- United Kingdom

- /

- Media

- /

- LSE:INF

Exploring High Growth Tech Stocks In The UK October 2024

Reviewed by Simply Wall St

In the last week, the United Kingdom market has been flat, but over the past 12 months, it has risen by 6.6%, with earnings forecasted to grow by 14% annually. In this context of steady growth and optimistic forecasts, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability within this dynamic sector.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

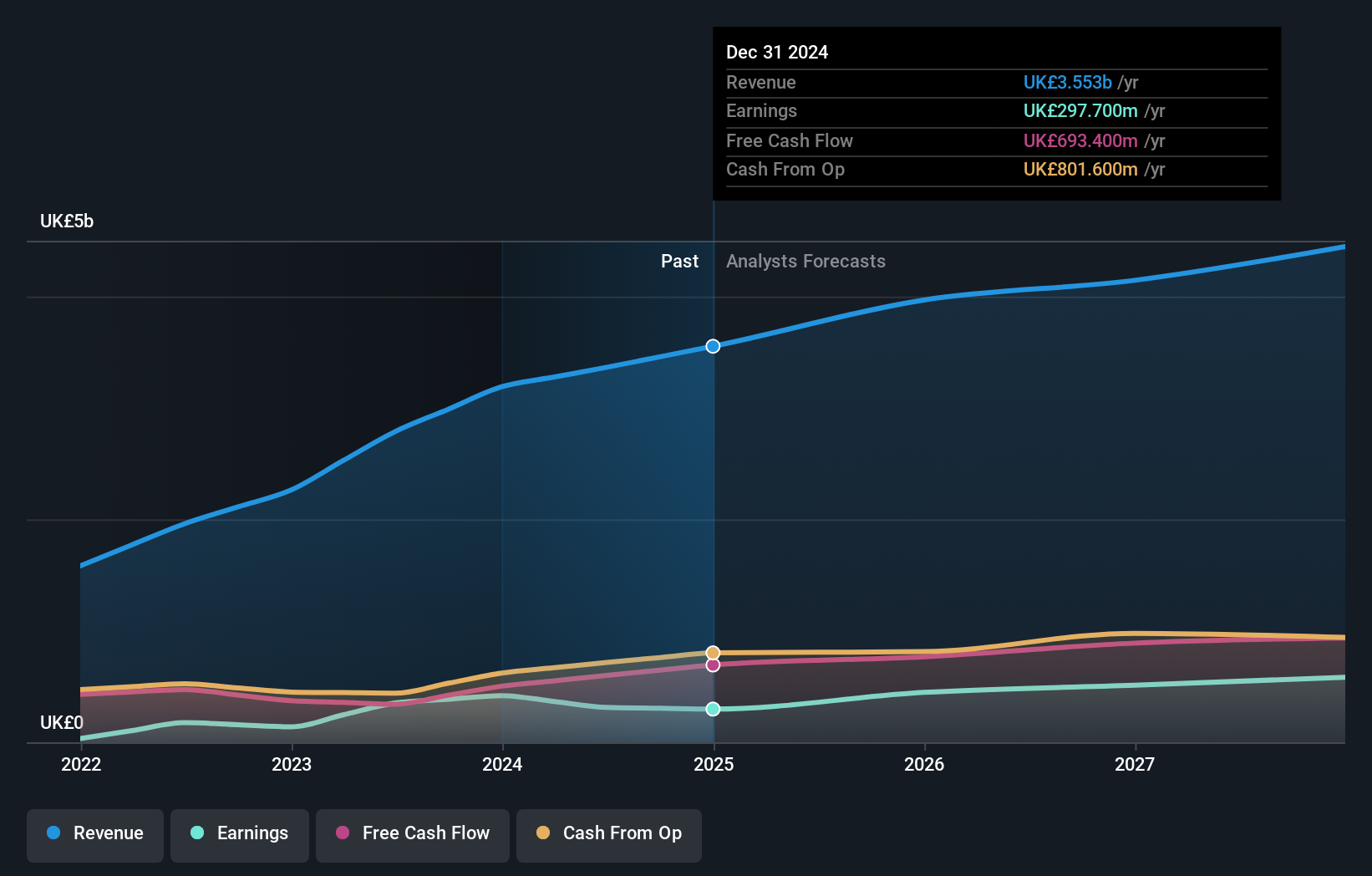

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the UK, Europe, the US, China, and other global markets with a market cap of £10.78 billion.

Operations: Informa generates revenue through its four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates internationally, providing a diverse range of services in events, digital services, and academic research across various regions including the UK, Europe, the US, and China.

Informa, a UK-based entity, is navigating through a dynamic phase with its earnings projected to surge by 22.5% annually. Despite facing challenges like a significant one-off loss of £213.5M impacting recent financials, the company's strategic moves are noteworthy. Recent endeavors include the acquisition of Ascential plc, enhancing its Informa Festivals business and strengthening long-term partnerships such as with Monaco, expanding beyond traditional markets into luxury lifestyle sectors. Moreover, Informa's commitment to innovation is evident from its R&D spending trends which have been pivotal in driving these expansions and partnerships. This blend of strategic acquisitions alongside robust R&D investment underscores Informa’s adaptability and forward-thinking approach in the high-growth tech landscape of the UK.

- Click here to discover the nuances of Informa with our detailed analytical health report.

Evaluate Informa's historical performance by accessing our past performance report.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

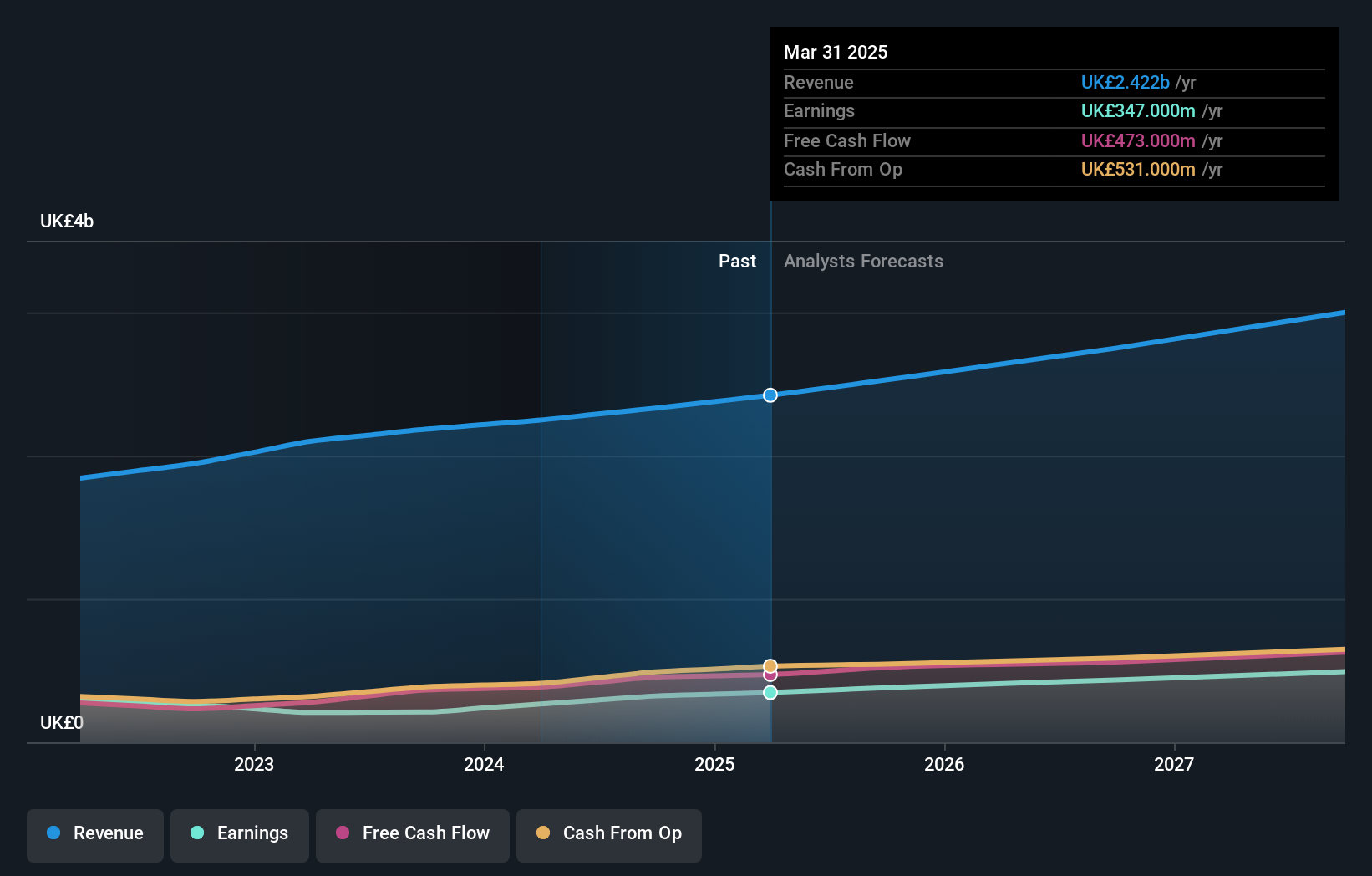

Overview: The Sage Group plc offers technology solutions and services for small and medium businesses across the United States, the United Kingdom, France, and other international markets, with a market capitalization of approximately £10.07 billion.

Operations: Sage Group generates revenue primarily from its technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company operates in multiple regions, including the United Kingdom & Ireland, which contributes £488 million to its revenue.

Sage Group, a key player in the UK's tech sector, is demonstrating robust growth with its earnings and revenue outpacing industry averages. With a 28.4% increase in earnings over the past year surpassing the software industry's 21.2%, and projected annual revenue growth at 7.7%, Sage is navigating well above the UK market forecast of 3.5%. This financial vigor is complemented by strategic initiatives like their recent partnership with VoPay, which integrates advanced payment technologies into Sage’s platforms, enhancing efficiency for SMBs—a segment critical to their ecosystem. Moreover, R&D investments remain a cornerstone of their strategy, ensuring continuous innovation and competitive edge in a rapidly evolving market.

- Delve into the full analysis health report here for a deeper understanding of Sage Group.

Review our historical performance report to gain insights into Sage Group's's past performance.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of £1.01 billion.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, which accounts for $258.50 million. The company's gross profit margin shows a notable trend, reflecting its operational efficiency in delivering automated test and assurance solutions globally.

Spirent Communications is navigating a challenging landscape with a recent net loss, yet it maintains a positive outlook with expected earnings growth of 40.5% annually. This optimism is bolstered by their pioneering work in 5G Fixed Wireless Access and Wi-Fi 7 testing solutions, addressing the accelerating demand for advanced network performance evaluations and robust connectivity standards. Their strategic focus on R&D has led to significant investments amounting to $26.3 million, representing an increase from previous years and underscoring their commitment to innovation in high-stakes tech environments. Despite setbacks, Spirent's projected revenue growth of 5.1% suggests resilience and adaptability in a competitive market.

- Dive into the specifics of Spirent Communications here with our thorough health report.

Gain insights into Spirent Communications' past trends and performance with our Past report.

Key Takeaways

- Unlock our comprehensive list of 47 UK High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.