- United Kingdom

- /

- Real Estate

- /

- LSE:HWG

Undervalued Small Caps With Insider Action In United Kingdom September 2024

Reviewed by Simply Wall St

The United Kingdom's market has faced recent turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting global economic uncertainties. Despite these challenges, small-cap stocks can offer unique opportunities for investors seeking to navigate the current market landscape. In this article, we will explore three undervalued small-cap stocks in the UK that have seen notable insider action, potentially signaling confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.5x | 5.5x | 13.10% | ★★★★★☆ |

| Domino's Pizza Group | 14.9x | 1.7x | 36.19% | ★★★★★☆ |

| Genus | 157.7x | 1.9x | 3.88% | ★★★★★☆ |

| GB Group | NA | 2.8x | 36.86% | ★★★★★☆ |

| CVS Group | 23.2x | 1.3x | 39.14% | ★★★★☆☆ |

| Essentra | 679.9x | 1.3x | 42.59% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -1.48% | ★★★☆☆☆ |

| NWF Group | 8.8x | 0.1x | 35.51% | ★★★☆☆☆ |

| Franchise Brands | 43.1x | 2.2x | 38.94% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -1447.86% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of approximately £1.02 billion.

Operations: The company generates revenue primarily from IT solutions, with the latest reported revenue at £207.02 million. The net income margin has shown an upward trend, reaching 22.63% as of February 2024. Operating expenses have been a significant part of the cost structure, amounting to £89.07 million in the same period.

PE: 24.5x

Bytes Technology Group, a small cap in the UK, recently announced a special dividend of 8.7 pence per share and increased its final dividend to 6.0 pence per share at their AGM on July 11, 2024. This indicates strong cash flow management despite relying entirely on external borrowing for funding. Earnings are forecasted to grow by 9.57% annually, reflecting potential for future growth. Insider confidence is evident from recent share purchases within the last quarter, suggesting optimism about the company's prospects.

- Dive into the specifics of Bytes Technology Group here with our thorough valuation report.

Evaluate Bytes Technology Group's historical performance by accessing our past performance report.

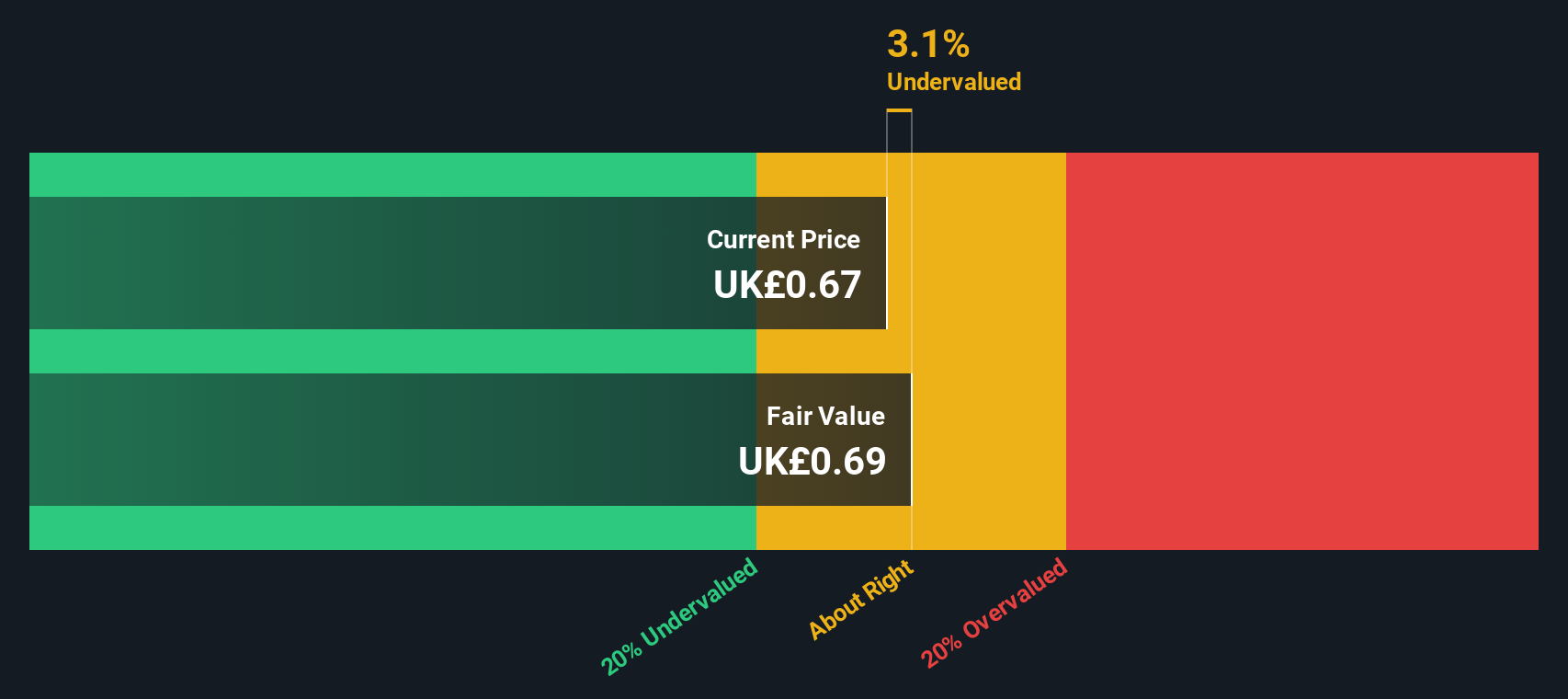

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment services with a market cap of £1.50 billion.

Operations: Hays generates revenue primarily through its Qualified, Professional and Skilled Recruitment segment, with a recent gross profit margin of 4.21%. The company incurs costs mainly in COGS (£6656.5m) and operating expenses (£225.8m).

PE: -299.9x

Hays, a UK-based recruitment firm, reported a decline in sales to £6.95 billion for the year ending June 30, 2024, down from £7.58 billion the previous year. The company faced a net loss of £4.9 million compared to a net income of £138.3 million last year. Despite this setback, insider confidence remains high with several purchases made by executives over the past six months. Additionally, Hays is expected to see earnings growth of 62% annually going forward, suggesting potential recovery and growth opportunities ahead.

- Unlock comprehensive insights into our analysis of Hays stock in this valuation report.

Examine Hays' past performance report to understand how it has performed in the past.

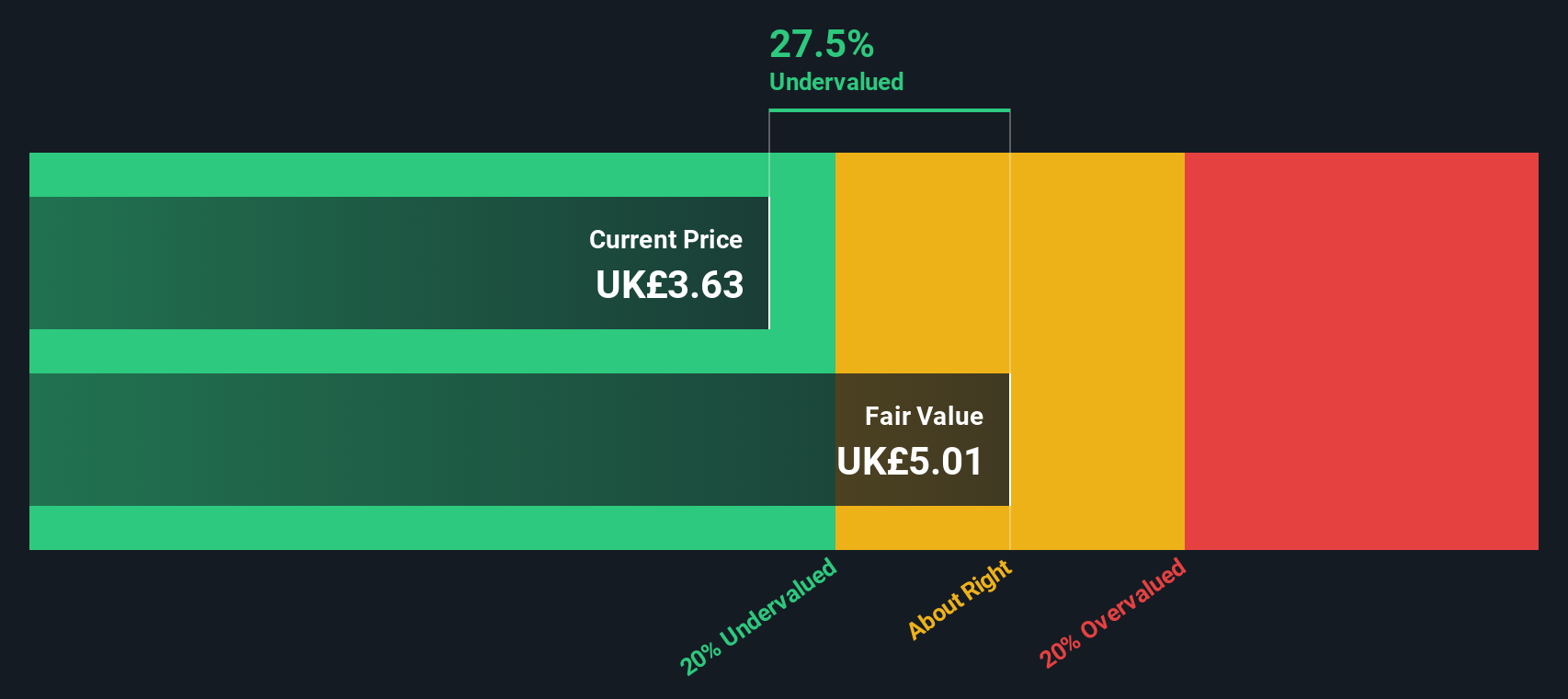

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★☆☆☆

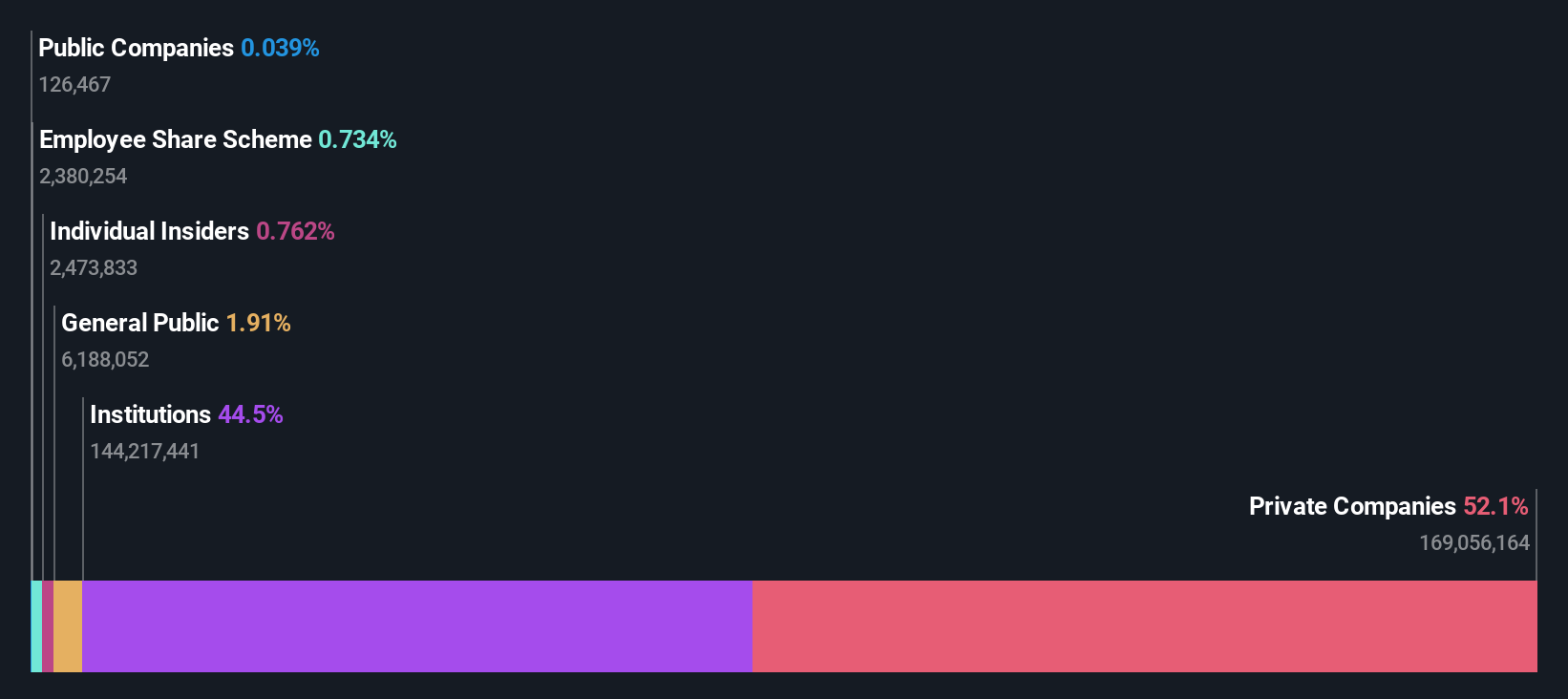

Overview: Harworth Group is a leading land and property regeneration company in the UK, focusing on transforming former industrial sites into residential, commercial, and mixed-use developments with a market cap of approximately £4.14 billion.

Operations: The company's revenue primarily comes from its sales operations, with notable fluctuations in both gross profit margin and net income margin over the periods analyzed. Gross profit margins have varied significantly, ranging from 0.11% to 54.39%. Operating expenses are a substantial part of the cost structure, consistently impacting overall profitability. Net income margins also show considerable variation, reflecting changes in non-operating expenses and other financial factors over time.

PE: 12.1x

Harworth Group, recently added to the FTSE 350 and FTSE 250 indexes, reported impressive earnings for H1 2024 with sales jumping to £41.31 million from £18.24 million a year ago and net income rising to £14.78 million from £2.85 million. Their Independent Non-Executive Chairman Alastair Lyons showed insider confidence by purchasing 50,000 shares worth approximately £80,000 in June 2024, increasing their holdings by over 14%. Harworth's strategic growth is further supported by new executive appointments focused on expanding their Midlands portfolio.

- Click here and access our complete valuation analysis report to understand the dynamics of Harworth Group.

Assess Harworth Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 25 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harworth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HWG

Harworth Group

Operates as a land and property regeneration company in the North of England and the Midlands.

Good value with adequate balance sheet.