We Think That There Are Some Issues For Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO) Beyond Its Promising Earnings

The market for Flexopack Société Anonyme Commercial and Industrial Plastics Company's (ATH:FLEXO) stock was strong after it released a healthy earnings report last week. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

Check out our latest analysis for Flexopack Société Anonyme Commercial and Industrial Plastics

Zooming In On Flexopack Société Anonyme Commercial and Industrial Plastics' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

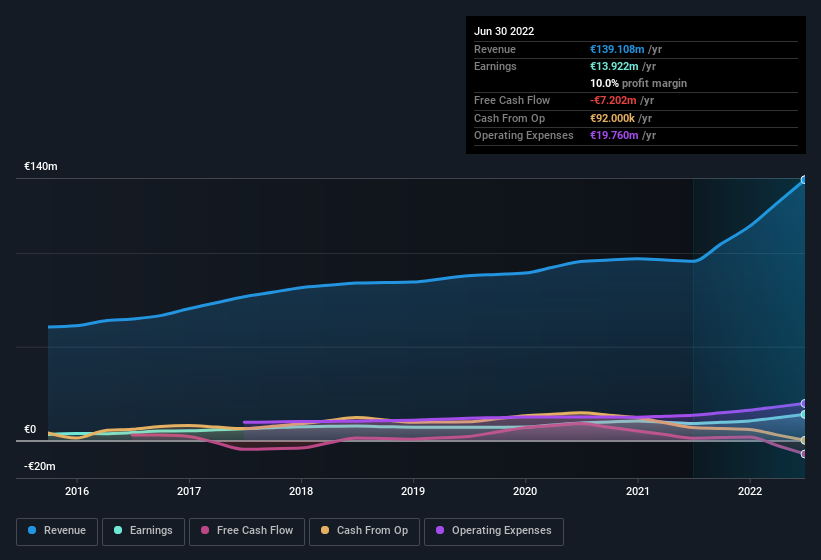

Over the twelve months to June 2022, Flexopack Société Anonyme Commercial and Industrial Plastics recorded an accrual ratio of 0.23. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Over the last year it actually had negative free cash flow of €7.2m, in contrast to the aforementioned profit of €13.9m. We saw that FCF was €1.3m a year ago though, so Flexopack Société Anonyme Commercial and Industrial Plastics has at least been able to generate positive FCF in the past.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Flexopack Société Anonyme Commercial and Industrial Plastics.

Our Take On Flexopack Société Anonyme Commercial and Industrial Plastics' Profit Performance

Flexopack Société Anonyme Commercial and Industrial Plastics didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Because of this, we think that it may be that Flexopack Société Anonyme Commercial and Industrial Plastics' statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 3 warning signs for Flexopack Société Anonyme Commercial and Industrial Plastics you should be mindful of and 1 of them is a bit unpleasant.

This note has only looked at a single factor that sheds light on the nature of Flexopack Société Anonyme Commercial and Industrial Plastics' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:FLEXO

Flexopack Société Anonyme Commercial and Industrial Plastics

Manufactures and sells flexible plastic packaging materials for the food industry in Greece, other European countries, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)