- Hong Kong

- /

- Auto Components

- /

- SEHK:3931

Market Participants Recognise CALB Group Co., Ltd.'s (HKG:3931) Earnings

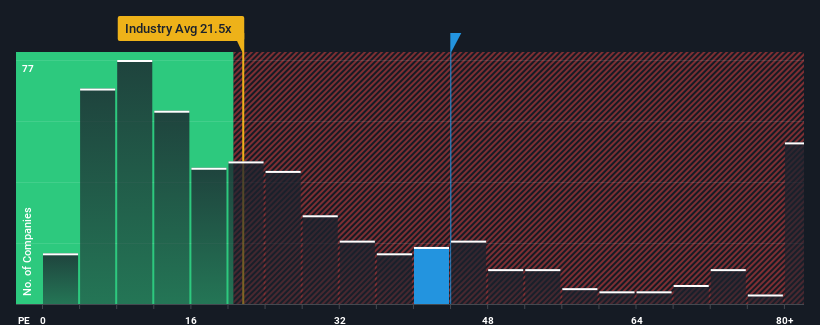

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider CALB Group Co., Ltd. (HKG:3931) as a stock to avoid entirely with its 43.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

CALB Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for CALB Group

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as CALB Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 291% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 91% per annum as estimated by the eleven analysts watching the company. With the market only predicted to deliver 21% each year, the company is positioned for a stronger earnings result.

With this information, we can see why CALB Group is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CALB Group's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that CALB Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for CALB Group that you need to be mindful of.

If these risks are making you reconsider your opinion on CALB Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3931

CALB Group

A new energy technology company, engages in the research and development, design, production, and sale of electric vehicle (EV) batteries and energy storage system (ESS) products in Mainland China, Europe, Asia, the United States, and internationally.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives