- United Kingdom

- /

- Real Estate

- /

- LSE:MTVW

Yü Group And Two More Undiscovered UK Stocks With Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, with the FTSE 100 showing signs of resilience and potential growth, investors are increasingly on the lookout for opportunities that might be flying under the radar. In this context, identifying stocks with untapped potential becomes crucial, especially in a market environment where discerning value can set one apart.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

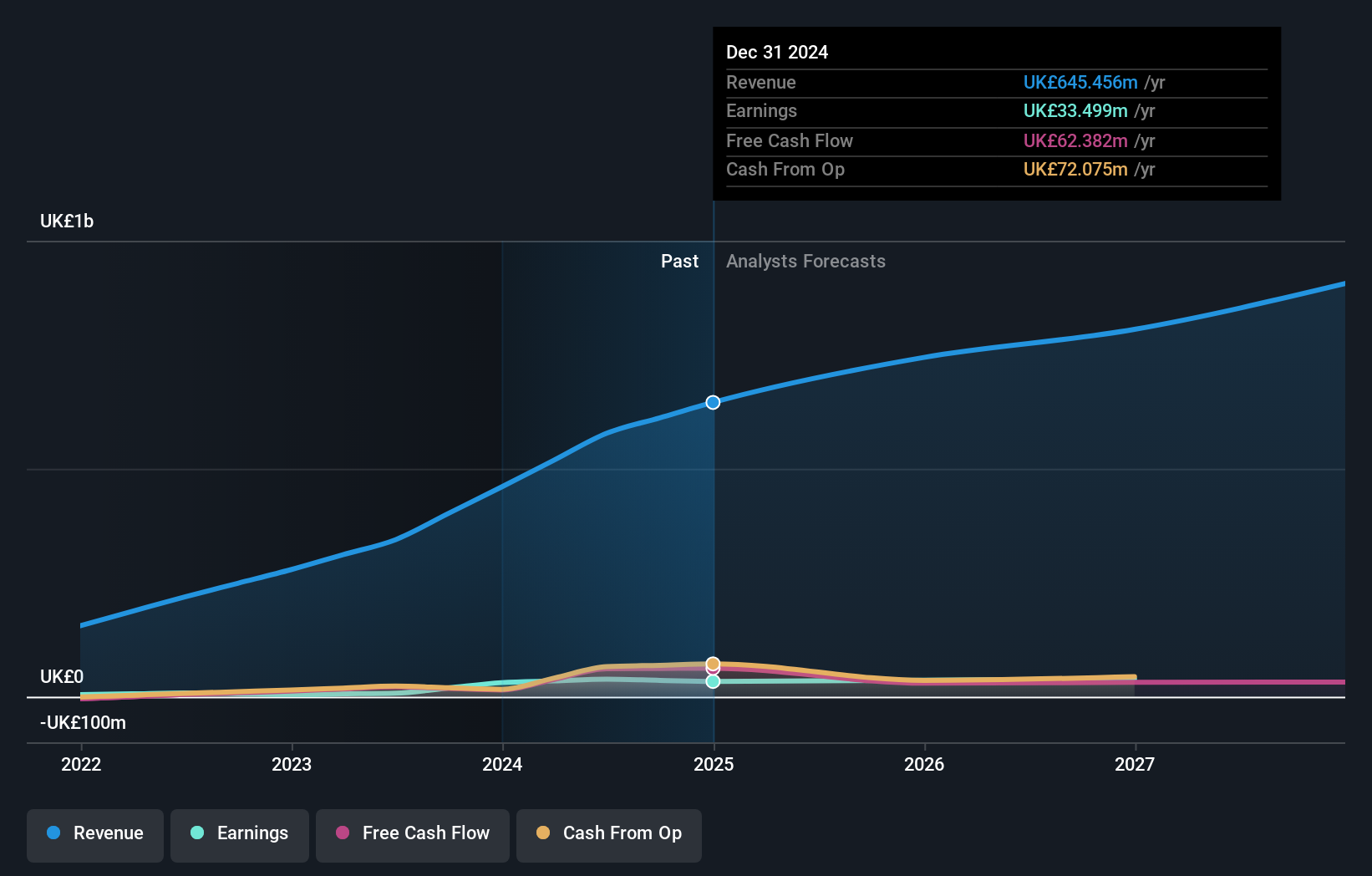

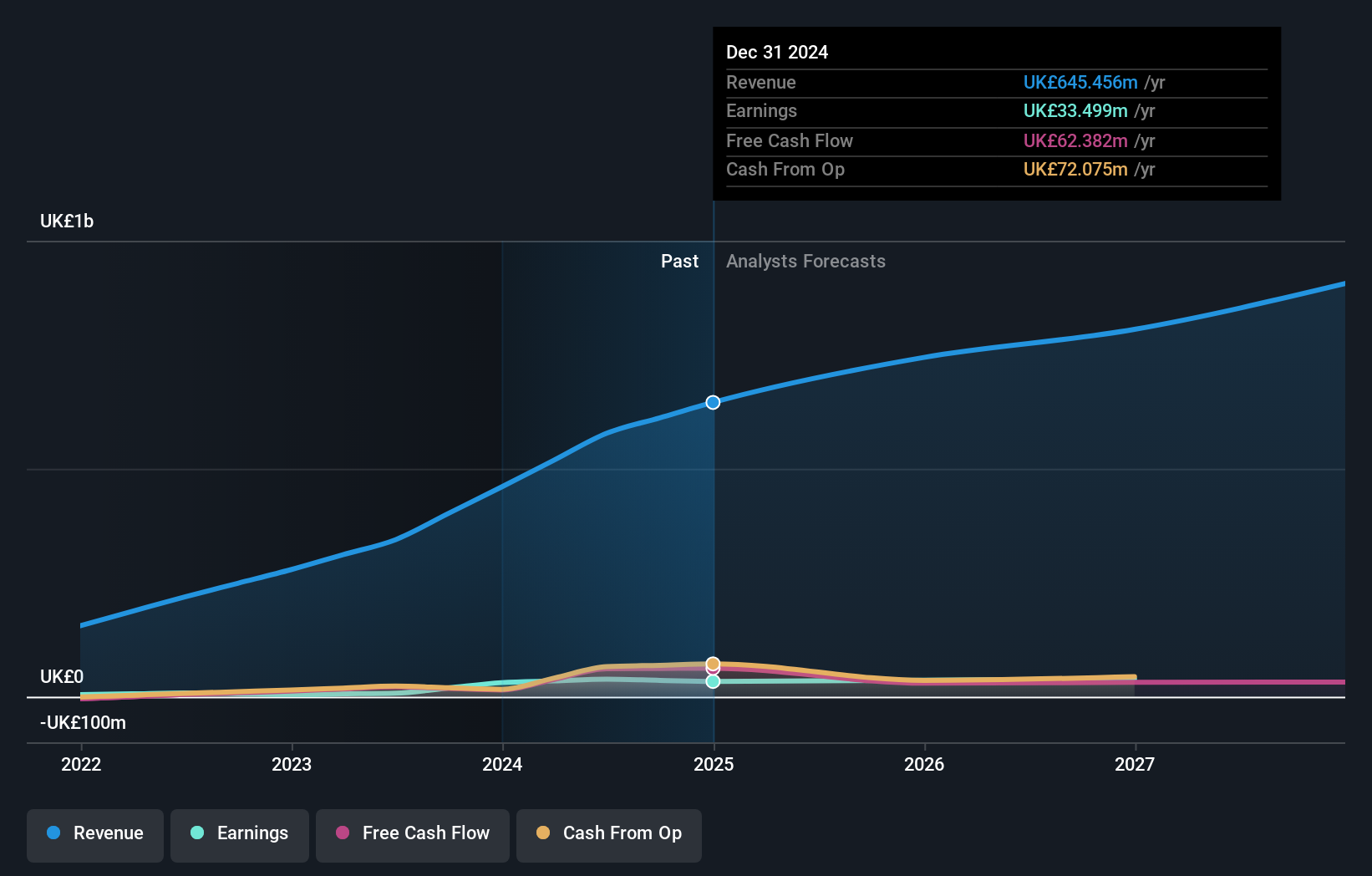

Overview: Yü Group PLC is a UK-based company that provides energy and utility solutions, with a market capitalization of £313.87 million.

Operations: The company generates the majority of its revenue from retail operations, amounting to £459.80 million, complemented by smaller segments in smart technology and metering assets. It has experienced a notable increase in gross profit margin over recent periods, reaching 18.05% as of the latest data, indicating improved efficiency in managing cost of goods sold relative to revenue.

Yü Group, a notable player in the UK's renewable energy sector, has demonstrated remarkable growth with earnings increasing by 547% over the past year, significantly outpacing its industry's decline of 16%. This growth trajectory is supported by a robust free cash flow and a debt level well-managed against its cash reserves. Trading at 63% below its estimated fair value, Yü offers compelling value. The company also announced a substantial dividend increase to 37 pence for 2024, reflecting strong financial health and confidence in sustained profitability.

- Take a closer look at Yü Group's potential here in our health report.

Review our historical performance report to gain insights into Yü Group's's past performance.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC is a UK-based company that provides energy and utility solutions, with a market capitalization of £313.87 million.

Operations: The company generates the majority of its revenue from retail operations, amounting to £459.80 million, complemented by smaller segments in smart technology and metering assets. It has experienced a notable increase in gross profit margin over recent periods, reaching 18.05% as of the latest data, indicating improved efficiency in managing cost of goods sold relative to revenue.

Yü Group, a notable player in the UK's renewable energy sector, has demonstrated remarkable growth with earnings increasing by 547% over the past year, significantly outpacing its industry's decline of 16%. This growth trajectory is supported by a robust free cash flow and a debt level well-managed against its cash reserves. Trading at 63% below its estimated fair value, Yü offers compelling value. The company also announced a substantial dividend increase to 37 pence for 2024, reflecting strong financial health and confidence in sustained profitability.

- Take a closer look at Yü Group's potential here in our health report.

Review our historical performance report to gain insights into Yü Group's's past performance.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

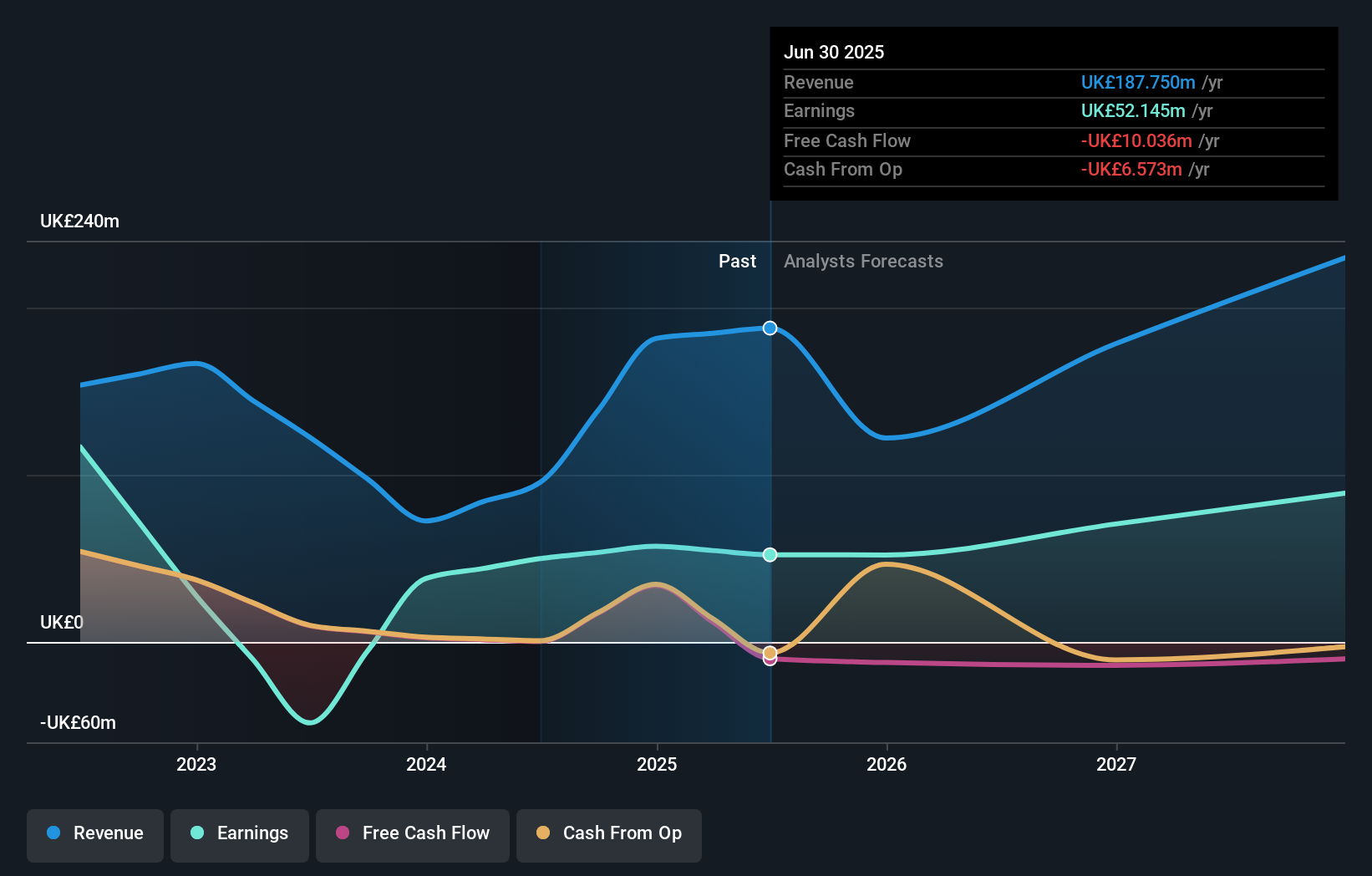

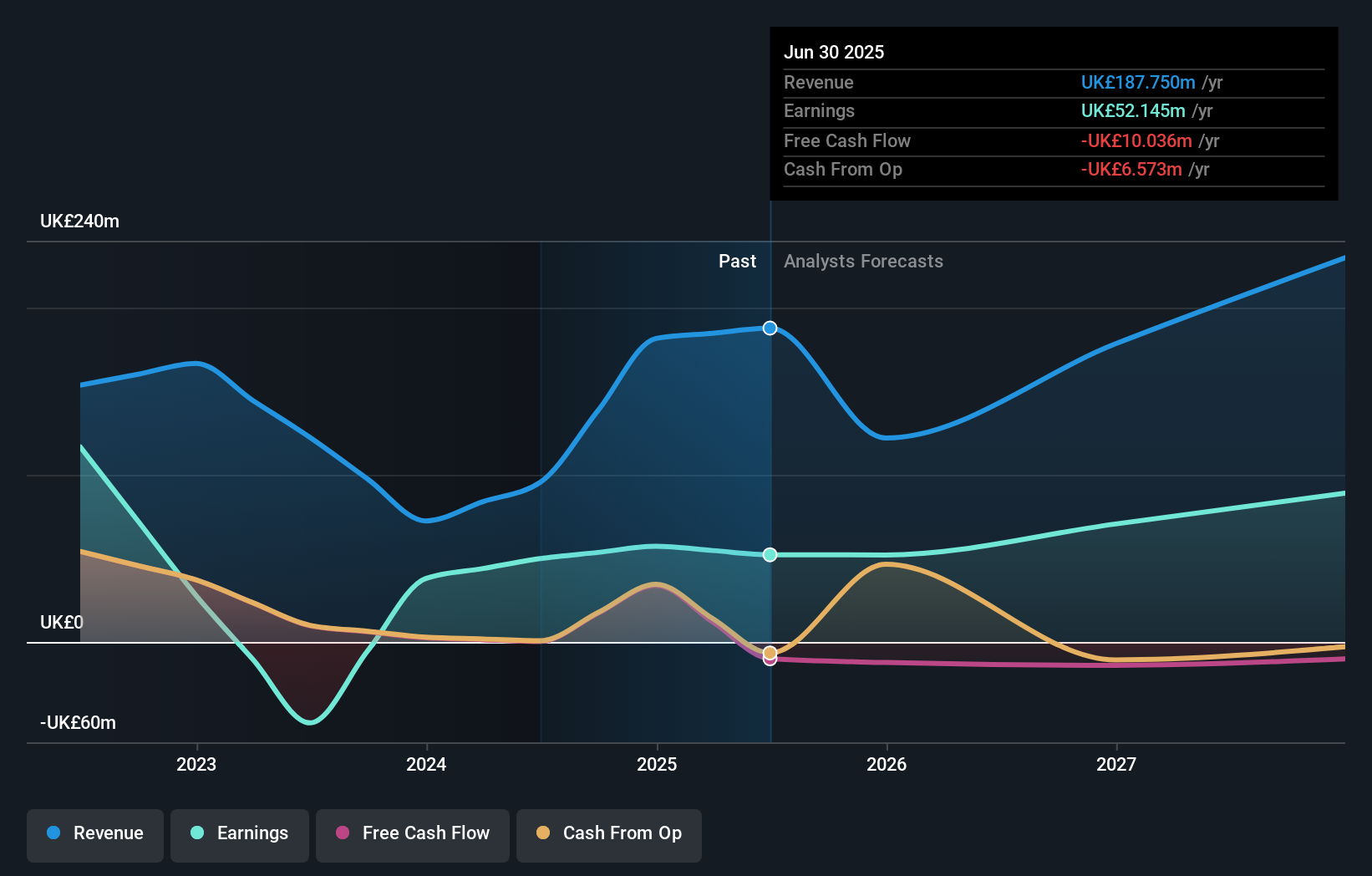

Overview: Harworth Group plc is a land and property regeneration company focused on developing and optimising assets across the North of England and the Midlands, with a market capitalization of £566.91 million.

Operations: The company generates revenue primarily through income generation activities, capital growth from other property activities, and the sale of development properties. It has a diverse operational model that includes generating £23.41 million from ongoing property income, £2.29 million from various other property-related activities, and a significant £46.73 million from selling properties developed for capital growth.

Harworth Group, with its strategic expansions and robust financials, stands out as a promising investment. Recently securing planning for a significant industrial hub in Leeds, the company anticipates starting construction in 2025 which could generate up to £190M in value. Financially, Harworth shows strength with a debt reduction from 16.6% to 10% over five years and maintains a satisfactory net debt-to-equity ratio of 5.7%. Additionally, earnings have surged by 36.3% this past year, outpacing the real estate industry's decline of 6.1%.

- Navigate through the intricacies of Harworth Group with our comprehensive health report here.

Understand Harworth Group's track record by examining our Past report.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group plc is a land and property regeneration company focused on developing and optimising assets across the North of England and the Midlands, with a market capitalization of £566.91 million.

Operations: The company generates revenue primarily through income generation activities, capital growth from other property activities, and the sale of development properties. It has a diverse operational model that includes generating £23.41 million from ongoing property income, £2.29 million from various other property-related activities, and a significant £46.73 million from selling properties developed for capital growth.

Harworth Group, with its strategic expansions and robust financials, stands out as a promising investment. Recently securing planning for a significant industrial hub in Leeds, the company anticipates starting construction in 2025 which could generate up to £190M in value. Financially, Harworth shows strength with a debt reduction from 16.6% to 10% over five years and maintains a satisfactory net debt-to-equity ratio of 5.7%. Additionally, earnings have surged by 36.3% this past year, outpacing the real estate industry's decline of 6.1%.

- Navigate through the intricacies of Harworth Group with our comprehensive health report here.

Understand Harworth Group's track record by examining our Past report.

Mountview Estates (LSE:MTVW)

Simply Wall St Value Rating: ★★★★☆☆

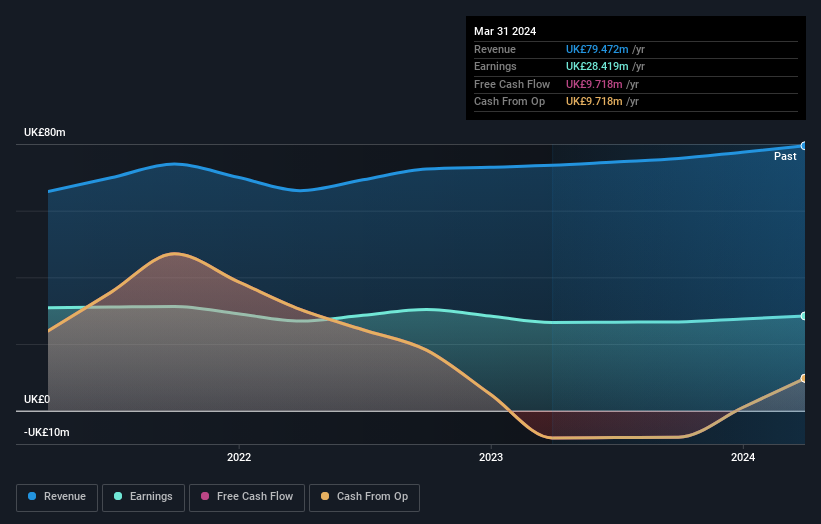

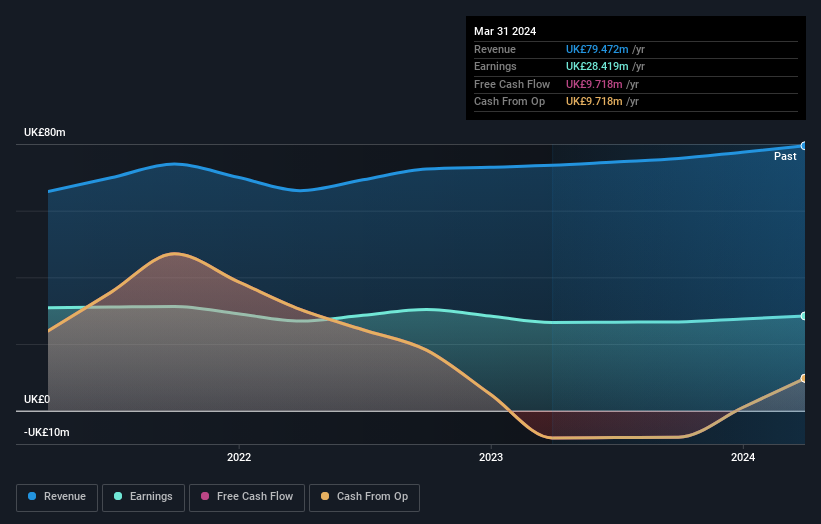

Overview: Mountview Estates P.L.C. is a UK-based company that operates in property trading and investment, with a market capitalization of £382.10 million.

Operations: The company operates in property trading and investment, generating the majority of its revenue from property trading (£78.94 million), with a smaller contribution from property investment (£0.53 million). It has demonstrated a gross profit margin increase over the observed periods, peaking at 66.12% in late 2020.

Mountview Estates, a lesser spotlighted UK real estate firm, showcases promising financials and growth metrics. With a P/E ratio of 13.4, below the market average of 16.8, it presents value in an overpriced sector. The company's earnings outpaced industry decline with a 7.4% increase last year while the sector fell by 6.1%. Additionally, its debt to equity ratio sits at a manageable 16.5%, supported by robust interest coverage at 11.2 times EBIT, indicating financial stability amidst growth endeavors.

- Delve into the full analysis health report here for a deeper understanding of Mountview Estates.

Gain insights into Mountview Estates' past trends and performance with our Past report.

Mountview Estates (LSE:MTVW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mountview Estates P.L.C. is a UK-based company that operates in property trading and investment, with a market capitalization of £382.10 million.

Operations: The company operates in property trading and investment, generating the majority of its revenue from property trading (£78.94 million), with a smaller contribution from property investment (£0.53 million). It has demonstrated a gross profit margin increase over the observed periods, peaking at 66.12% in late 2020.

Mountview Estates, a lesser spotlighted UK real estate firm, showcases promising financials and growth metrics. With a P/E ratio of 13.4, below the market average of 16.8, it presents value in an overpriced sector. The company's earnings outpaced industry decline with a 7.4% increase last year while the sector fell by 6.1%. Additionally, its debt to equity ratio sits at a manageable 16.5%, supported by robust interest coverage at 11.2 times EBIT, indicating financial stability amidst growth endeavors.

- Delve into the full analysis health report here for a deeper understanding of Mountview Estates.

Gain insights into Mountview Estates' past trends and performance with our Past report.

Where To Now?

- Access the full spectrum of 78 UK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MTVW

Mountview Estates

Engages in the property trading and investment business in the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion