- Greece

- /

- Construction

- /

- ATSE:AKTR

Intrakat Société Anonyme Technical and Energy Projects' (ATH:INKAT) Attractive Earnings Are Not All Good News For Shareholders

We didn't see Intrakat Société Anonyme Technical and Energy Projects' (ATH:INKAT) stock surge when it reported robust earnings recently. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for Intrakat Société Anonyme Technical and Energy Projects

Examining Cashflow Against Intrakat Société Anonyme Technical and Energy Projects' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

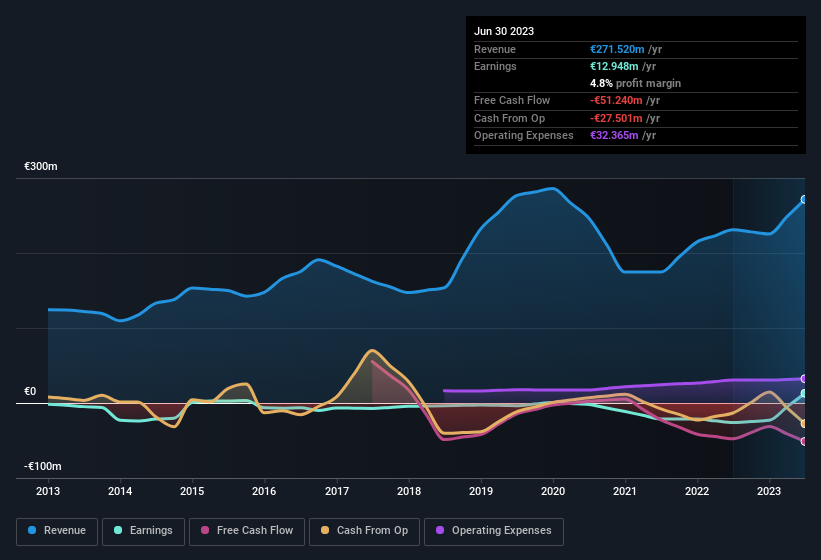

For the year to June 2023, Intrakat Société Anonyme Technical and Energy Projects had an accrual ratio of 0.28. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Over the last year it actually had negative free cash flow of €51m, in contrast to the aforementioned profit of €12.9m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of €51m, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Intrakat Société Anonyme Technical and Energy Projects.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Intrakat Société Anonyme Technical and Energy Projects issued 114% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Intrakat Société Anonyme Technical and Energy Projects' EPS by clicking here.

A Look At The Impact Of Intrakat Société Anonyme Technical and Energy Projects' Dilution On Its Earnings Per Share (EPS)

Three years ago, Intrakat Société Anonyme Technical and Energy Projects lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

If Intrakat Société Anonyme Technical and Energy Projects' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Intrakat Société Anonyme Technical and Energy Projects' Profit Performance

In conclusion, Intrakat Société Anonyme Technical and Energy Projects has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). Considering all this we'd argue Intrakat Société Anonyme Technical and Energy Projects' profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. In terms of investment risks, we've identified 3 warning signs with Intrakat Société Anonyme Technical and Energy Projects, and understanding these should be part of your investment process.

Our examination of Intrakat Société Anonyme Technical and Energy Projects has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:AKTR

Aktor Societe Anonyme Holding Company Technical and Energy Projects

Engages in the construction business in Greece, European countries, and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)