- United Kingdom

- /

- Software

- /

- AIM:FDP

High Insider Ownership Of Up To 17% In These 3 UK Growth Companies

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, with the FTSE 100 showing cautious movements ahead of significant economic events, investors are closely monitoring indicators that could influence market directions. In such a climate, examining growth companies in the UK with high insider ownership might offer valuable insights, as substantial insider stakes often suggest confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Getech Group (AIM:GTC) | 17.3% | 108.7% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's explore several standout options from the results in the screener.

FD Technologies (AIM:FDP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FD Technologies plc is a company that offers software and consulting services both in the United Kingdom and internationally, with a market capitalization of approximately £398.39 million.

Operations: The company generates revenue through its KX and First Derivative segments, totaling £79.15 million and £169.72 million respectively.

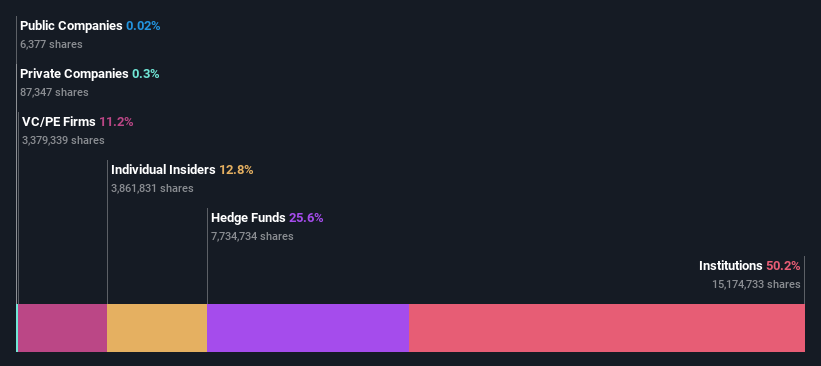

Insider Ownership: 12.8%

FD Technologies, a growth-oriented company with significant insider ownership in the UK, faces challenges despite its potential. Recently reporting a substantial net loss of £40.78 million for FY 2024 and a decline in sales to £248.86 million from the previous year, the company's short-term outlook appears strained. However, it is forecasted to outpace average market revenue growth at 4.2% annually and transition to profitability within three years, suggesting recovery and growth prospects ahead.

- Click here and access our complete growth analysis report to understand the dynamics of FD Technologies.

- The analysis detailed in our FD Technologies valuation report hints at an deflated share price compared to its estimated value.

Helical (LSE:HLCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Helical plc is a UK-based company focused on the development, investment, and rental of real estate properties, with a market capitalization of approximately £296.05 million.

Operations: The company generates revenue primarily through property investments and developments, totaling £39.91 million.

Insider Ownership: 12.4%

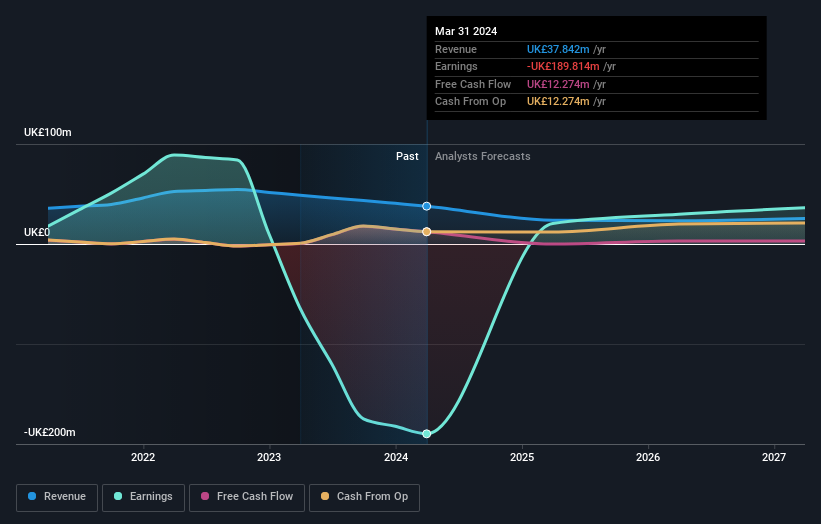

Helical, a UK-based property development firm, is navigating a challenging phase with significant executive changes and a sharp dividend cut. The company reported substantial losses of £189.81 million for FY 2024, worsening from the previous year. Despite these setbacks, Helical is poised for potential growth under new leadership focusing on lucrative over station development projects in London. Insider confidence remains high as the company transitions towards profitability with an expected robust return on equity in three years.

- Delve into the full analysis future growth report here for a deeper understanding of Helical.

- Our valuation report here indicates Helical may be overvalued.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.39 billion.

Operations: The company generates its revenue through diversified financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

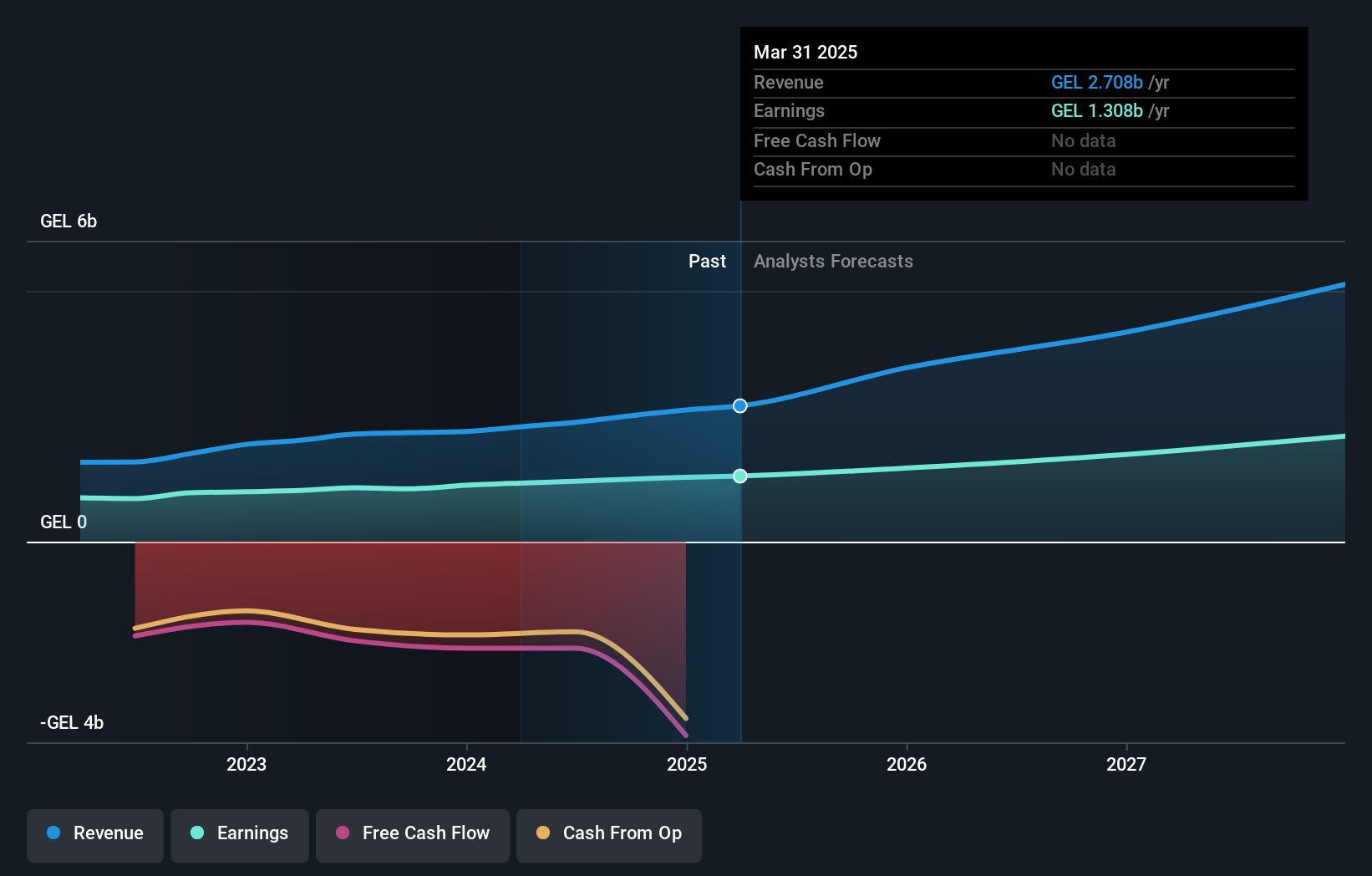

TBC Bank Group, a UK-listed entity, demonstrates robust growth with a 23.6% annual earnings increase over five years and forecasts suggesting further expansion. Earnings are expected to grow by 15.22% annually, outpacing the UK market projection of 12.5%. Additionally, revenue growth is anticipated at 18.3% yearly, also above the market average of 3.5%. Despite these positive trends, the bank's dividend track record remains unstable and it has a high level of bad loans at 2.1%. A recent share buyback program aims to enhance shareholder value by repurchasing up to GEL 75 million in shares for cancellation and employee benefits.

- Unlock comprehensive insights into our analysis of TBC Bank Group stock in this growth report.

- In light of our recent valuation report, it seems possible that TBC Bank Group is trading behind its estimated value.

Next Steps

- Get an in-depth perspective on all 67 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDP

FD Technologies

Provides software and consulting services in the United Kingdom and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives