As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing the implications of interest rate adjustments and economic data on market stability. Amidst this backdrop, dividend stocks present an appealing option for those seeking income-generating investments that can offer some resilience in volatile conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★☆

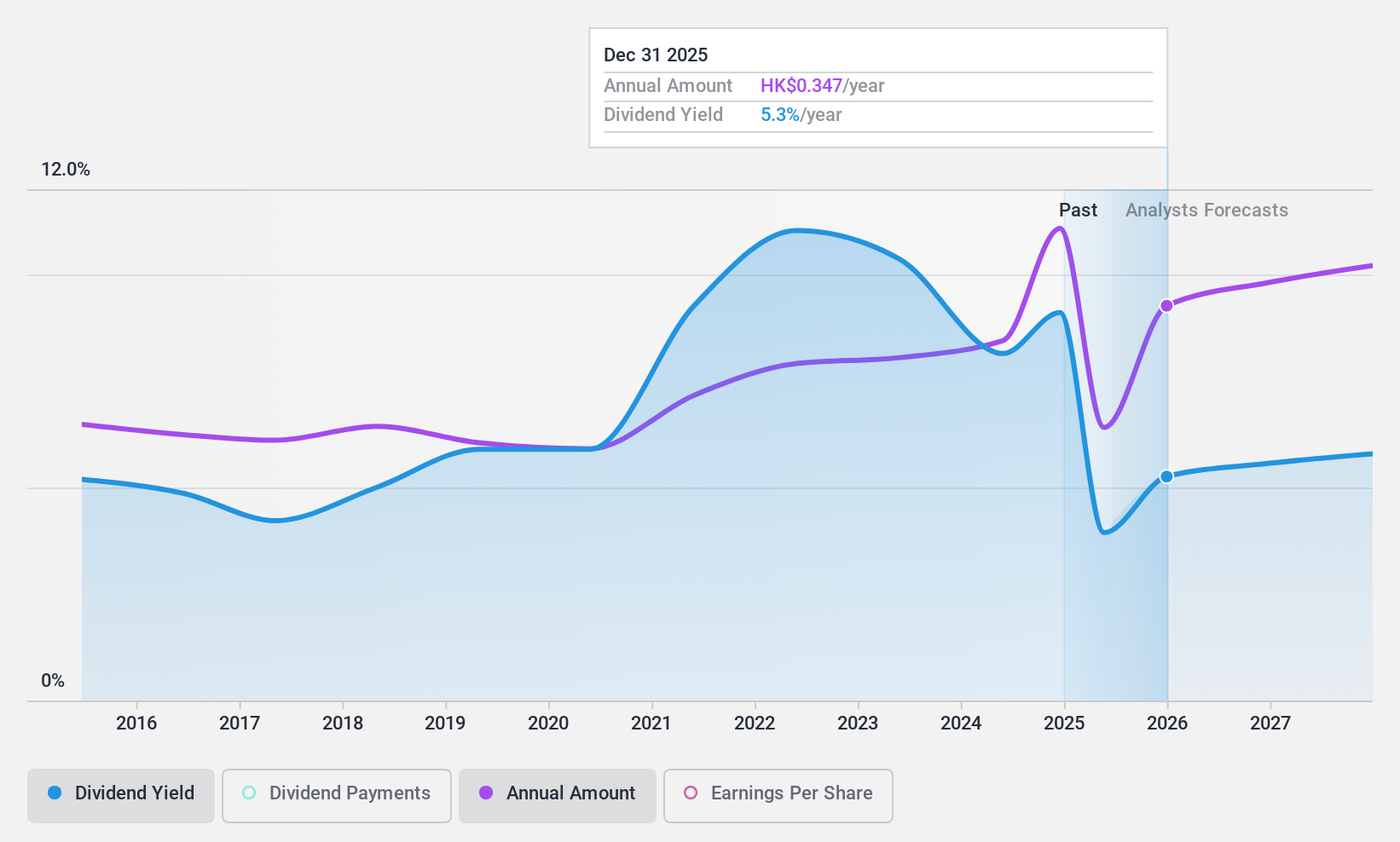

Overview: Chongqing Rural Commercial Bank Co., Ltd. provides banking services in the People’s Republic of China and has a market capitalization of approximately HK$67.82 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates revenue through various banking services within the People’s Republic of China.

Dividend Yield: 6.8%

Chongqing Rural Commercial Bank recently approved an interim dividend of RMB 1.944 per 10 shares, payable January 2025. The bank's dividends are well-covered by earnings with a payout ratio of 29.8%, indicating sustainability. Despite its dividend yield being below the top tier in Hong Kong, it offers a stable and reliable history over the past decade with consistent growth in payments. Earnings have grown modestly at 1.7% over the past year, supporting future payouts.

- Click here to discover the nuances of Chongqing Rural Commercial Bank with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Chongqing Rural Commercial Bank's share price might be too pessimistic.

Japan Petroleum Exploration (TSE:1662)

Simply Wall St Dividend Rating: ★★★★★☆

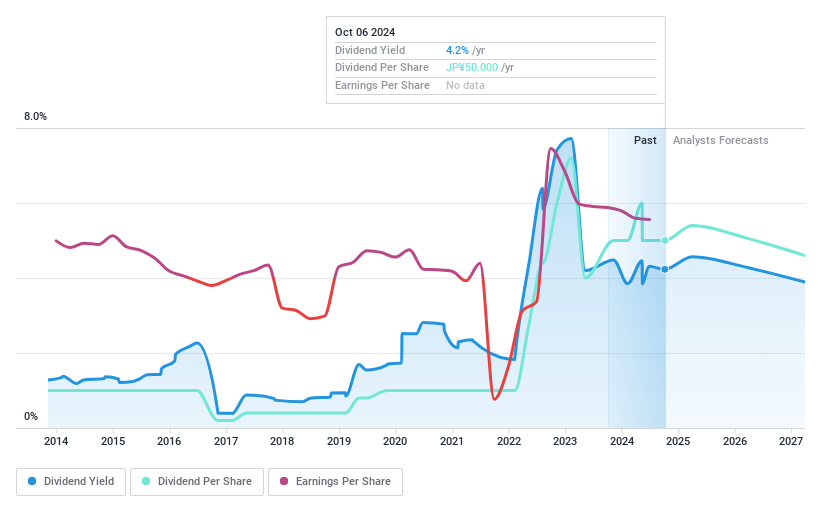

Overview: Japan Petroleum Exploration Co., Ltd. explores, develops, produces, and sells oil, natural gas, and other energy resources across Japan, Europe, North America, and the Middle East with a market cap of ¥286.16 billion.

Operations: Japan Petroleum Exploration Co., Ltd.'s revenue segments are ¥272.61 billion from Japan, ¥33.82 billion from the Middle East, and ¥43.41 billion from North America.

Dividend Yield: 4.4%

Japan Petroleum Exploration's dividend is supported by a low payout ratio of 33.7%, indicating sustainability, though cash flow coverage is tighter at 72.7%. The dividend yield of 4.44% ranks in the top quartile in Japan, but payments have been volatile over the past decade despite overall growth. Recent involvement in carbon capture projects with partners could impact future financials and dividends, as they aim for project launches by fiscal 2030.

- Navigate through the intricacies of Japan Petroleum Exploration with our comprehensive dividend report here.

- The analysis detailed in our Japan Petroleum Exploration valuation report hints at an deflated share price compared to its estimated value.

Stark Technology (TWSE:2480)

Simply Wall St Dividend Rating: ★★★★★★

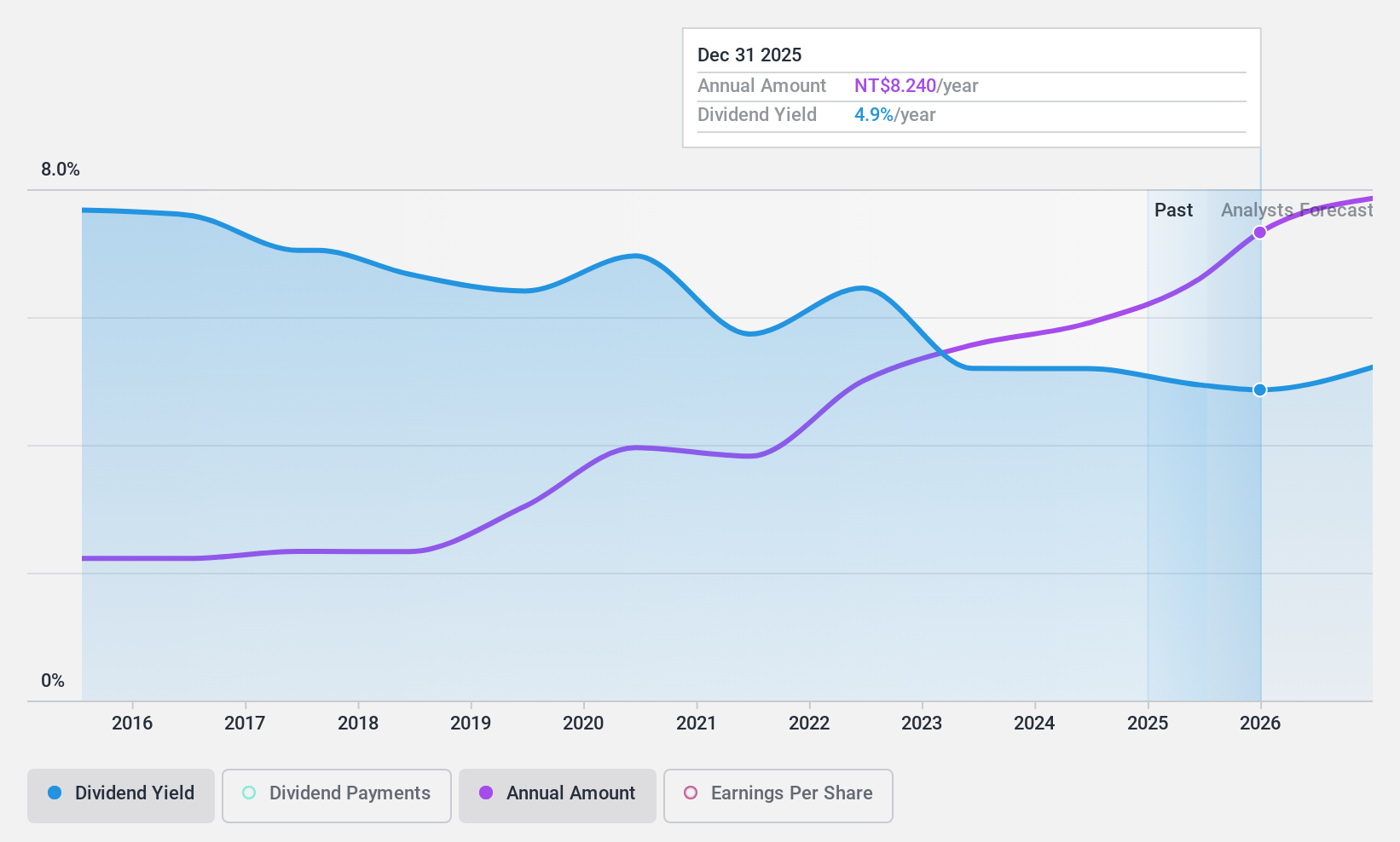

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market cap of NT$14.41 billion.

Operations: Stark Technology Inc. generates revenue of NT$7.27 billion from its computer services segment.

Dividend Yield: 4.8%

Stark Technology's dividends have been stable and reliable over the past decade, with a high yield of 4.83%, placing it among the top 25% in Taiwan. The dividend is well-supported by earnings and cash flow, with payout ratios of 89.9% and 84.8%, respectively, indicating sustainability despite being on the higher side. Recent earnings showed slight growth in sales but stable net income, suggesting a consistent financial base for ongoing dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Stark Technology.

- The valuation report we've compiled suggests that Stark Technology's current price could be quite moderate.

Next Steps

- Click this link to deep-dive into the 1937 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3618

Chongqing Rural Commercial Bank

Engages in the provision of banking services in the People’s Republic of China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives