- United Kingdom

- /

- Communications

- /

- LSE:SPT

High Growth Tech Stocks in the United Kingdom for February 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery and its impact on UK companies tied to international markets. In such a challenging environment, identifying high growth tech stocks becomes crucial as they often demonstrate resilience and potential for innovation-driven expansion despite broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.14% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Pinewood Technologies Group | 20.07% | 25.09% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 7.67% | 56.01% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

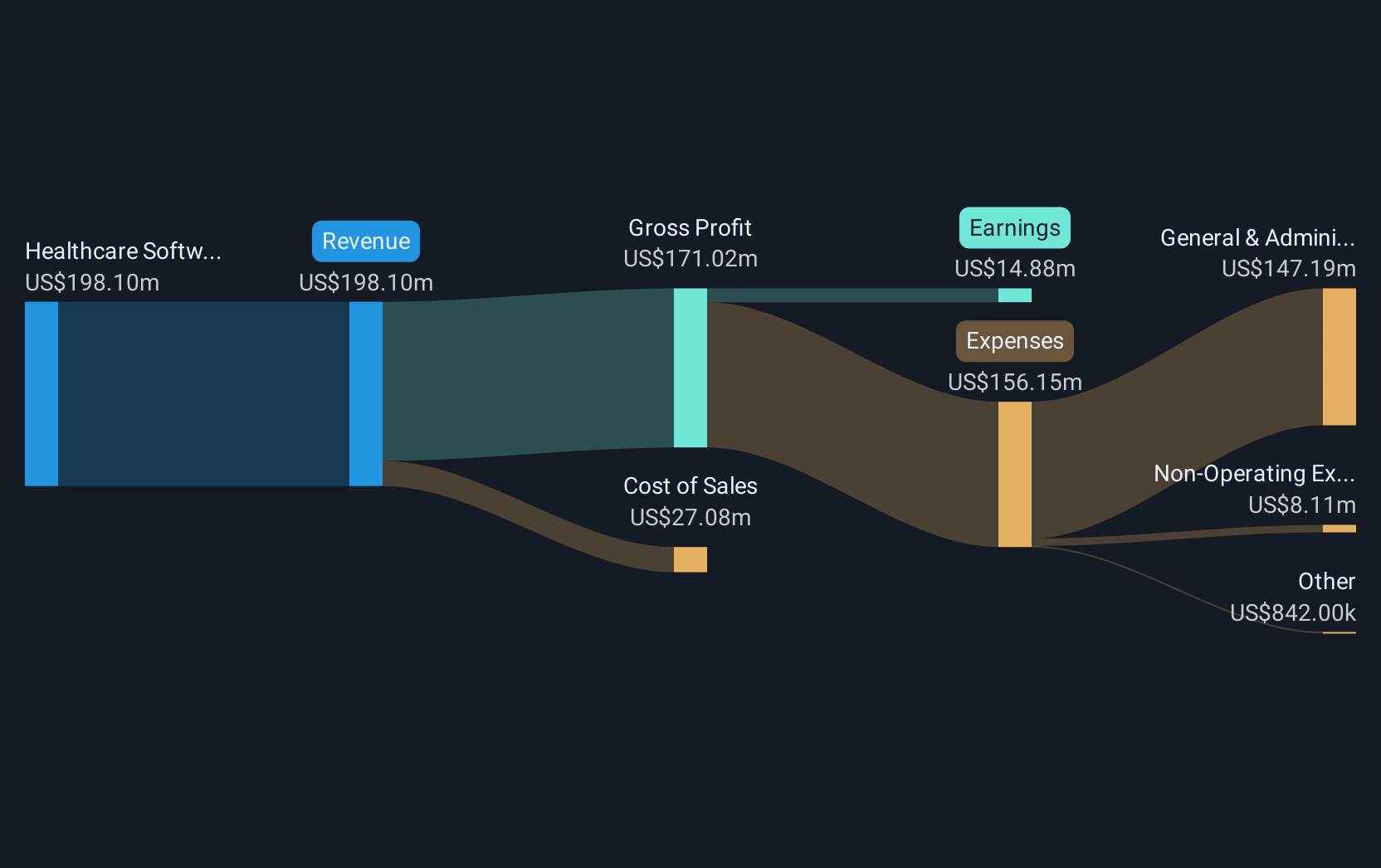

Overview: Craneware plc, along with its subsidiaries, specializes in developing, licensing, and supporting computer software for the U.S. healthcare industry and has a market cap of £672.35 million.

Operations: Craneware focuses on creating software solutions tailored for the U.S. healthcare sector, generating revenue primarily through licensing and support services. The company's offerings are designed to enhance operational efficiency and financial performance for healthcare providers.

Craneware, a player in the UK's high-growth tech sector, particularly within healthcare services, has demonstrated robust performance with an earnings growth of 26.4% last year—outpacing the industry average of 3.6%. Despite this strong performance, its revenue growth projection of 8.4% per year trails behind the broader market expectation of 20% annually. However, Craneware's projected annual earnings increase by a significant 29.6%, well above the UK market forecast of 14.8%. This financial trajectory is complemented by strategic executive appointments aimed at bolstering leadership in navigating evolving healthcare economics and technology landscapes—a move illustrated by recent additions like Susan Nelson from MedStar Health to their board. These leadership enhancements align with Craneware’s focus on maintaining competitive advantage in a rapidly changing sector where technological innovation and effective financial management are crucial for sustainability and growth. The firm's commitment to research and development (R&D), although not quantified here, likely plays a pivotal role in fostering these advancements, ensuring that Craneware not only keeps pace but potentially sets trends within the healthcare tech sphere.

- Click here and access our complete health analysis report to understand the dynamics of Craneware.

Explore historical data to track Craneware's performance over time in our Past section.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc is a company that offers consulting, digital, and software products and services to both private and public sector clients in the UK and internationally, with a market capitalization of approximately £235.80 million.

Operations: Capita generates revenue primarily from two segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion).

Capita, amidst a challenging landscape with an anticipated annual revenue dip of 1.3%, contrasts sharply with its earnings forecast, which is set to surge by 35% annually. This growth trajectory is underscored by strategic expansions and renewals such as the recent £1.3 billion Royal Navy training contract and the £89 million Gas Safe Register management deal, enhancing Capita's footprint in public sector engagements. These developments not only bolster Capita’s service delivery capabilities but also align with its digital transformation goals aimed at streamlining operations and improving client engagement through new technology implementations.

- Navigate through the intricacies of Capita with our comprehensive health report here.

Gain insights into Capita's historical performance by reviewing our past performance report.

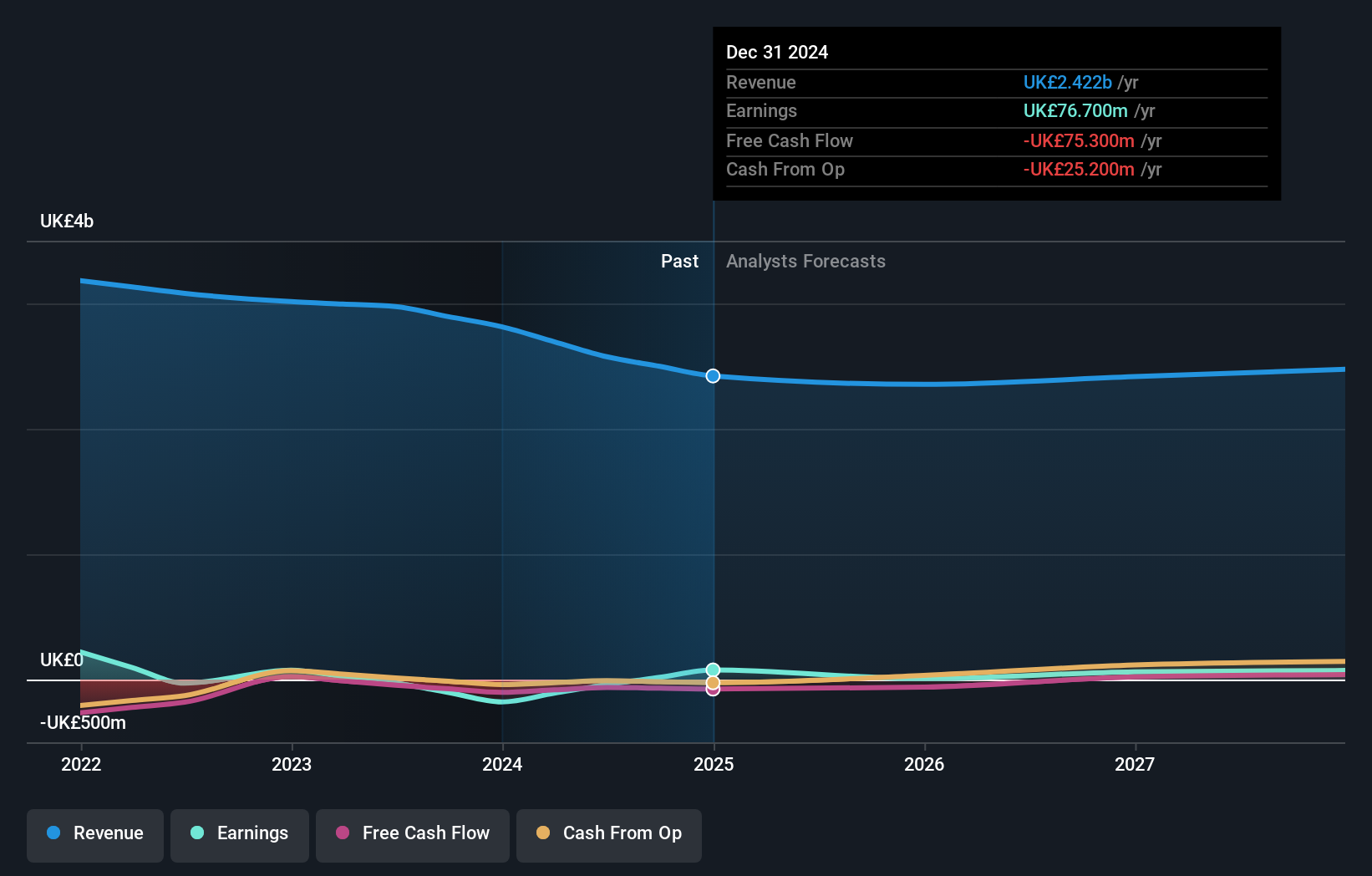

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions globally, with a market cap of £1.06 billion.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, which accounts for $258.50 million. The company's business operations span across the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Spirent Communications, amid a challenging tech landscape, has demonstrated resilience with a revenue growth of 7.3% annually, outpacing the UK market average of 3.5%. This growth is further complemented by an impressive earnings forecast, projecting a 36.2% increase per year. The company's commitment to innovation is evident in its R&D spending trends which have strategically aligned with emerging tech demands, particularly in AI and Ethernet infrastructure for hyperscalers. Recently, Spirent has been pivotal in developing new standards for automotive positioning in China—a move that not only enhances vehicle safety but also positions the company favorably within international regulatory frameworks. This strategic direction not only underscores Spirent's adaptability but also its potential to influence significant market segments globally.

- Unlock comprehensive insights into our analysis of Spirent Communications stock in this health report.

Evaluate Spirent Communications' historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 43 UK High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SPT

Spirent Communications

Provides automated test and assurance solutions in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives