- United Kingdom

- /

- Professional Services

- /

- AIM:ELIX

Undiscovered Gems in the UK to Explore This November 2024

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been marked by a downturn in the FTSE 100, influenced by weak trade data from China and its ongoing economic struggles, which have impacted global sentiment. Amidst these challenges, discovering promising stocks involves identifying companies with strong fundamentals and resilience to external economic pressures, making them potential hidden opportunities in this fluctuating environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 8.54% | 5.28% | 22.11% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Bioventix (AIM:BVXP)

Simply Wall St Value Rating: ★★★★★★

Overview: Bioventix PLC creates, manufactures, and supplies sheep monoclonal antibodies for diagnostic applications worldwide, with a market capitalization of £206.18 million.

Operations: Bioventix generates revenue primarily through its biotechnology segment, which contributed £13.61 million. The company's net profit margin stands at 69.1%, indicating a strong conversion of revenue into profit.

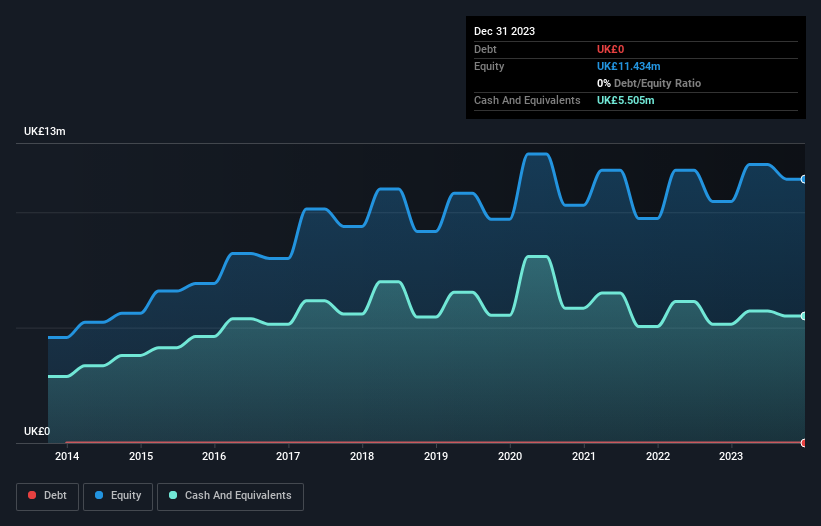

Bioventix, a small player in the biotech sector, showcases a solid financial foundation with no debt over the past five years and high-quality earnings. The company's price-to-earnings ratio of 25.5x sits just below the industry average of 26x, suggesting potential value for investors. Despite negative earnings growth at -3.3% compared to an industry average of -21.2%, Bioventix reported sales of £13.61 million for the year ending June 2024, up from £12.82 million previously, though net income slightly dipped to £8.1 million from £8.37 million last year.

- Take a closer look at Bioventix's potential here in our health report.

Explore historical data to track Bioventix's performance over time in our Past section.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc is a management consultancy firm operating in the United Kingdom, the United States, and internationally with a market capitalization of £343.57 million.

Operations: Elixirr derives its revenue primarily from management consulting services, totaling £97.37 million.

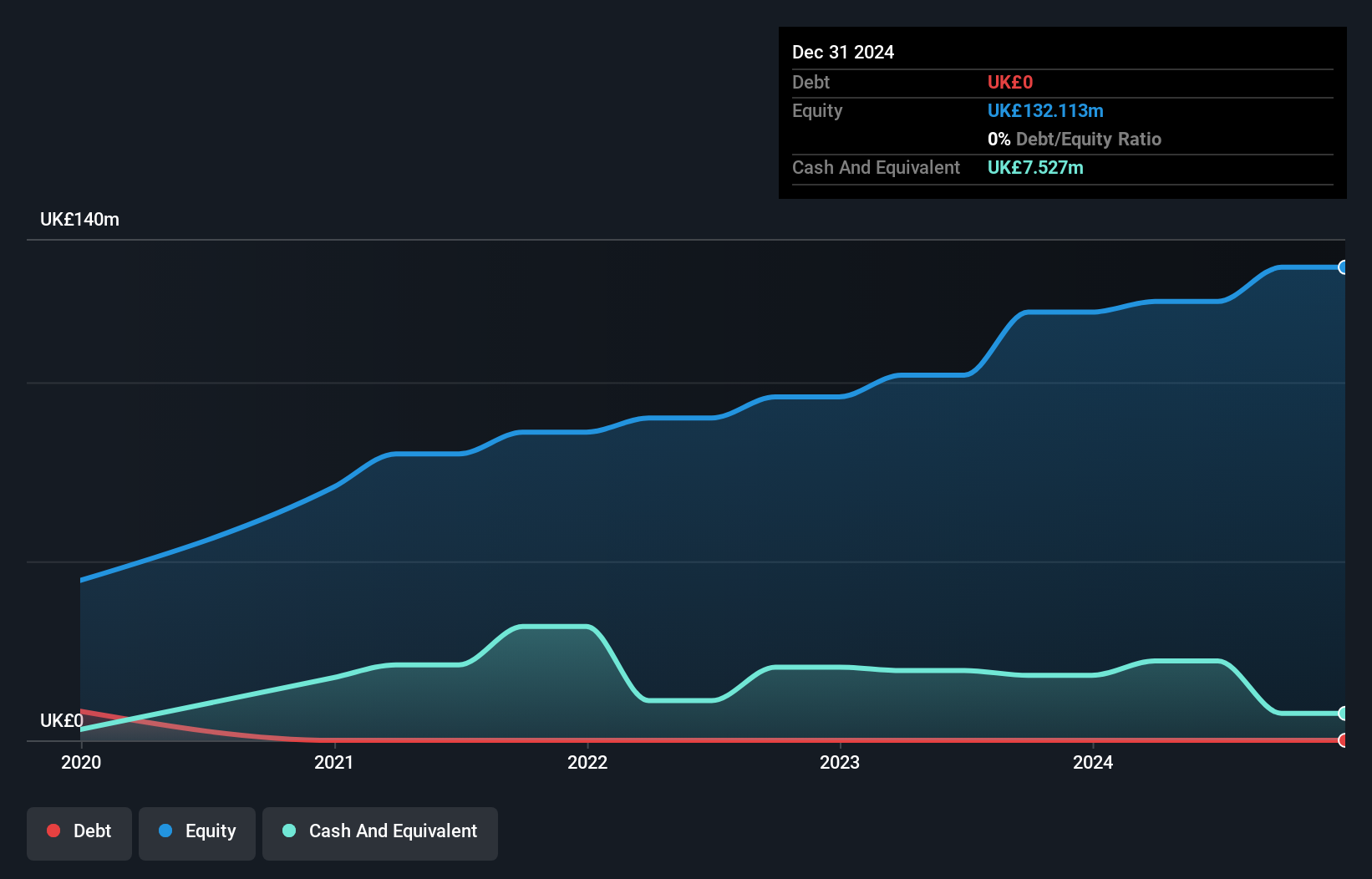

Elixirr, a nimble player in the professional services sector, has shown impressive earnings growth of 32.8% over the past year, outpacing its industry peers. The firm remains debt-free and is trading at 58.5% below its estimated fair value, indicating strong relative value potential. Despite recent insider selling and shareholder dilution due to a £25 million equity offering at £6.5 per share, Elixirr maintains profitability with net income rising to £8.84 million for H1 2024 from £7.67 million last year. Recent strategic partnerships and executive appointments underscore its commitment to innovation and expansion in global markets.

- Delve into the full analysis health report here for a deeper understanding of Elixirr International.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £298.76 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: Yü Group generates revenue primarily from supplying energy and utility solutions in the UK. The company focuses on optimizing its cost structure to enhance profitability. Notably, it has achieved a net profit margin of 3.5%.

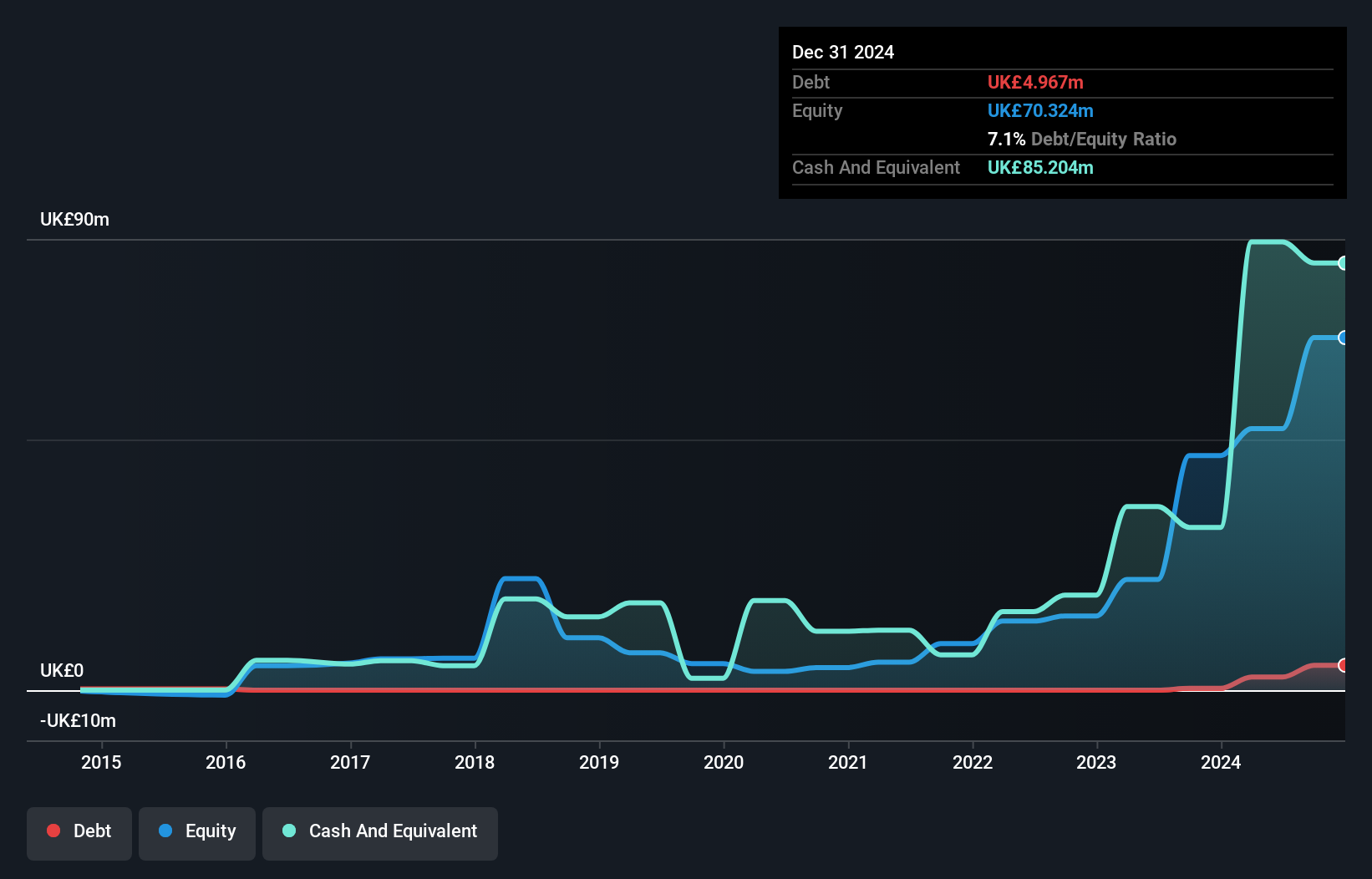

Yü Group, a dynamic player in the UK energy sector, has shown significant growth with earnings surging by 400% over the past year, outpacing the Renewable Energy industry's -3.9%. The company is trading at a substantial 59% below its estimated fair value, suggesting potential undervaluation in comparison to peers. With revenues forecasted to grow annually by 15.85%, Yü Group's financial health appears robust as it holds more cash than total debt and maintains positive free cash flow. Recent buybacks of approximately £3.99 million further indicate confidence in its future prospects despite projected earnings declines of 1.7% annually over three years.

- Click here and access our complete health analysis report to understand the dynamics of Yü Group.

Examine Yü Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Click here to access our complete index of 78 UK Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elixirr International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ELIX

Elixirr International

Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

Flawless balance sheet and undervalued.