- United Kingdom

- /

- Software

- /

- AIM:CRDL

3 UK Penny Stocks With Market Caps Under £60M To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China, which has impacted global markets. Despite these challenges, investors may still find opportunities in smaller companies that offer potential growth at lower price points. Penny stocks, though an older term, represent a segment of the market where strong financials and solid fundamentals can uncover hidden value and potential for significant returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.03 | £452.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.37 | £353.04M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.55 | £197.4M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.852 | £1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.742 | £62.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.42 | £45.44M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.475 | £431.41M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £177.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.28 | £71.01M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Autins Group (AIM:AUTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Autins Group plc is an investment holding company that provides noise, vibration, and harshness insulation materials, with a market cap of £5.46 million.

Operations: Autins Group does not report specific revenue segments.

Market Cap: £5.46M

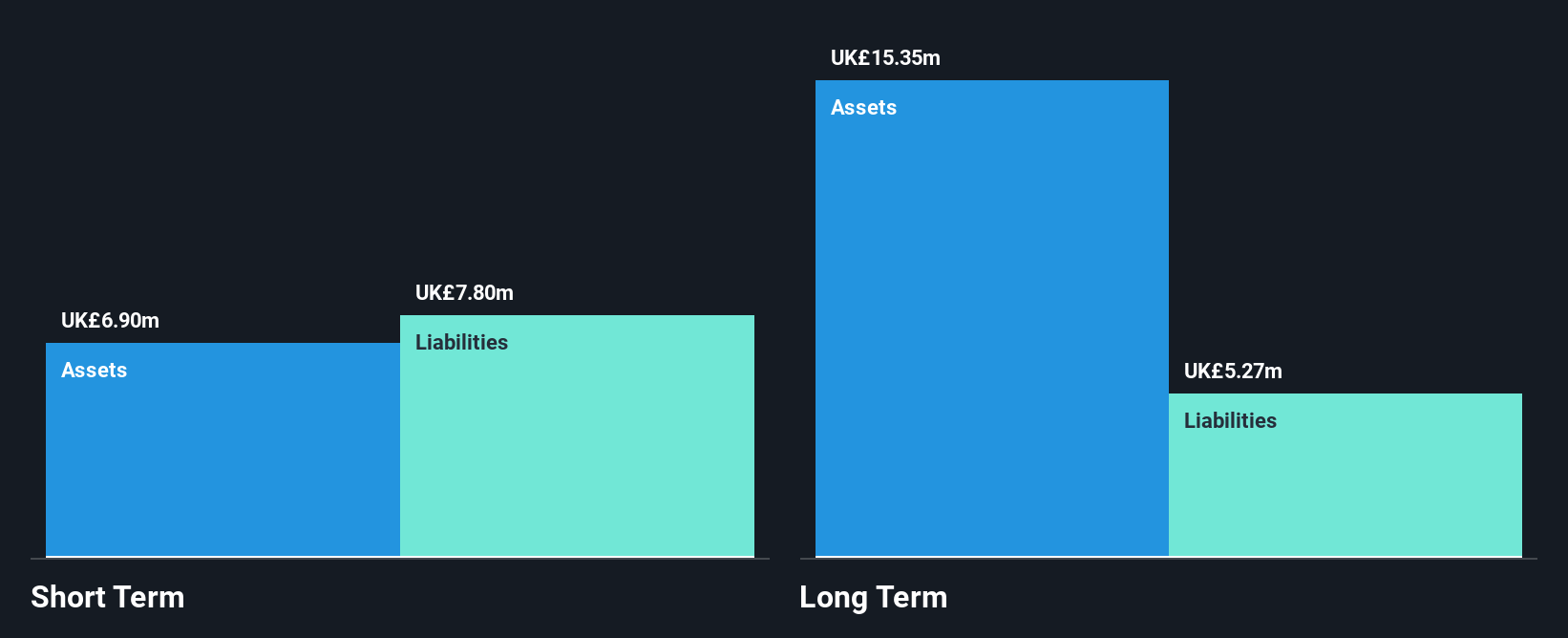

Autins Group, with a market cap of £5.46 million, has reported sales of £31.11 million for the eighteen months ending March 2025 but remains unprofitable with a net loss of £1.66 million. Despite its current losses, the company anticipates achieving its first net profit since 2017 by fiscal year 2026 due to recent business wins and efficiency improvements. While it faces challenges such as short-term liabilities exceeding assets and high share price volatility, Autins benefits from a satisfactory debt level and sufficient cash runway for over three years thanks to positive free cash flow growth at nearly 40% annually.

- Unlock comprehensive insights into our analysis of Autins Group stock in this financial health report.

- Gain insights into Autins Group's future direction by reviewing our growth report.

Cordel Group (AIM:CRDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cordel Group Plc is a software company operating in Australia, the United Kingdom, New Zealand, and the Americas with a market cap of £16.54 million.

Operations: The company generates revenue of £4.76 million from its data integration and analytic services.

Market Cap: £16.54M

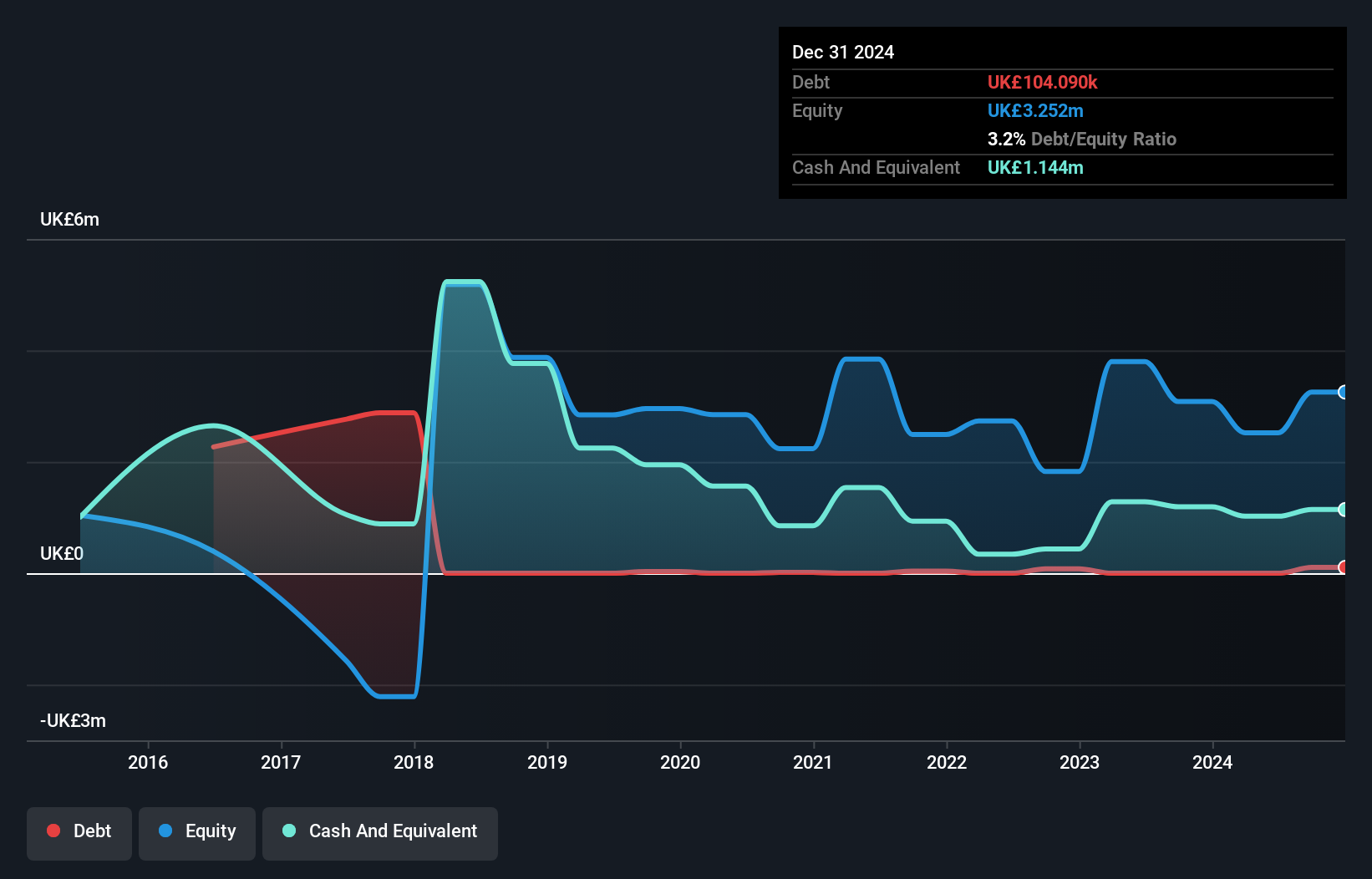

Cordel Group, with a market cap of £16.54 million and revenue forecasted to reach up to £5 million for fiscal year 2025, is unprofitable but shows potential through strategic contracts. Recent agreements include a significant five-year deal with a leading U.S. freight railroad worth over US$7.5 million and collaboration with DG8 Design and Engineering Ltd for Network Rail projects, showcasing its advanced LiDAR technology capabilities. Despite high share price volatility and negative return on equity, Cordel's cash reserves exceed its debt, providing financial stability as it expands in the rail data analytics sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Cordel Group.

- Examine Cordel Group's earnings growth report to understand how analysts expect it to perform.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £56.15 million.

Operations: The company's revenue is primarily generated from its operations within the United Kingdom, amounting to £36.35 million.

Market Cap: £56.15M

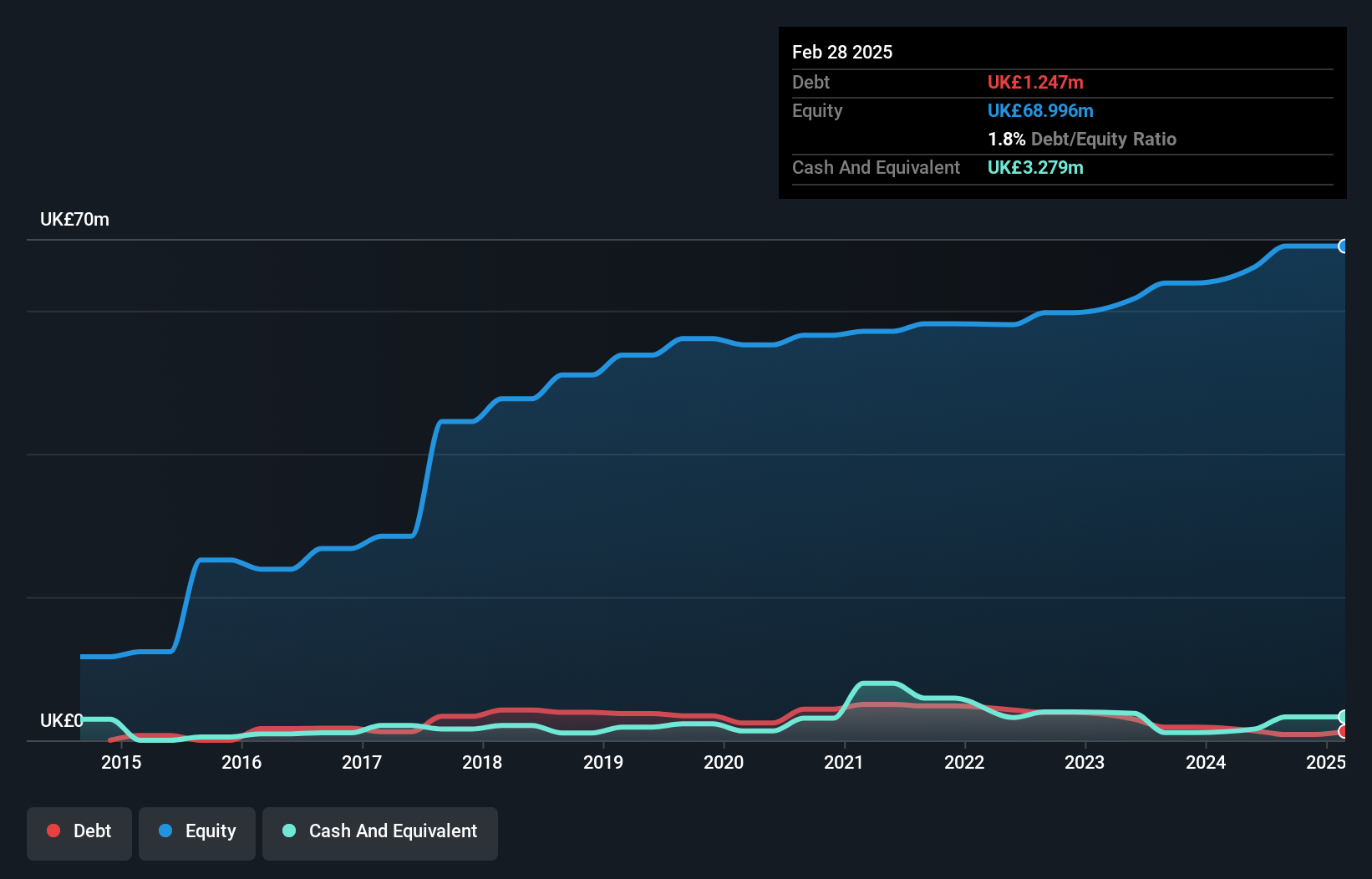

Time Finance plc, with a market cap of £56.15 million, demonstrates robust financial health and growth potential within the UK market. The company's earnings have grown significantly by 49.5% over the past year, surpassing industry averages, while maintaining high-quality earnings and improving profit margins from 13.4% to 17.2%. Its debt management is commendable with more cash than total debt and operating cash flow covering debt well at 322.1%. Despite a relatively new management team, Time Finance is strategically positioned for acquisitions that align with its core business strategy, as indicated by recent corporate guidance affirming confidence in meeting financial targets for FY2024-2025.

- Jump into the full analysis health report here for a deeper understanding of Time Finance.

- Explore Time Finance's analyst forecasts in our growth report.

Key Takeaways

- Click here to access our complete index of 302 UK Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRDL

Cordel Group

Operates as a software company in Australia, the United Kingdom, New Zealand, and the Americas.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives