- United Kingdom

- /

- Software

- /

- AIM:KAPE

Kape Technologies Plc (LON:KAPE) insiders who sold US$29m worth of stock earlier this year are probably glad they did so as market cap slides to UK£1.2b

Insiders at Kape Technologies Plc (LON:KAPE) sold US$29m worth of stock at an average price of US$3.85 a share over the past year, making the most of their investment. The company's market valuation decreased by UK£86m after the stock price dropped 6.8% over the past week, but insiders were spared from painful losses.

Although we don't think shareholders should simply follow insider transactions, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Kape Technologies

The Last 12 Months Of Insider Transactions At Kape Technologies

Over the last year, we can see that the biggest insider sale was by the insider, Ran Greenberg, for UK£11m worth of shares, at about UK£3.80 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (UK£3.38). So it may not shed much light on insider confidence at current levels.

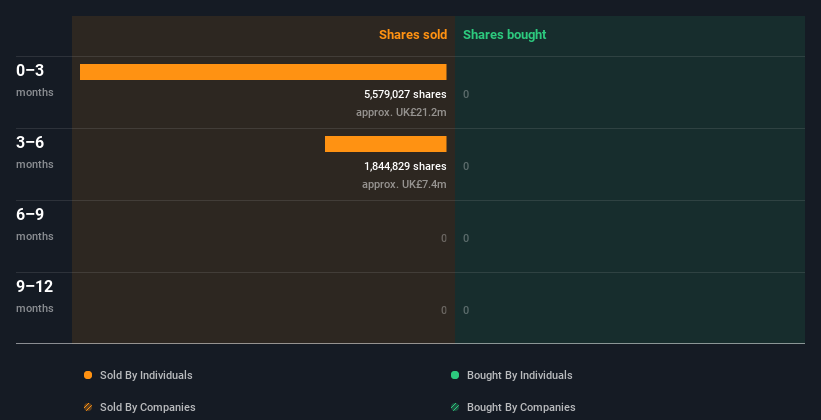

In the last year Kape Technologies insiders didn't buy any company stock. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Kape Technologies Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Kape Technologies. In total, insiders sold UK£21m worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Kape Technologies insiders own about UK£667m worth of shares (which is 56% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Kape Technologies Tell Us?

Insiders sold stock recently, but they haven't been buying. Looking to the last twelve months, our data doesn't show any insider buying. It is good to see high insider ownership, but the insider selling leaves us cautious. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Kape Technologies. For example, Kape Technologies has 4 warning signs (and 1 which can't be ignored) we think you should know about.

Of course Kape Technologies may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Kape Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:KAPE

Kape Technologies

Kape Technologies PLC, together with its subsidiaries, develops and distributes digital products in the online security space.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.