We Think Some Shareholders May Hesitate To Increase Helios Towers plc's (LON:HTWS) CEO Compensation

Key Insights

- Helios Towers to hold its Annual General Meeting on 15th of May

- Salary of US$803.8k is part of CEO Tom Greenwood's total remuneration

- The total compensation is 136% higher than the average for the industry

- Over the past three years, Helios Towers' EPS grew by 56% and over the past three years, the total shareholder return was 1.5%

CEO Tom Greenwood has done a decent job of delivering relatively good performance at Helios Towers plc (LON:HTWS) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 15th of May. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Helios Towers

How Does Total Compensation For Tom Greenwood Compare With Other Companies In The Industry?

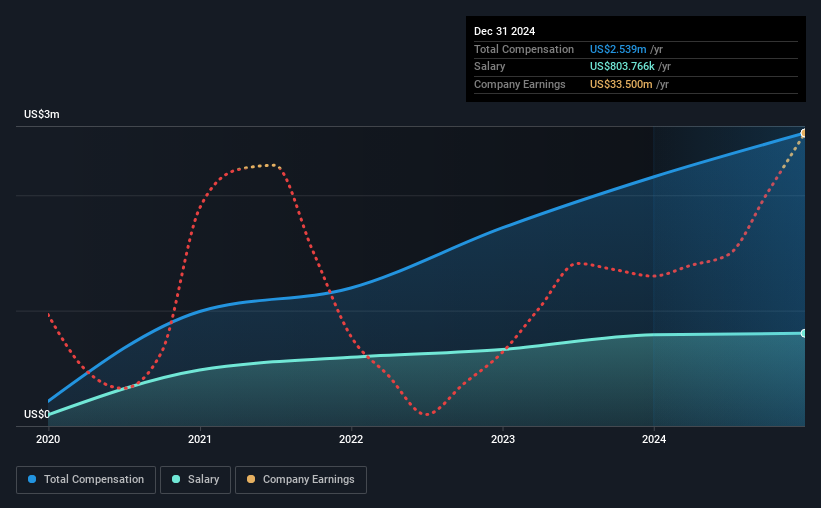

At the time of writing, our data shows that Helios Towers plc has a market capitalization of UK£1.2b, and reported total annual CEO compensation of US$2.5m for the year to December 2024. We note that's an increase of 18% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$804k.

For comparison, other companies in the the United Kingdom Telecom industry with market capitalizations ranging between UK£751m and UK£2.4b had a median total CEO compensation of US$1.1m. Hence, we can conclude that Tom Greenwood is remunerated higher than the industry median. Moreover, Tom Greenwood also holds UK£6.3m worth of Helios Towers stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$804k | US$792k | 32% |

| Other | US$1.7m | US$1.4m | 68% |

| Total Compensation | US$2.5m | US$2.2m | 100% |

Speaking on an industry level, nearly 62% of total compensation represents salary, while the remainder of 38% is other remuneration. Helios Towers sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Helios Towers plc's Growth

Helios Towers plc's earnings per share (EPS) grew 56% per year over the last three years. In the last year, its revenue is up 9.8%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Helios Towers plc Been A Good Investment?

With a total shareholder return of 1.5% over three years, Helios Towers plc has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Helios Towers that investors should think about before committing capital to this stock.

Important note: Helios Towers is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helios Towers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HTWS

Helios Towers

An independent tower company, acquires, builds, and operates telecommunications towers.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026