- United Kingdom

- /

- Hospitality

- /

- LSE:ROO

April 2025 UK Penny Stocks: Discovering Market Opportunities

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnectedness of global markets and the challenges faced by economies striving to recover post-pandemic. Despite these broader market fluctuations, opportunities still exist for investors who are willing to explore beyond well-known blue-chip stocks. Penny stocks, though an older term, continue to represent smaller or newer companies that can offer unique investment prospects when they possess strong financial foundations and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.04M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.74 | £282.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.67 | £353.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.612 | £999.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £155.66M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.866 | £2.13B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 385 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market cap of £212.34 million.

Operations: The company's revenue is primarily generated from its data-driven omni-channel marketing automation services, amounting to £82.59 million.

Market Cap: £212.34M

dotdigital Group, with a market cap of £212.34 million, offers SaaS and managed services for digital marketing professionals. The company is trading at 25.8% below its estimated fair value and has not diluted shareholders over the past year. Despite negative earnings growth recently, it maintains high-quality earnings and covers short-term liabilities with assets of £64.7M against liabilities of £17.7M. Recent executive changes include appointing Tom Mullan as CFO, bringing extensive software sector experience to support strategic acquisition plans and enhance revenue growth through initiatives like their WhatsApp channel launch in April 2025.

- Unlock comprehensive insights into our analysis of dotdigital Group stock in this financial health report.

- Gain insights into dotdigital Group's outlook and expected performance with our report on the company's earnings estimates.

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online food delivery platform across several countries, including the United Kingdom and Singapore, with a market cap of approximately £1.95 billion.

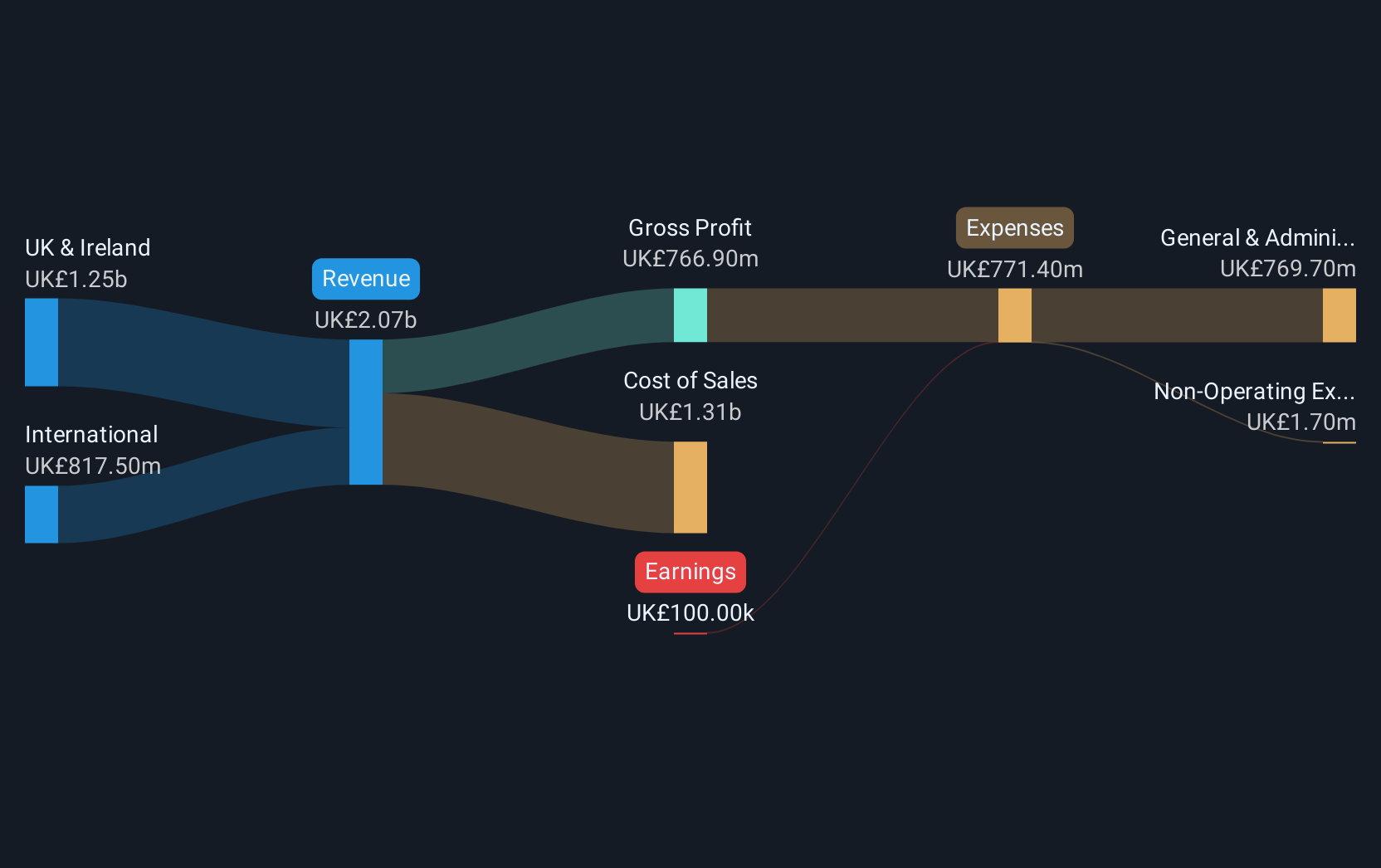

Operations: The company generates revenue of £2.07 billion from its on-demand food delivery platform operations.

Market Cap: £1.95B

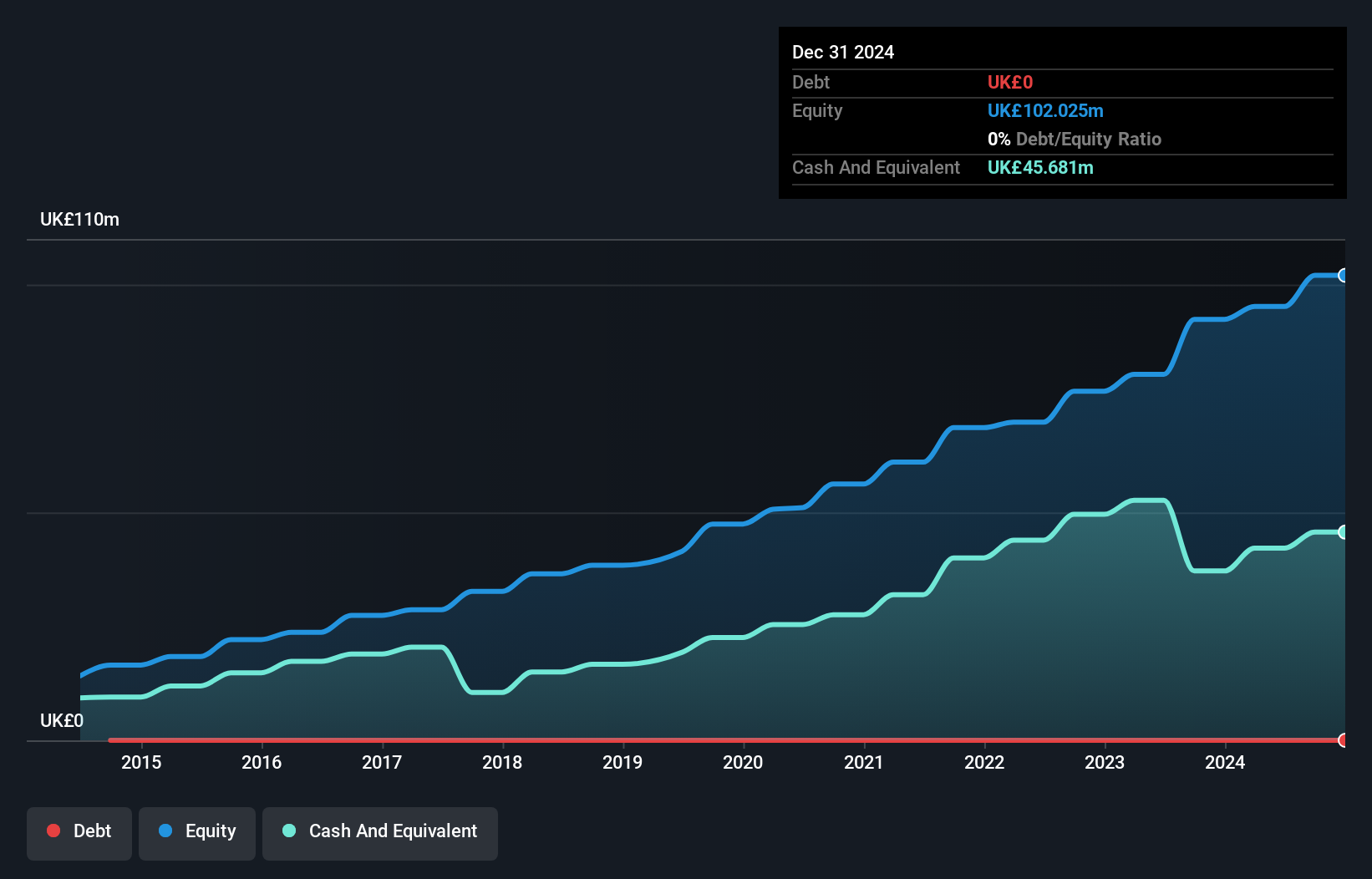

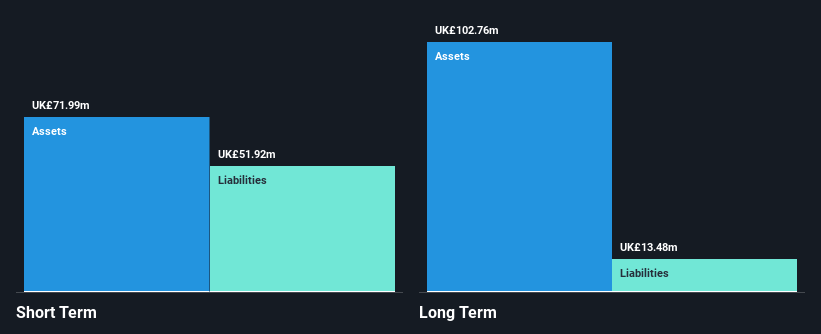

Deliveroo plc, with a market cap of £1.95 billion, is trading at 49.9% below its estimated fair value despite being unprofitable. The company has shown consistent revenue growth, reporting £518 million for Q1 2025 compared to £485 million the previous year. It has reduced losses over five years by 41.5% annually and maintains a strong cash runway exceeding three years due to positive free cash flow growth of 22.8% per year. Deliveroo's strategic initiatives include an increased equity buyback plan now authorized at £250 million, reflecting confidence in its financial stability and future prospects.

- Dive into the specifics of Deliveroo here with our thorough balance sheet health report.

- Examine Deliveroo's earnings growth report to understand how analysts expect it to perform.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zotefoams plc, with a market cap of £123.76 million, manufactures, distributes, and sells polyolefin block foams across the United Kingdom, Europe, North America, and internationally.

Operations: The company's revenue is primarily derived from High-Performance Products (£79.64 million), Polyolefin Foams (£66.93 million), and Mucell Extrusion LLC (£1.22 million).

Market Cap: £123.76M

Zotefoams plc, with a market cap of £123.76 million, is trading at 61.8% below its estimated fair value but remains unprofitable with a net loss of £2.76 million in 2024 despite increased sales to £147.79 million from the previous year. The company is expanding internationally with new facilities in Vietnam and South Korea, aiming to strengthen its position in the athletic footwear market through its partnership with Nike, which generated over £65 million in revenue for 2024. Zotefoams' debt management shows improvement, and it plans strategic investments funded within existing leverage levels to drive future growth.

- Take a closer look at Zotefoams' potential here in our financial health report.

- Learn about Zotefoams' future growth trajectory here.

Summing It All Up

- Explore the 385 names from our UK Penny Stocks screener here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ROO

Deliveroo

A holding company, operates an online food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives