Exploring Three High Growth Tech Stocks In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China, which has struggled to regain its economic footing post-pandemic. Amidst these broader market challenges, identifying high-growth tech stocks in the UK involves assessing companies that demonstrate resilience and adaptability in dynamic environments, offering potential for robust performance despite global economic headwinds.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Facilities by ADF | 26.24% | 161.47% | ★★★★★☆ |

| YouGov | 4.26% | 64.92% | ★★★★★☆ |

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Pinewood Technologies Group | 24.48% | 41.53% | ★★★★★☆ |

| Oxford Biomedica | 15.27% | 99.34% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc offers online market research services across various regions including the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific with a market cap of £311.85 million.

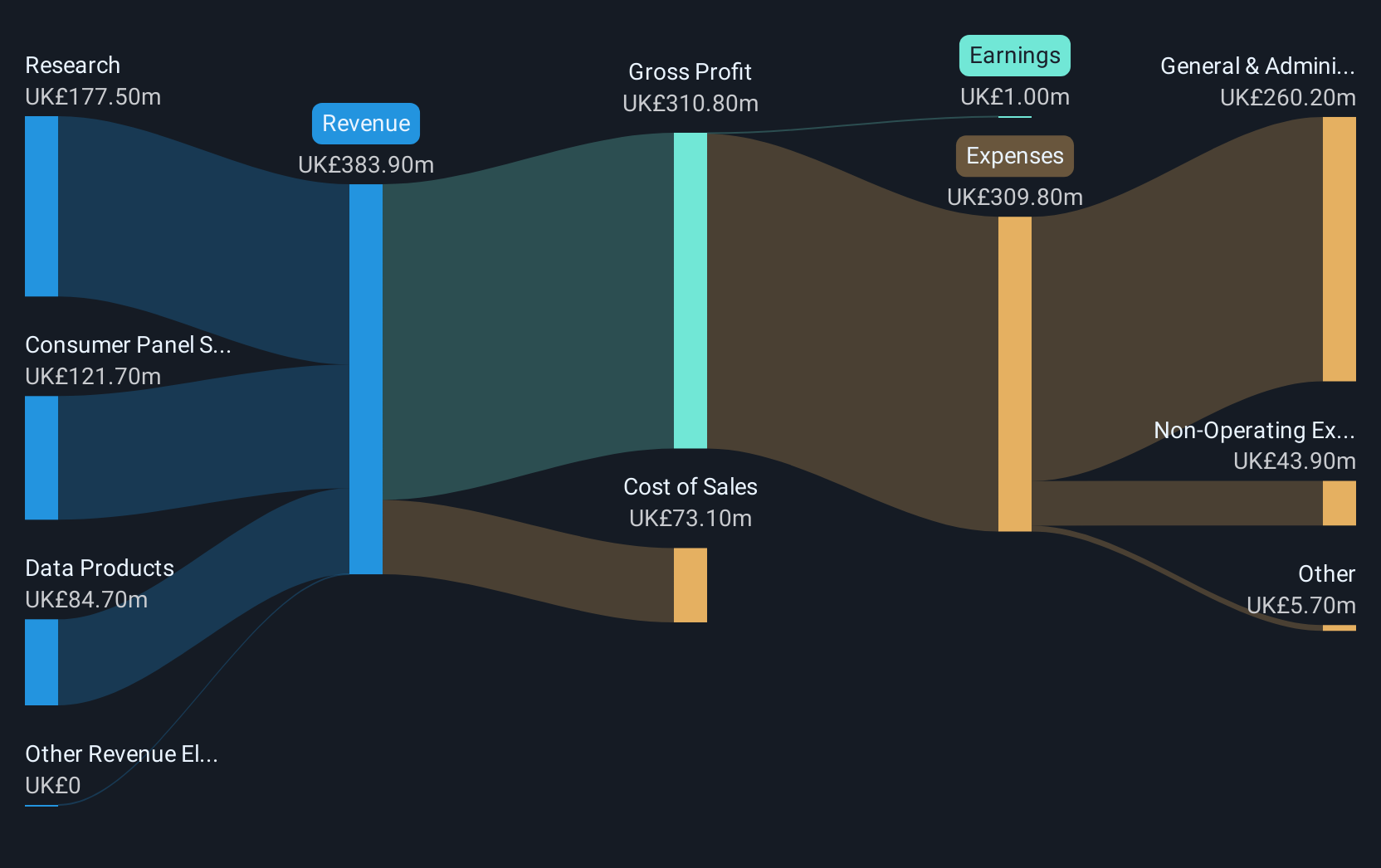

Operations: The company generates revenue primarily from three segments: Research (£177.50 million), Data Products (£84.70 million), and Consumer Panel Services (£121.70 million).

YouGov's recent performance underscores its resilience in a challenging market, with H1 2025 sales surging to £191.7 million from £143.1 million the previous year and net income nearly doubling to £7.9 million. This growth is bolstered by strategic leadership changes, including Stephan Shakespeare’s return as interim CEO, aimed at steering the company through transitional dynamics while capitalizing on AI-enhanced data products despite budget pressures across the industry. With an impressive forecast of 64.9% annual earnings growth over three years and revenue growth outpacing the UK market at 4.3% annually, YouGov is navigating its sector with innovative adaptations and targeted investments in high-growth areas like AI and data analytics, positioning it well for sustained advancement amidst evolving market conditions.

- Delve into the full analysis health report here for a deeper understanding of YouGov.

Explore historical data to track YouGov's performance over time in our Past section.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Growth Rating: ★★★★☆☆

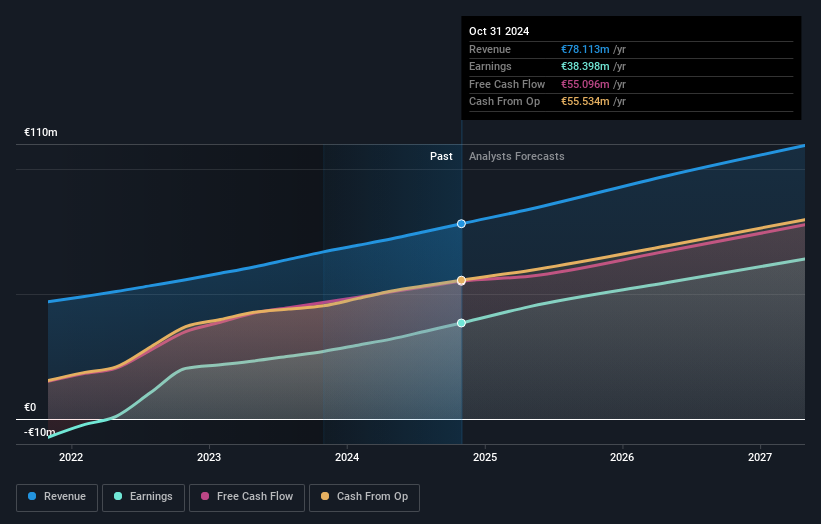

Overview: Baltic Classifieds Group PLC operates online classifieds portals across the automotive, real estate, jobs and services, and general merchandise sectors in Estonia, Latvia, and Lithuania with a market cap of £1.50 billion.

Operations: BCG generates revenue from its online classifieds portals, with the automotive segment contributing €29.89 million and real estate €20.27 million, followed by jobs & services at €15.03 million and generalist at €12.92 million.

Baltic Classifieds Group (BCG) is distinguishing itself in the Interactive Media and Services industry, outpacing its peers with a notable earnings growth of 42.1% over the past year, significantly above the industry average of 3.4%. This performance is underpinned by robust revenue forecasts, expected to grow at 13.6% annually, surpassing the UK market's growth rate of 4%. Moreover, BCG's strategic committee enhancements, including Tom Hall’s recent appointments to key financial oversight roles, signal a commitment to maintaining rigorous governance standards. These factors collectively position BCG for sustained competitive advantage in a rapidly evolving digital marketplace.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of approximately £1.02 billion.

Operations: Spirent Communications generates revenue primarily from its Networks & Security and Lifecycle Service Assurance segments, with $279.20 million and $181 million respectively.

Spirent Communications is making significant strides in the tech industry, underscored by its recent product launches at OFC 2025 and a pioneering collaboration with JAXA for lunar exploration technology. Despite a slight revenue dip to $460 million from $474 million year-on-year, Spirent's innovative edge is evident in its R&D focus, crucial for advancing next-gen network solutions and space navigation technologies. The company's commitment to high-performance testing platforms aligns with growing demands for AI-driven Ethernet solutions, positioning it well amid evolving tech landscapes.

Where To Now?

- Reveal the 37 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Baltic Classifieds Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BCG

Baltic Classifieds Group

Operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion