- United Kingdom

- /

- Hospitality

- /

- LSE:SSPG

UK's May 2025 Stocks That Could Be Trading Below Fair Value

Reviewed by Simply Wall St

As the UK market navigates the challenges posed by fluctuating global trade dynamics, particularly with China's economic struggles impacting the FTSE 100, investors are keenly observing opportunities that may arise from these uncertainties. In such a climate, identifying stocks that could be trading below their fair value becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Savills (LSE:SVS) | £9.42 | £16.43 | 42.7% |

| Aptitude Software Group (LSE:APTD) | £2.90 | £5.13 | 43.5% |

| Big Technologies (AIM:BIG) | £1.08 | £2.09 | 48.3% |

| Victrex (LSE:VCT) | £8.00 | £15.44 | 48.2% |

| Informa (LSE:INF) | £8.01 | £15.23 | 47.4% |

| SDI Group (AIM:SDI) | £0.74 | £1.37 | 46.1% |

| Vistry Group (LSE:VTY) | £5.838 | £11.24 | 48.1% |

| Entain (LSE:ENT) | £7.418 | £13.79 | 46.2% |

| Duke Capital (AIM:DUKE) | £0.2925 | £0.53 | 44.8% |

| Deliveroo (LSE:ROO) | £1.756 | £3.05 | 42.5% |

Let's explore several standout options from the results in the screener.

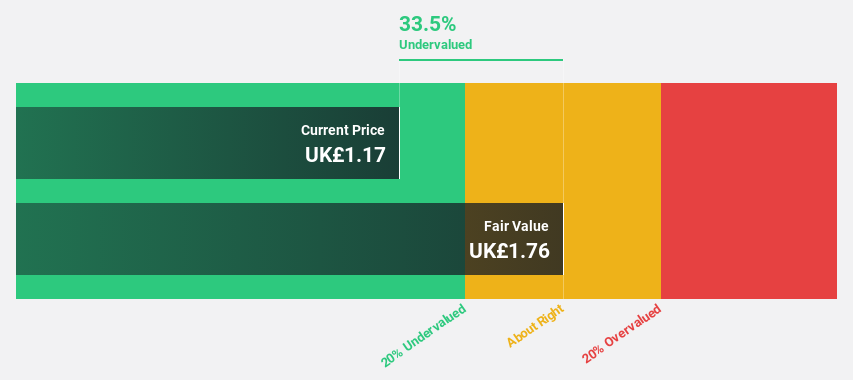

Big Technologies (AIM:BIG)

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies and services for the offender and personal monitoring industry across the Americas, Europe, and Asia-Pacific, with a market cap of £311.18 million.

Operations: Big Technologies PLC generates revenue through its development and provision of remote monitoring technologies and services for the offender and personal monitoring sectors across various regions, including the Americas, Europe, and Asia-Pacific.

Estimated Discount To Fair Value: 48.3%

Big Technologies is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on cash flow valuation. Despite a recent decline in net income to £2.42 million from £16.19 million, the company's earnings are expected to grow substantially at 35% annually, outpacing the UK market's growth rate of 14.2%. However, revenue growth forecasts remain modest at 3.8% per year amidst recent management changes and volatile share prices.

- Our expertly prepared growth report on Big Technologies implies its future financial outlook may be stronger than recent results.

- Take a closer look at Big Technologies' balance sheet health here in our report.

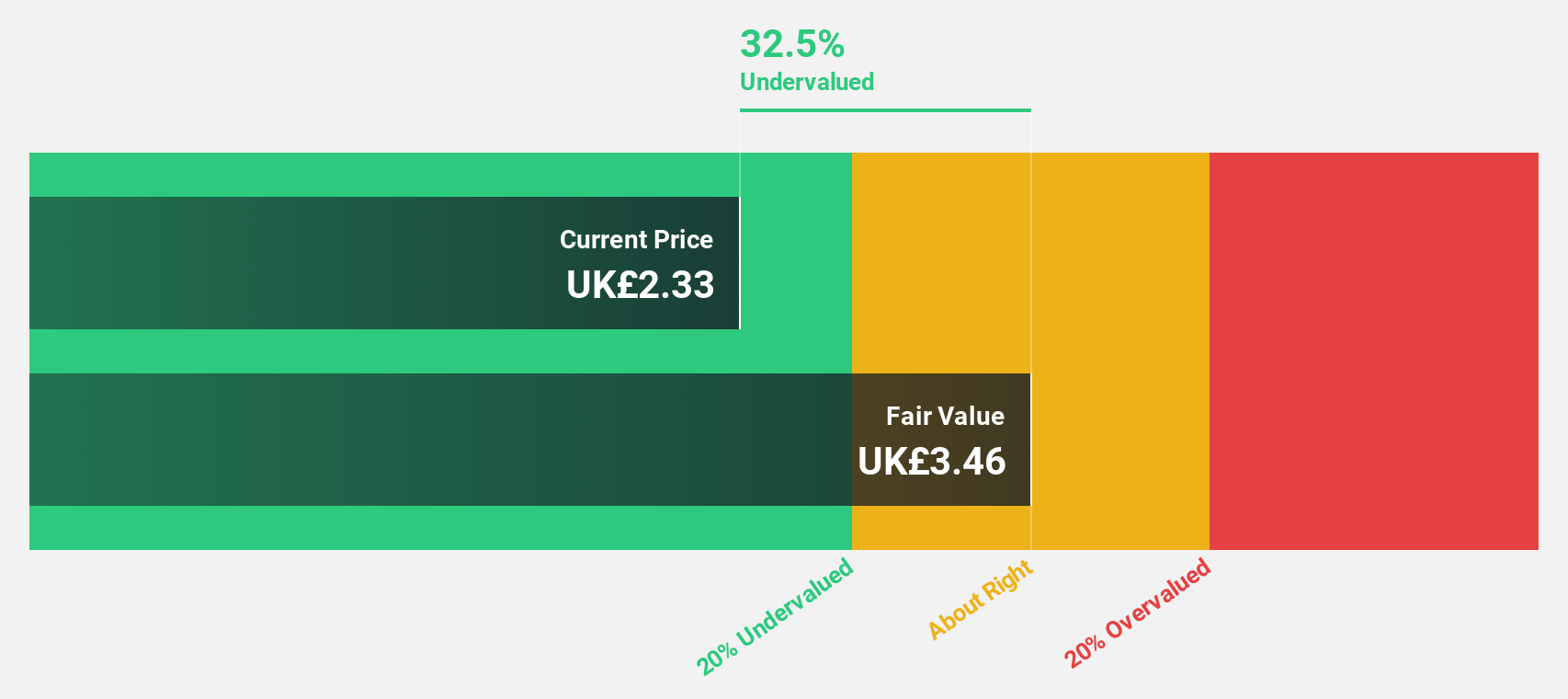

ConvaTec Group (LSE:CTEC)

Overview: ConvaTec Group PLC develops, manufactures, and sells medical products, services, and technologies across Europe, North America, and internationally with a market cap of £5.72 billion.

Operations: The company's revenue from the development, manufacture, and sale of medical products and technologies amounts to $2.29 billion.

Estimated Discount To Fair Value: 21.7%

ConvaTec Group is trading over 20% below its estimated fair value of £3.57, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow at 16.9% annually, surpassing the UK market's growth rate. Recent financial results show an increase in net income to US$190.5 million from US$130.3 million year-over-year, alongside a strategic collaboration with WOCN® to enhance ostomy care education globally, reinforcing its commitment to healthcare improvement.

- Our comprehensive growth report raises the possibility that ConvaTec Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of ConvaTec Group stock in this financial health report.

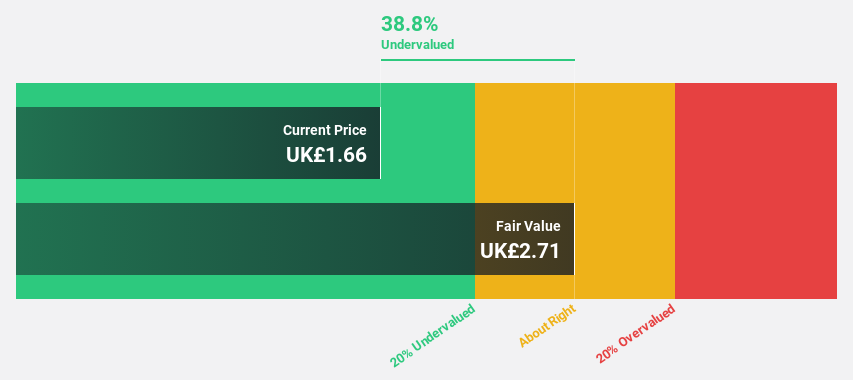

SSP Group (LSE:SSPG)

Overview: SSP Group plc operates food and beverage outlets across North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally with a market cap of approximately £1.40 billion.

Operations: The company's revenue is primarily derived from the food and beverage travel sector, mainly at airports and railway stations, amounting to £3.58 billion.

Estimated Discount To Fair Value: 36.6%

SSP Group is trading at £1.75, significantly below its estimated fair value of £2.75, suggesting it is undervalued based on cash flows. The company's revenue growth forecast of 5.2% annually outpaces the UK market and earnings are expected to grow 57.5% per year, with profitability anticipated in three years. Despite a net loss of £61.5 million for H1 2025, its high future return on equity and good relative valuation offer potential upside.

- The growth report we've compiled suggests that SSP Group's future prospects could be on the up.

- Click here to discover the nuances of SSP Group with our detailed financial health report.

Summing It All Up

- Unlock our comprehensive list of 51 Undervalued UK Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SSPG

SSP Group

Operates food and beverage outlets in North America, Europe, the United Kingdom, Ireland, the Asia Pacific, Eastern Europe, the Middle East, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives