- United Kingdom

- /

- Communications

- /

- AIM:FTC

High Growth Tech Stocks in the UK to Watch January 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies closely tied to its economy. In this environment, identifying high growth tech stocks requires a focus on innovation and resilience, as these qualities can help companies navigate global economic uncertainties and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Filtronic | 20.89% | 51.16% | ★★★★★★ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Altitude Group | 24.51% | 30.10% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Filtronic (AIM:FTC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally with a market cap of £221.17 million.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, which reported £25.43 million in sales.

Filtronic's recent strategic moves, including the addition of a new engineering design center at Cambridge Science Park and the appointment of Antonino Spatola as Chief Commercial Officer, underscore its commitment to innovation and market expansion in RF and microwave solutions. These developments are pivotal as Filtronic not only recorded a staggering 576.9% earnings growth over the past year but also projects an annual revenue increase of 20.9% and earnings growth of 51.2%. This positions Filtronic well within the UK's high-tech sector, particularly in Space and Defence communications, where it is set to leverage its enhanced capabilities and strategic positioning to foster significant advancements.

- Take a closer look at Filtronic's potential here in our health report.

Evaluate Filtronic's historical performance by accessing our past performance report.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc is a company that offers consulting, digital, and software products and services to both private and public sector clients in the UK and internationally, with a market cap of £226.31 million.

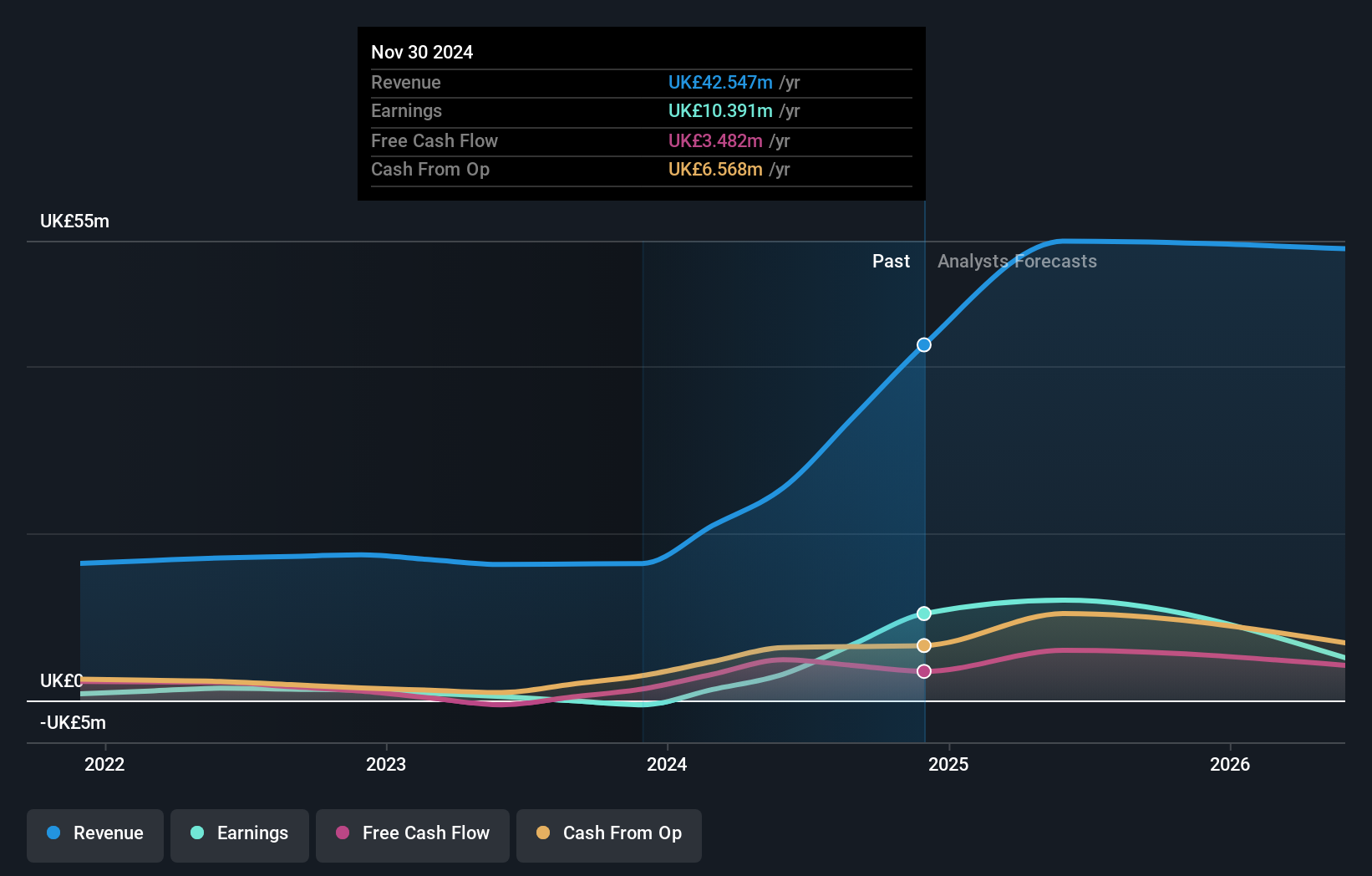

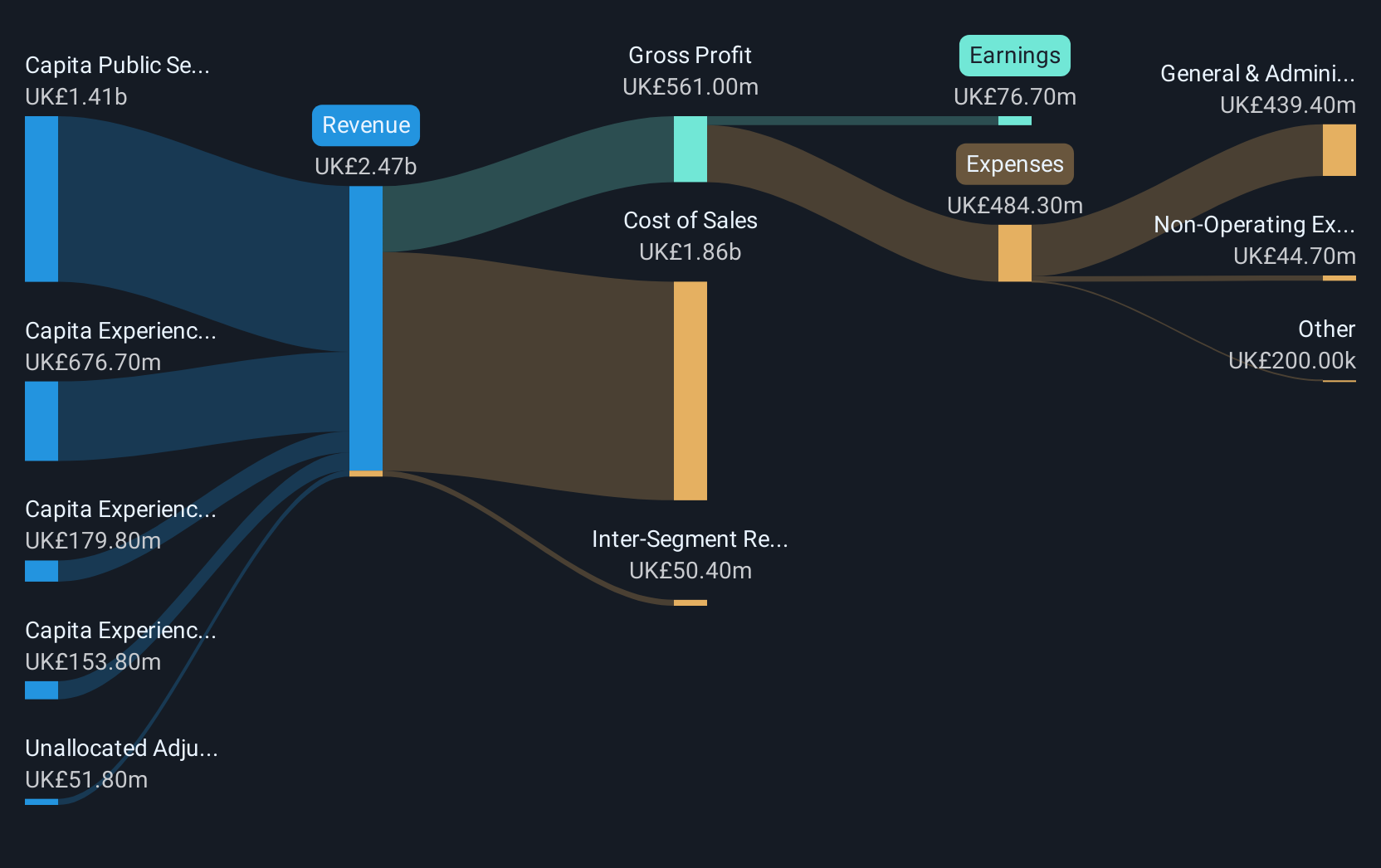

Operations: Capita's revenue streams are primarily derived from its Capita Experience segment, generating £1.12 billion, and the Capita Public Service segment, contributing £1.49 billion.

Capita, amid recent executive shifts and a new office location, faces challenges with a projected annual revenue dip of 1.3%. However, it's not all bleak; the firm is set to reverse its unprofitable streak, eyeing an impressive profit surge at an annual rate of 35.0% over the next three years. This turnaround is anchored by a robust forecasted return on equity of 46.5%, signaling potential resilience and efficiency gains ahead. These developments suggest Capita could be positioning itself for a more competitive stance in the UK's tech landscape despite current headwinds.

- Get an in-depth perspective on Capita's performance by reading our health report here.

Gain insights into Capita's historical performance by reviewing our past performance report.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of approximately £993.16 million.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, which accounted for $258.50 million. The company operates within the automated test and assurance solutions industry across multiple regions.

Spirent Communications, navigating through a challenging tech landscape, has recently underscored its innovation prowess by securing a partnership with a leading AI-focused hyperscaler for 800G Ethernet fabric testing. This collaboration is pivotal as it leverages Spirent's B3 800G Appliance to optimize high-speed networks essential for AI applications, highlighting the company's crucial role in advancing Ethernet infrastructure. Despite experiencing a significant earnings drop of 81.1% last year, Spirent is poised for recovery with an anticipated earnings growth of 41% annually over the next three years. Moreover, their involvement in developing China’s new automotive positioning standard showcases their strategic expansion into international regulatory frameworks, potentially boosting their market influence and operational scope in upcoming years.

- Unlock comprehensive insights into our analysis of Spirent Communications stock in this health report.

Understand Spirent Communications' track record by examining our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 43 UK High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and rest of the world.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)