- United Kingdom

- /

- Water Utilities

- /

- LSE:PNN

Pennon Group (LSE:PNN) poised for growth with acquisitions and WaterShare+ amid financial challenges

Reviewed by Simply Wall St

Pennon Group (LSE:PNN) is making strategic strides with its recent acquisition clearance for Sutton and East Surrey, positioning itself for growth despite facing challenges like high operating costs and a significant debt ratio. The company's innovative WaterShare+ scheme and a strong dividend yield highlight its commitment to customer engagement and shareholder returns, while its undervaluation presents potential investment opportunities. In the following discussion, we will explore Pennon's financial performance, strategic initiatives in renewable energy, and the external factors that could impact its future trajectory.

Get an in-depth perspective on Pennon Group's performance by reading our analysis here.

Key Assets Propelling Pennon Group Forward

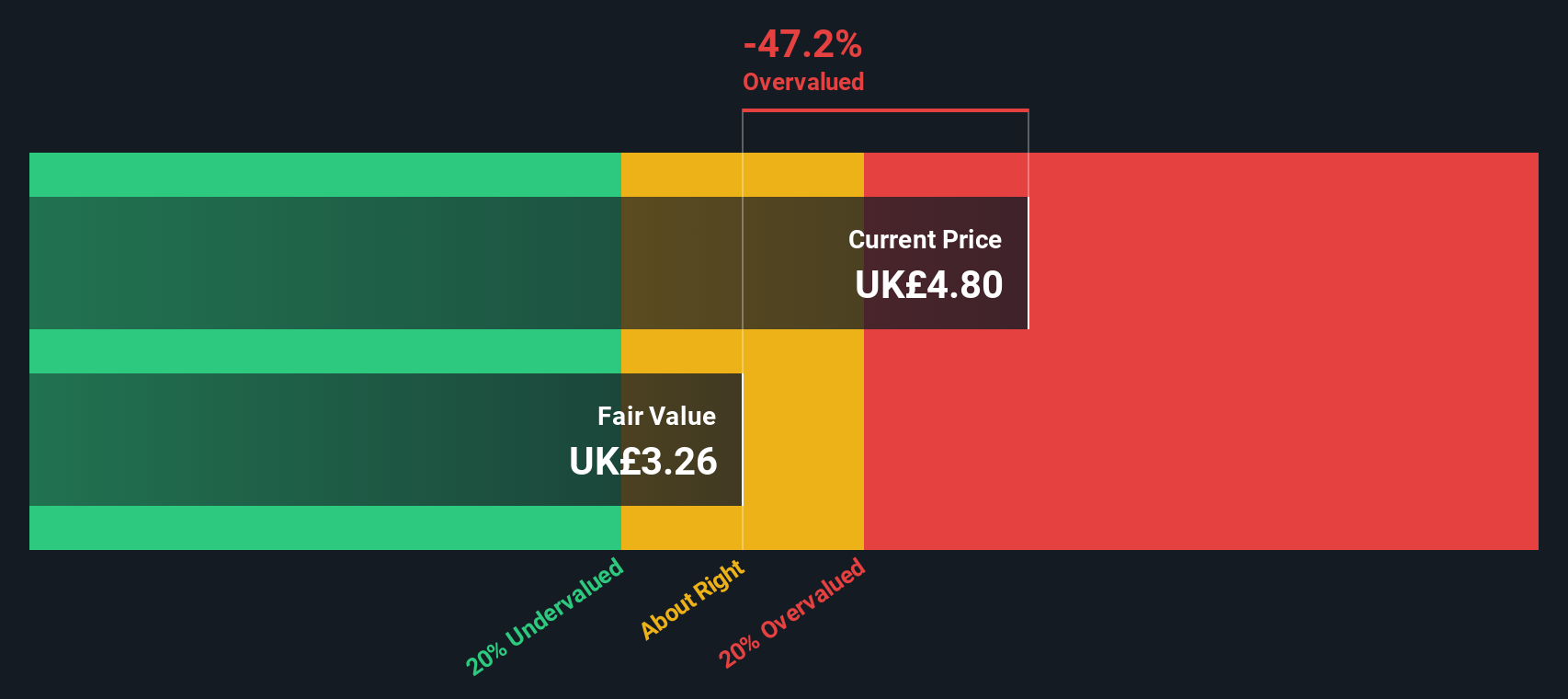

Pennon Group's strategic acquisitions, such as the recent clearance for Sutton and East Surrey, highlight its operational excellence. This move, as noted by CEO Susan Davy, positions the company for significant growth, particularly with the strong assessments for South West Water and Sutton and East Surrey business plans. Financially, the group has demonstrated resilience, with CFO Laura Flowerdew reporting a headline EBITDA of £164 million, showing stability despite a slight decrease from the previous period. The innovative WaterShare+ scheme, which empowers customers with a stake and say in the business, further underscores the company's customer-centric approach. This initiative, launched in 2020, has been pivotal in achieving 100% affordability for customers this year. Moreover, Pennon’s expected revenue growth of 7.2% annually, significantly outpacing the UK market's 3.6%, along with a dividend yield of 7.21%, places it among the top 25% of UK dividend payers. Notably, the company is trading below its estimated fair value of £7.15, with a price of £6.24, suggesting an undervaluation based on its SWS Price-To-Sales Ratio.

Challenges Constraining Pennon Group's Potential

Despite these strengths, Pennon faces several challenges. The company is currently unprofitable, with a Return on Equity of -3.99%, and carries a high net debt to equity ratio of 310.8%. Laura Flowerdew has highlighted revenue challenges within South West Water, where the successful "Water is Precious" campaign led to a £19 million revenue impact due to reduced demand. Additionally, operating costs have surged by 29.8% to £363.7 million, driven by inflationary pressures and the full consolidation of SES. Dividend payments have also fallen over the past decade, not being covered by earnings or cash flows, which raises concerns about sustainability. Furthermore, shareholder dilution has been a point of contention, with a 9.5% increase in total shares outstanding.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for Pennon are abundant, particularly in renewable energy investments and the expansion of non-regulated businesses. Susan Davy has emphasized the company's commitment to net zero, with Pennon Power's investment already seeing nearly half of its targeted capacity under construction. This strategic move not only derisks energy requirements but also promises returns exceeding those of the regulated water business. Additionally, the expansion of non-regulated business, including SES Business Water, has resulted in a combined market share of 15% and strong EBITDA performance. These initiatives are poised to enhance Pennon's market position and capitalize on emerging opportunities, potentially leading to profitability within the next three years.

External Factors Threatening Pennon Group

However, external threats loom, including weather and environmental challenges. Susan Davy notes that rainfall levels have been 15% higher than the 2023 base, exacerbating storm overflow spills. Regulatory and compliance risks also persist, as Pennon continues to work with inspectors on lessons from past incidents. The response to the Draft Determination, covering four areas of representation, aims to balance risk and return with achievable targets. Interest payments on debt remain a concern, with earnings covering only 0.8 times the interest, highlighting potential financial vulnerabilities. These factors collectively pose significant risks to Pennon's growth trajectory and market share.

Conclusion

Pennon Group's strategic acquisitions and customer-centric initiatives, such as the WaterShare+ scheme, position it for substantial growth, with annual revenue expected to rise by 7.2%, outpacing the UK market. However, challenges such as high debt levels and unprofitability, coupled with increased operational costs, raise concerns about financial sustainability. Despite these issues, Pennon's commitment to renewable energy and expansion into non-regulated businesses offer promising avenues for future profitability. The company's current trading price below its estimated fair value suggests potential for share price appreciation, reflecting its strategic positioning and growth prospects in the water and energy sectors.

Summing It All Up

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PNN

Pennon Group

Provides water and wastewater services in the United Kingdom.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)