Here's Why We Think Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Flexopack Société Anonyme Commercial and Industrial Plastics (ATH:FLEXO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Flexopack Société Anonyme Commercial and Industrial Plastics

How Quickly Is Flexopack Société Anonyme Commercial and Industrial Plastics Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Flexopack Société Anonyme Commercial and Industrial Plastics' EPS has grown 26% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

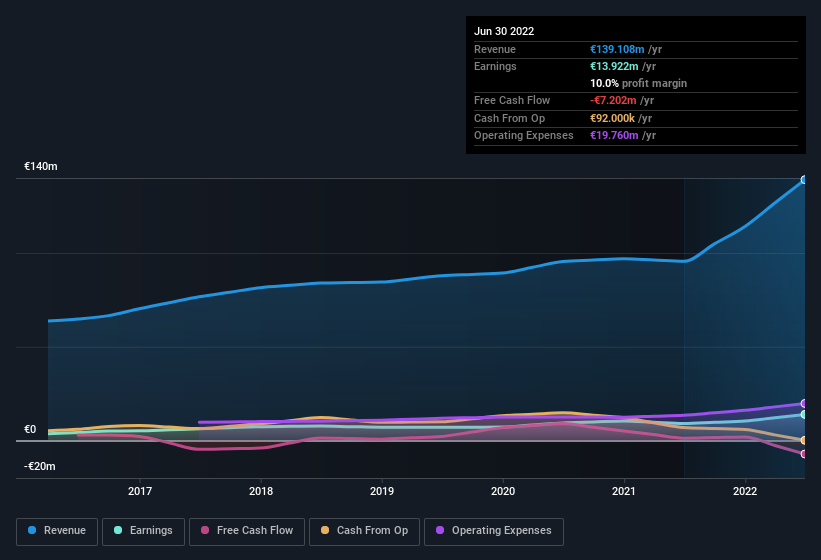

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Flexopack Société Anonyme Commercial and Industrial Plastics maintained stable EBIT margins over the last year, all while growing revenue 46% to €139m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Flexopack Société Anonyme Commercial and Industrial Plastics is no giant, with a market capitalisation of €105m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Flexopack Société Anonyme Commercial and Industrial Plastics Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Flexopack Société Anonyme Commercial and Industrial Plastics insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 73% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have €76m invested in the business, at the current share price. So there's plenty there to keep them focused!

Does Flexopack Société Anonyme Commercial and Industrial Plastics Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Flexopack Société Anonyme Commercial and Industrial Plastics' strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It is worth noting though that we have found 2 warning signs for Flexopack Société Anonyme Commercial and Industrial Plastics (1 makes us a bit uncomfortable!) that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:FLEXO

Flexopack Société Anonyme Commercial and Industrial Plastics

Manufactures and sells flexible plastic packaging materials for the food industry in Greece, other European countries, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives