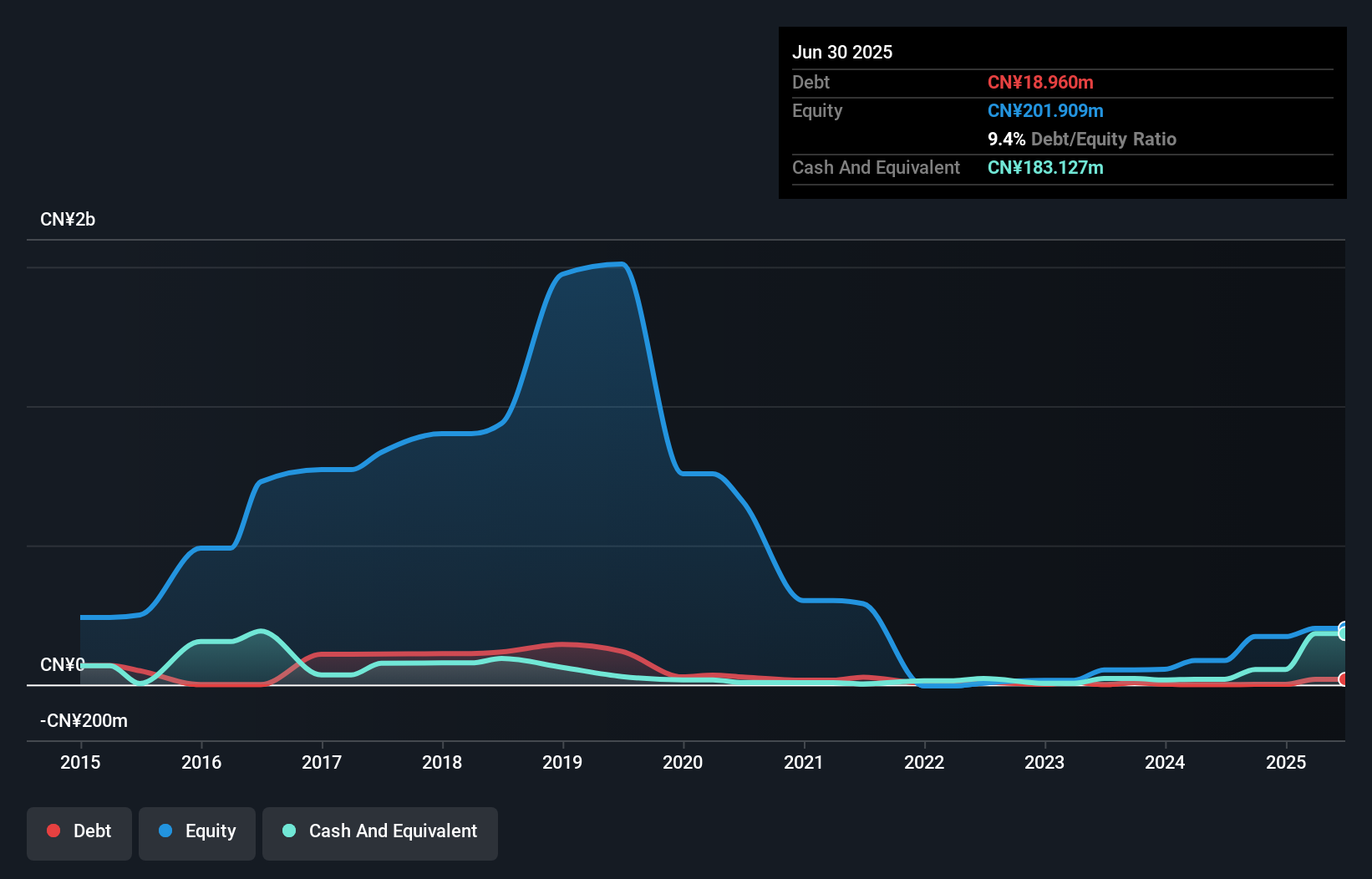

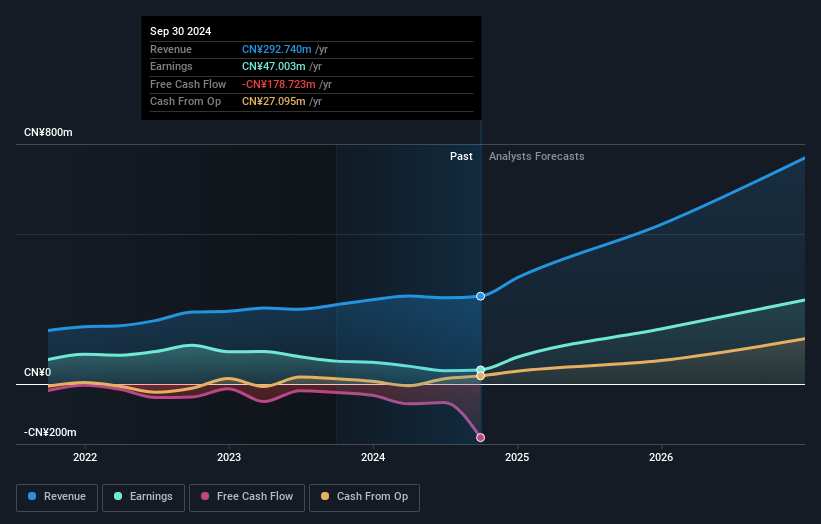

Fengyinhe Holdings, a promising player in the Asian market, has shown impressive earnings growth of 83.6% over the past year, outpacing its industry average of 11.6%. Despite a debt to equity ratio increase from 4.1% to 9.4% over five years, it remains financially sound with more cash than total debt and positive free cash flow. The company's earnings are considered high quality, though its share price has been volatile recently. With an upcoming board meeting set to discuss half-yearly results and potential dividends on August 29th, Fengyinhe's future prospects seem intriguing for investors seeking growth opportunities in Asia.

- Take a closer look at Fengyinhe Holdings' potential here in our health report.

Examine Fengyinhe Holdings' past performance report to understand how it has performed in the past.

Great Microwave Technology (SHSE:688270)

Simply Wall St Value Rating: ★★★★★★

Overview: Great Microwave Technology Co., Ltd. focuses on the R&D, production, and sale of integrated circuit chips and microsystems in China, with a market cap of CN¥13.81 billion.

Operations: Great Microwave Technology generates revenue primarily from the sale of integrated circuit chips and microsystems. The company's net profit margin has shown variability over recent periods, reflecting changes in cost management and pricing strategies.

Great Microwave Technology, a nimble player in the semiconductor space, has showcased impressive growth with earnings surging 67.2% over the past year, outpacing the industry's 10.4%. The firm reported H1 2025 sales of CNY 204.87 million and net income of CNY 62.32 million, a substantial leap from last year's figures. Despite its volatile share price recently, it operates debt-free and maintains a high level of non-cash earnings quality. While free cash flow remains negative at CNY -123.91 million as of June 2025, future earnings are projected to grow by an annual rate of 57.29%, indicating robust potential ahead.

- Delve into the full analysis health report here for a deeper understanding of Great Microwave Technology.

Gain insights into Great Microwave Technology's past trends and performance with our Past report.

Make It Happen

- Get an in-depth perspective on all 2381 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8030

Fengyinhe Holdings

An investment holding company, provides various financial services to real estate market in the People’s Republic of China.

Outstanding track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)