The board of Computacenter plc (LON:CCC) has announced that the dividend on 28th of October will be increased to £0.221, which will be 31% higher than last year's payment of £0.169 which covered the same period. This makes the dividend yield about the same as the industry average at 3.0%.

Check out our latest analysis for Computacenter

Computacenter's Dividend Is Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last dividend was quite easily covered by Computacenter's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share is forecast to rise by 4.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 51%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

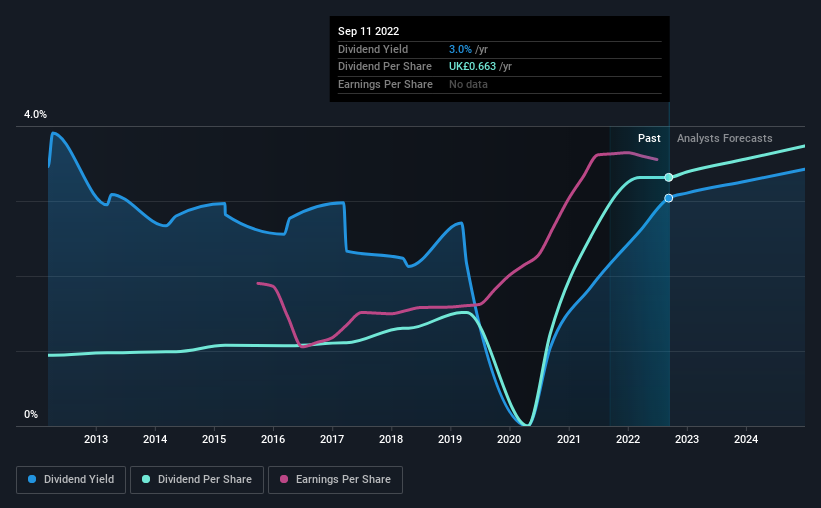

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of £0.189 in 2012 to the most recent total annual payment of £0.663. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Computacenter has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Computacenter has impressed us by growing EPS at 19% per year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Computacenter Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Computacenter is a strong income stock thanks to its track record and growing earnings. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Computacenter that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CCC

Computacenter

Provides technology and services to corporate and public sector organizations in the United Kingdom, Germany, Western Europe, North America, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)